Inflation comes in hotter while Nvidia results loom large

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Overview

It was a bit of a rollercoaster week for US equities, which saw all three key indices (the Dow Jones, S&P 500 & Nasdaq) end their five-week winning streak. Hot inflation triggered the sell-off, although bullish investors buying on the dip did their best to keep the rally going before bears got the upper hand on Friday.

Investors in the UK shook off the news that we have entered a technical recession and the FTSE 100 rose 2% – though it remains in negative territory for 2024. To put that into context; Japan roared ahead again and, when measured in local currency, is now up more than 15% year to date! Unsurprisingly, US yields were higher; gold was down. Oil has been slowly creeping up, which undoubtedly helped the UK market.

US Inflation Is Not Behaving

On Tuesday, January inflation data for the US came in hotter than expected with the headline CPI number showing a 3.1% increase – higher than the 2.9% forecast by economists. The equity market tumbled on the news and bond yields shot higher.

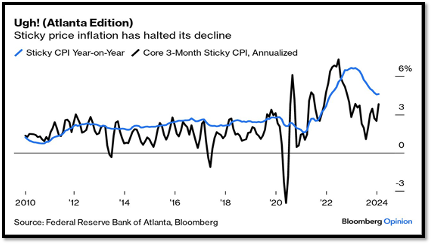

I have wasted many column inches explaining all the different sorts of inflation measures there are, as this topic is to economists what snow is to Eskimos and, on this occasion, to borrow a line from Coldplay, ‘it was all yellow’ if you know what I mean! While one-year trends remain marginally downward, there is a worrying move higher on a one- and three-month basis, as this chart on Atlanta Sticky inflation shows clearly.

Somehow, markets managed to claw their way back from this shock, a testament to the strength of the prevailing bullish sentiment, only for the release of the wholesale inflation data on Friday of January to underscore the problem again. January’s Producer Price Index (PPI) rose by 0.3%, surpassing the Dow Jones economists’ prediction of a 0.1% increase. The core PPI, which excludes food and energy, saw a 0.5% rise, exceeding the expected 0.1% increase.

Bond markets bore the brunt of the bad news; following the release of the inflation data, the 10-year Treasury yield soared past 4.3%, and the 2-year Treasury yield reached over 4.7% at one point, marking its highest level since December. Even then, equity investors held the equity indices flat before an end-of-day sell-off. Until this week, investors’ consensus was that rate reductions would commence in the first half of the year. However, it seems probable that the Fed will hold off until the latter half of the year.

The optimists suggest that the most significant component, Shelter Inflation, is still overstated and will fall much lower over the coming months, allowing headline inflation to glide into the Fed target range. But looking at job numbers, wages and economic growth stats point to continued upward pressures. Inflation might get stuck at a higher equilibrium level than 2%, possibly nearer 3% and the million-dollar question of ‘when will the Fed cut rates?’, may yet become ‘will the Fed cut rates?’. Much, but not all, of the US equity market rally this year is predicated on the assumption that we will get meaningful cuts in rates this year. If we don’t, valuations look vulnerable even if earnings growth outperforms analysts’ expectations.

UK Technical Recession

Last week we got confirmation that the UK entered a mild recession during the latter half of 2023. The country’s Gross Domestic Product decreased by 0.3% in the final quarter, exceeding the 0.1% reduction predicted by economists, according to the Office for National Statistics. This downturn followed a steady 0.1% fall in the prior quarter, aligning with the economic definition of a recession, which is identified by two successive quarters of negative growth. Despite a marginal 0.1% overall growth for the year, this represents the weakest annual increase since 2009, except for the pandemic’s initial year.

This recession, though expected, underscores the impact of the Bank of England’s efforts to curb inflation. These developments emerge at an inconvenient time for Rishi Sunak, coinciding with losses in two by-elections and making it all the more likely we will see a government change this year. Upon assuming office in October 2022, Sunak committed to five principal goals:

- Economic growth

- Debt reduction

- Cutting inflation by half

- Decreasing health service wait times

- Curbing boat migration across the English Channel

To date, the only area where progress could be attributed to his administration is in slowing inflation. This domain is predominantly influenced by the bank rather than the government itself.

However, all is not doom and gloom. The UK recession is about as mild as it gets, with early indicators suggesting an imminent recovery. Indeed, this situation may prompt the Bank of England to accelerate its shift towards lowering interest rates. Although, BoE Governor Andrew Bailey downplayed the recession’s importance earlier this week, highlighting preliminary signs of an “upturn” in early 2024 surveys, despite previous bank forecasts expecting to avoid a contraction in the last quarter.

To my mind, despite this reading, the outlook is brightening. UK employment data remains solid and real wages are favourable and consumer confidence continues to recover. Throw in the fact that since the start of the year, there has been a fall in the gas price, which is now back to levels last seen in the summer of 2021, and I think inflation figures are set to tumble; the latest data suggests the new utility price cap will fall 15%+ in April, with a further fall of 7-8% in July.

Together these should help bring UK inflation down to 2% or perhaps even below in the coming months. Now, not only should that provide leeway for the BoE to bring rates down, but the lower utility bills will provide an extra £300-400 of cash flow for the average households on an annualised basis. Lower inflation is also helping the Chancellor with lower interest costs on debt, which should provide some headroom for more giveaways in The Budget on the 6th of March. I expect to see consumer confidence continue to improve, probably not in time to see Sunak escape an odds-on defeat at the polls, but it does set the scene for an uptick in consumer spending, corporate profits, rising share prices…but perhaps I am getting carried away there!

US Earnings

The most eagerly anticipated company earnings report in recent memory comes on Wednesday when we’ll hear from the flag bearer of the Artificial Intelligence (AI) boom – Nvidia. Excitement over AI’s business potential has boosted Nvidia’s shares by more than 40% since the start of the year. The resultant $570 billion increase in market capitalisation (to put it into some context) is more than triple the market value of Intel and that’s just the increase in value since the start of the year. Nvidia is now the third most valuable company on Wall Street after Apple and Microsoft. The maker of graphics chips for gaming and AI is seen as posting quarterly earnings of $4.51 per share in its upcoming report, representing a year-over-year change of +412.5%.

Nvidia divides the investment community, with as many people championing the case for even more astonishing price gains as those condemning the run as a fantasy bubble similar to the ‘dot com’ surge at the turn of the last century. However, if it does hit analyst expectations, the valuation on a forward P/E ratio is actually reasonable given growth expectations, although at roughly 37x earnings it is hardly cheap.

We shall see, and the results are likely to have substantial ripple effects for large swathes of the technology sector. There is undoubtedly a lot of froth in the share prices of many AI-related businesses, but to compare Nvidia to a ‘dot com’ bubble stock is to miss the point, as there are fast-growing earnings coming from the company. We are still in the infancy of the secular growth on offer from the wide-scale use and adoption of Artificial Intelligence.

As for the rest of the mere mortal companies, earnings continue to beat analyst expectations in the US. Overall, from the 79% of the companies in the S&P 500 that have reported actual results for Q4 2023 to date, 75% have reported actual EPS above estimates. The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth rate for the fourth quarter is 3.2%. Looking ahead, analysts expect (year-over-year) earnings growth of 3.9% for Q1 2024 and 9.0% for Q2 2024. For 2024, analysts are now calling for (year-over-year) earnings growth of 10.9% (all figures are from FactSet Earnings Insights).

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production