Rate Cut Odds Spike as fears of a Fed policy misstep align perfectly with concerns on growth.

Author: Ash Weston – Head of MPS, 8AM Global

So – you’ve been left with me for this week. At least it was a quiet one…!

Usually, I’d seek to inject some level of fun into this, but given the gravity and volume of market news, I’ll spare everyone and try and pack in as much as I can!

All the major benchmarks ended the week lower as investors navigated the busiest stretch of the quarterly earnings reporting season and a significant week for monthly economic data. The recent shift towards value stocks and small-caps hit a bump in the road, with the small-cap Russell 2000 Index experiencing a sharp decline towards the week’s end. Similarly, the Nasdaq dropped over 10% from its July peak, entering a technical correction.

Four of the “Magnificent Seven reported second-quarter earnings during the week: Microsoft, Meta Platforms (Facebook), Apple, and Amazon.com. While earnings results varied, a common theme was the expectation of significant capital spending to enhance artificial intelligence (AI) capabilities.

Amazon shares dropped over 11% in early trading on Friday after its earnings report and call the previous evening revealed capital expenditures of over $30 billion in the first half of the year, with an expected increase in the second half to support AI demands on its cloud computing division, AWS. Microsoft reported spending $19 billion in the second quarter alone, with further increases expected later in the year, while Meta projected spending between $37 billion and $40 billion in the second half. Alphabet had previously estimated spending around $24 billion over the same period.

These huge spends gave investors a ‘reality check’ as they grew impatient to see these big spends generate a return. However, this pullback should be taken in context of the last five years as highlighted below!

Where is the Fed rate cut?

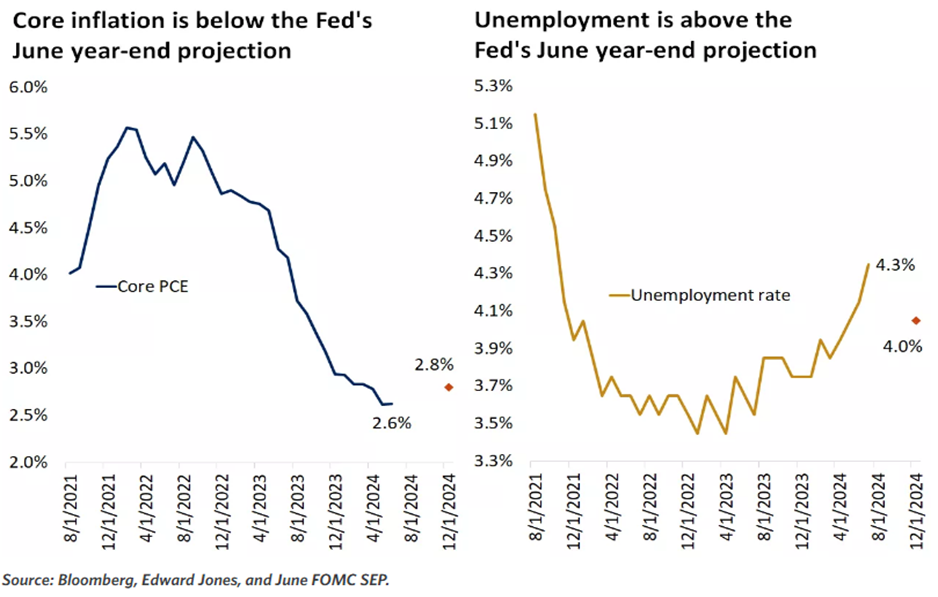

For several months, the US labour market has been slowing down (traditionally bad news), but this “slowing” has been a return to normal levels from previously overheated conditions, and during the last couple years of inflation and higher rates has been received by markets as “good news”. We’ve been writing for many months that “bad news is good news” for markets, as anything that blunts the US economy reinforces the chances of a decrease in inflation and provides an impetus for the accompanying FED rate cuts.

However, after a series of disappointing data points this week and inflation nearing its target, the “Bad news is good news” story may be shifting. Following the BoE cutting rates (more later), investors are questioning whether the Federal Reserve will be too late.

The FED leaving its rate unchanged last week was in line with expectations, but it tweaked its statement to reflect the growing chance of a September rate cut. Powell, in his press conference, confirmed this possibility, saying,

“The job is not done on inflation. Nonetheless, we can afford to begin to dial back the restriction in the policy rate.”

