Inflation data fails to tame the bull market

Author: Tom McGrath – Chief Investment Officer, 8AM Global

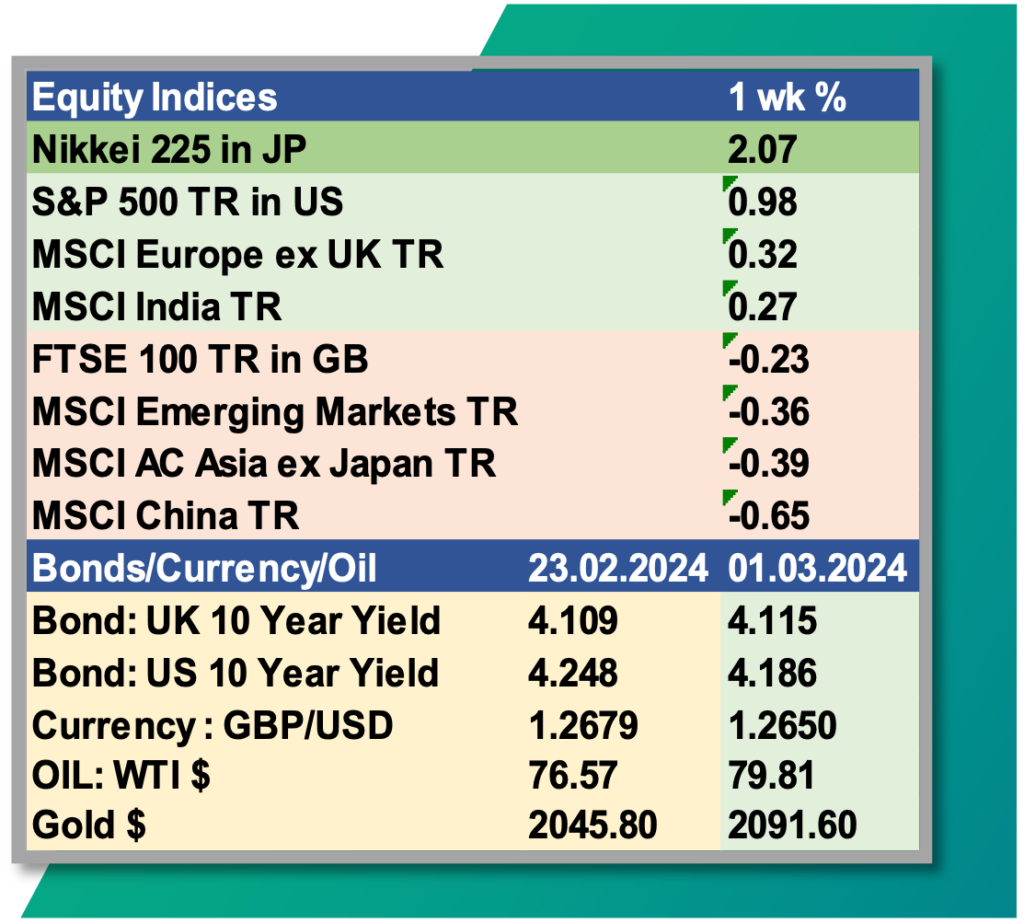

Market Overview

Although we saw no great moves in the equity indices last week, Japan and the S&P 500 still hit new all-time closing highs. The Nasdaq finally joined them, which broke above its previous 2021 record. Oil nudged higher, and gold also registered meaningful gains, perhaps partly following the Bitcoin surge. Bond yields were relatively stable. Earnings season has just about passed us by, so the primary focus for investors invariably returns to the macro data – inflation, interest rates, jobs, growth – on which there will as ever be constant subjective interpretations. But I think it is fair to say that a bullish mood prevails; the Goldilocks narrative is still just about in place, only with fewer rate cuts than expected at the start of the year.

European Inflation Data

Things could have been a lot different last week, as the release of both US and European inflation data had the potential to spook the markets. Thankfully, the numbers were acceptable, and as the mood was buoyant, it proved sufficient to ensure the upward trend remained in place.

Looking first at the ECB release, inflation in the Eurozone decreased more slowly than expected in February, justifying European Central Bank officials to continue their caution about prematurely reducing interest rates. According to Eurostat, consumer prices increased by 2.6% year-on-year in February, which is higher than the 2.5% forecast by economists in a Bloomberg survey. Additionally, core inflation, which excludes fluctuating items like food and energy, decreased to 3.1%, less than what was predicted. This deceleration in inflation is consistent throughout the Eurozone as the impact of rising energy prices diminishes and the economy of the 20-member bloc shows signs of slowing. Declines were reported in Germany, France, and Spain earlier in the week, while Italy confirmed on Friday that its inflation rate remained steady at 0.9%.

The data is timely as the ECB is due to adjust borrowing costs again, and following this release, it looks likely that the deposit rate will be kept at 4% for the fourth consecutive meeting. A consensus is forming among officials for a potential rate cut in June, though a smaller group advocates for more immediate action. The Portuguese Finance Minister Fernando Medina recently expressed concerns about the dangers of maintaining stringent monetary policy. He argued that the risks of maintaining current policy settings now outweigh those associated with initiating a reduction, pointing out that the economy has already sufficiently decelerated. However, there is ongoing worry that persistent high wage and labour cost increases could continue to fuel inflationary pressures for an extended period. We will need to see a bit more weakness in the jobs market before we get an ECB cut.