So, with inflation moving in the right direction, remembering the FED’s dual mandate, it’s entirely likely they are more sensitive to the potential downside risks of a weak labour market, as “bad news” is simply “bad news” at this stage. With unemployment above its 4.00% forecast, investors are starting to price in increased odds of FED cuts. CME Fedwatch is currently showing high odds of multiple cuts throughout the year, with nearly 50% odds of the rate ending up between 4.00 and 4.25% by the end of 2024 and a 73.5% chance of a 50 basis point (0.50 percentage point) rate cut at the next Fed meeting in September versus only an 11.5% chance just a week earlier!

Yields tumble as expectations for rate cuts jump – are bonds back?

Longer-term interest rates plummeted in the aftermath of the ISM manufacturing print and the jobs data, sending the yield on the benchmark 10-year Treasury note to its lowest intraday level (3.79%) since late December. (Bond prices and yields move in opposite directions.)

CONTEXT: For more than two years now, the yield curve has been inverted, meaning that unlike most of the time during a “normal” business cycle, yields on short-term bonds have been higher than long-term bonds. An inverted yield curve has historically been a negative signal for financial markets because higher short-term yields lift borrowing costs for consumers and businesses, while lower long-term yields discourage banks from lending. It is also a signal that Fed policy is overly restrictive.

As the FED hinted that it might start cutting alongside the volatility last week, the bond market has begun to price in a more aggressive easing cycle, driving a sharp rally in bond prices and a drop in yields. Finally, the normal relationship between bond performance and equity might be back!

The 2-year yield fell below 4.0% for the first time since May 2023, while the 10-year dipped below 3.90%, down from April’s high of 4.70%. The path of least resistance for yields is lower, and it’s expected that short-term yields will continue to fall faster than long-term yields, helping the yield curve normalise, as shown below.

BoE cuts rates!

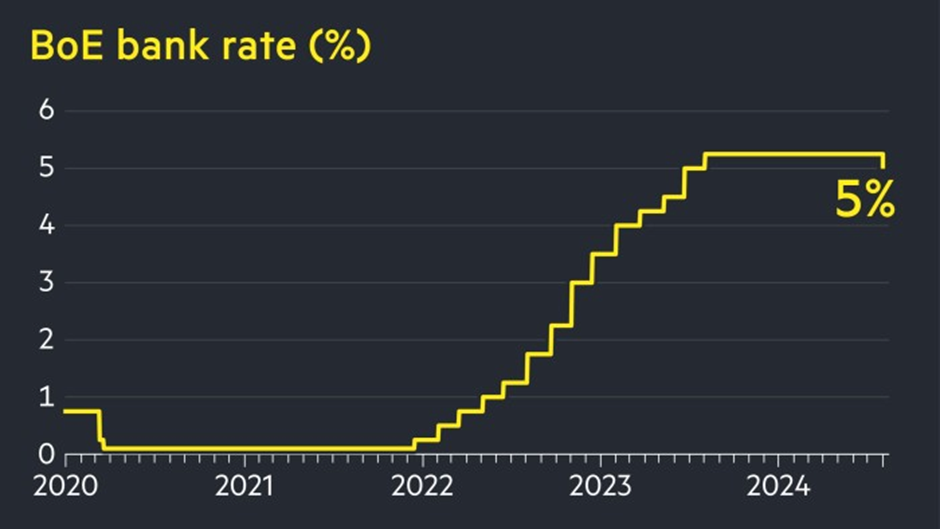

So, what would have been the headline in a quiet week in markets has been relegated to here! Following Europe, the BoE cut its key interest rate by a quarter point to 5.00%, its first reduction since 2020. In a quiet week, this would have likely driven UK markets higher, but this was lost in the deluge of news from the US.

Andrew Bailey also signalled that policymakers were not about to embark on a rapid succession of cuts, stating,

“We need to make sure that inflation stays low and be careful not to cut interest rates too quickly or by too much.”

Investors now expect the BoE to make one or two further rate reductions by the end of the year.

The BoE said on Thursday that it expected headline inflation to climb from 2% to 2.7% this year before slowing. It added that it expects consumer price inflation to drop to 1.7% by 2026 and then to 1.5% in 2027. The BoE also upgraded its gross domestic product forecast for this year to 1.25% from just 0.5% and expected expansion of 1% in 2025 — all relatively positive noises for the UK.

Interestingly—although perhaps only from an academic perspective—the FT has compiled this visual guide to rate decisions since 2020, showing the UK joining the ‘rate cut club’ alongside the Eurozone, Peru, and Brazil!

Noting the (now) significantly increased odds for a cut in the US, it now sits in somewhat lonely company in the ‘no cut yet’ club.

All of this, alongside continued increases in private equity activity post the 2023 slump, continues to add to the case for UK PLC as an attractive, well-priced market for investors. With pending policy and political outcomes in the US – noting that Kamala and Trump are still just about level pegging – the odds remain strong for the UK to play a more significant role in investor portfolios as they aim to secure a potential bargain.

Europe

Any market positivity the Paris Olympics might have unleashed was quickly quashed by turbulent global markets.

In local currency, the European STOXX Europe 600 Index ended the week 2.92% lower. Within this bucket, Germany’s DAX tumbled 4.11%, France’s CAC 40 Index dropped 3.54%, and Italy’s FTSE MIB lost 5.30%.

There were various changes in CPI reads across the different Eurozone countries. However, given the increasing length of this article and this market’s broad alignment with the overarching story in the US, let’s move on.

Japan

Japan wasn’t immune from the global pullback. During a week that saw a hawkish turn from the Bank of Japan, it suffered losses, with the Nikkei 225 Index falling by 4.7%. On Friday, this negative tone was compounded by the news from the US and the resultant move in markets. The absolute drop in the Nikkei was among the biggest in the index’s history, comparable to its one-day plunges in March 2020 when the coronavirus pandemic struck and during the “Black Monday” global stock market crash in October 1987.

In addition, a rebounding Yen continues to hamper the outlook for earnings for Japan’s export-oriented companies. At the end of last week, the yen strengthened to around 148.9 against the dollar from about 153.7.

Consensus remains positive for Japan, with this being treated as a logical pause while investors absorb weaker-than-expected company guidance. Any improvement on these forecasts will result in positive sentiment, reinforcing changes in corporate governance and the shift from deflation to inflation, providing continued positive momentum over the medium-long term.

Asia

Adding to the continuing pile of bad news, the killing of Hamas’ political chief in Iran increased concerns about a broader Middle East war and sparked a short-lived jump in oil prices. Subsequently, the Brent crude index moved lower as the week progressed, as the worries about slowing global economic growth returned to the fore.

Hamas leader Ismail Haniyeh, who was visiting Tehran for the inauguration of the new Iranian president, was killed on Tuesday in an attack that the Iranian government blamed on Israel. Haniyeh’s death was one of several incidents over the past week that led to increasing worries that the war in Gaza could expand to the broader region. On July 27th, a rocket attack on the Israeli-controlled Golan Heights killed 12 children, and although Lebanese militia group Hezbollah denied responsibility, Israel responded by killing a Hezbollah commander in Lebanon.

The effects of conflict in this part of the world are felt only indirectly in most UK multi-asset portfolios. But this doesn’t lessen the impact of the secondary effects of oil prices on inflation, as well as general worries about the escalation of global conflict.

A small note here on China; as one of the very few sectors that didn’t record a negative return for the week. Generally Chinese equities were mixed after some weak manufacturing data, but considering some of the falls in western markets, IA China was able to record a flat week, providing an astonishing (

+0.04%. Given its disappointing performance over the past few years, I think we can put this down to a low baseline rather than any sort of significant positive signal!

In summary? Don’t panic, this Bull market is likely to continue even as volatility increases.

In the first half of the year, market volatility was low (oddly so), with the VIX index, a measure of stock-market fluctuations, staying around 14—30% below its long-term average. However, these first few weeks of the second half are showing a decidedly different trend!

Thursday of last week saw the biggest intraday swings since late 2022. The S&P 500 rose by 0.8% in the morning but then dropped as much as 2% before recovering some losses later in the day, and the selling continued on Friday following the jobs report.

Concerns about the Federal Reserve potentially cutting rates too late, combined with election-related uncertainties, could mean additional volatility in the US, especially as we enter a typically weaker part of the year. Historically, the period from August to October has been the worst for stocks, with lower returns and higher volatility. However, this negative trend is more pronounced when stocks are already in a downtrend (unlike this year). Since 1941, whenever the S&P 500 has risen by 10% or more in the first half of the year, it has averaged a 7% increase in the second half. The only caution is that short, pronounced pullbacks in the second half tend to be deeper than in the first half, averaging 9%.

Beyond technology, the outlook for earnings remains positive, as S&P 500 earnings growth is on track to accelerate from 6% in the first quarter to about 11% in the second. The biggest upside surprises are coming from a combination of cyclical and defensive sectors, such as financials and healthcare, and less so from the growth sectors. This remains consistent with most market predictions that growth will broaden out from the M7 as we approach the start of rate-cutting in the US.

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production