US Inflation

I also suspect that the Europeans will probably not go alone here and will wait for the US to take the lead on rate cuts. They might have to wait longer than expected, and that delay could have consequences as US inflation is starting to get a bit sticky. Headline PCE Inflation (the bit that the Fed pay close attention to) came in bang on market expectations at 2.4% year-on-year, with Core PCE at 2.8%. However, the devil was in the details. I was surprised at the muted reaction of both the bond and equity markets, as a closer dig into the data showed that the purest ‘Supercore’ measure appeared problematic. January saw its biggest month-on-month increase in a year, while the measure also ticked up slightly on a year-on-year basis.

Ok, it is only one month, and there could be extraneous reasons for an outlier, but it would cause me concern if I were unfortunate enough to be working at the Fed. I love the irony that a large part of the increase in the Supercore can be attributed to significant rises in portfolio management prices! The data did at least confirm that the severe price surges following the pandemic have subsided. Items such as gas, oil, eggs (which once saw inflation rates exceeding 60%), and car rentals are now experiencing deflation.

Similarly, other categories are seeing year-on-year decreases as they become obsolete with technological advancement; calculators and typewriters, for example, are deflating at rates above 10%, as are televisions, which had briefly spiked due to supply chain issues post-pandemic. As I have long argued, technological advances (of which there are many) are long-term deflators of prices, and if we combine that with productivity advances, we could, in time, effectively “outsmart” inflationary pressure.

The significance of the PCE Index lies in its importance to the Federal Reserve, as it’s the measure the central bank prefers and targets for its monetary policy. Last year, declines in the PCE Index played a crucial role in the argument for potential rapid interest rate reductions. However, the latest release supports the notion that any rate cuts will not commence before June at the earliest. Moreover, several factors complicate the possibility of rate cuts.

The Fed is wary of being blamed for fuelling a stock market bubble and is inclined to err on the side of caution to avoid the historical misstep of premature cuts that led to rampant inflation in the 1970s. As elections draw near, the risk increases that any rate cut could be criticised as a politically motivated effort to benefit President Biden.

So far, investors have adjusted well to the likelihood that rate cuts won’t be coming till June now, but I suspect that if it looks likely that this is to be delayed further, then their patience might run a bit thin. It’s time to watch the jobs data, which might hold the key… Let’s hope we don’t get any spike in energy prices as yet another left-field factor that could upset the apple cart.

UK Budget Looms Large Next Week

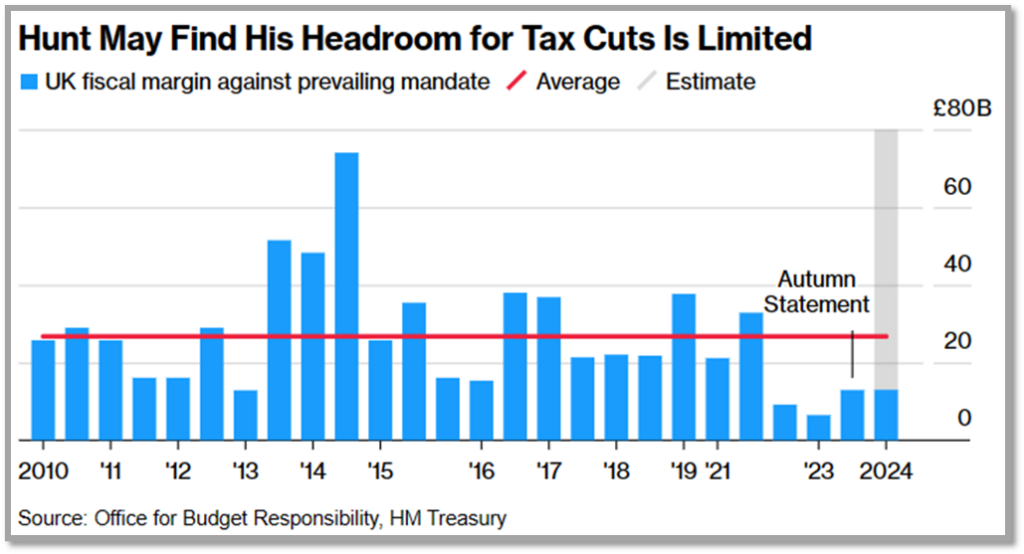

Jeremy Hunt faces a challenging task with his upcoming budget announcement scheduled for March 6. He is under Tory pressure to deliver significant tax cuts to boost the Conservative Party’s popularity ahead of potential elections while also being constrained by the fragile state of the UK’s public finances. Speculatively, we may see tax cuts that include a reduction of at least one percentage point off the basic rate of income tax or national insurance, decisions that are pending final economic forecasts from the Office for Budget Responsibility (OBR).

Hunt’s dilemma is compounded by the limited fiscal headroom available, estimated at £13 billion, before breaching his own rule of reducing national debt within five years. This narrow margin will force him to consider other revenue-generating measures, such as extending the windfall tax on oil and gas company profits to fund the tax cuts. I don’t think that a bit of Fiscal largesse will do it. The Tories are too far behind in the polls, but it won’t stop them from trying, as much can still happen between now and the election, and the upcoming budget is one of the best opportunities for them to regain voter support. However, Hunt is a sensible man and will realise that he must balance the demand for tax cuts with the risk of fuelling inflation or causing unrest in financial markets, similar to the aftermath of Liz Truss’s tenure as Prime Minister with her proposal of extensive unfunded tax cuts.

Moreover, with the Bank of England’s interest rates at 5.25% and inflation expected to fall below the 2% target, the timing and nature of any fiscal adjustments by Hunt will be closely watched for their potential impact on inflation and interest rate expectations. Let’s see what happens, but without a doubt, his upcoming budget will be a tightrope walk between electoral gains and economic prudence.

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production