The Sound of one hand clapping…

Author: Ash Weston, Head of MPS, 8AM Global

Is it a victory if you are fighting yourself? – Global Overview

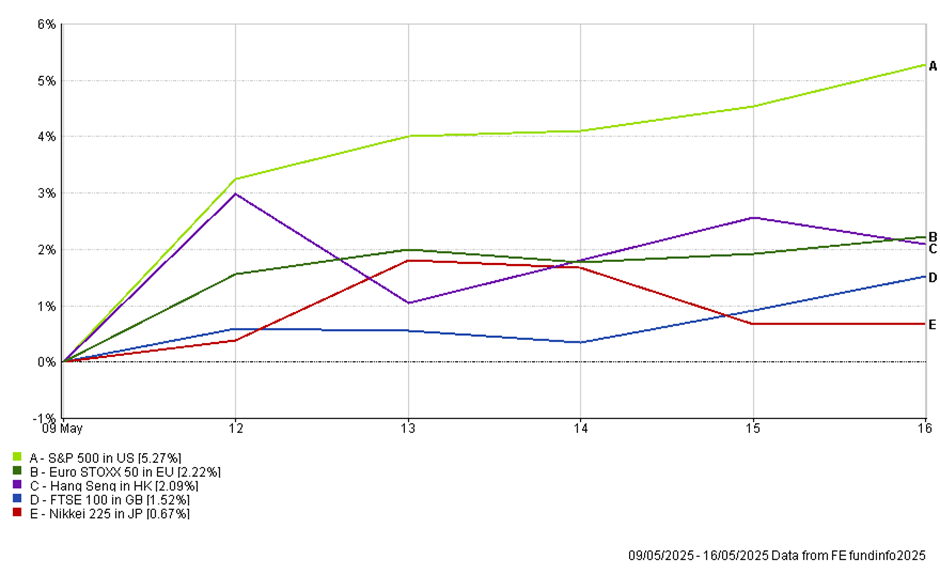

Despite lingering geopolitical uncertainty, global equities rallied sharply during the week on the back of a tentative US–China trade truce and softer-than-expected inflation data. On Sunday into Monday, US and Chinese officials agreed to slash their reciprocal tariffs from extreme levels, in a ‘total reset’ (the US to 30% from 145%, China to 10% from 125%) for a 90-day negotiation period. This move sent a wave of relief through markets: Wall Street leapt higher, and global stock indexes jumped. Investor sentiment was further bolstered mid-week by US April CPI data, which showed consumer inflation at an annual 2.3% (below forecasts and the lowest since early 2021). These two points undercut recession fears: safe-haven assets weakened while equities pushed towards “risk-on”.

Looking at currency effects, sterling strengthened modestly versus USD over the week. Thus, US equity gains in dollar terms were slightly softer for sterling investors. For example, the S&P 500’s roughly +5.0% USD gain translated into about a +4.3% return in GBP. European gains were similar in GBP since EUR/GBP was essentially flat.

North America

By Friday, US indices were again sitting close to all-time highs. The S&P 500 closed at 5,958, close to its previous high set in February at 6,144, driven by tech and AI. The Nasdaq likewise finished higher for the week, as investors rushed back in on the positive inflation and policy news.

Strong corporate earnings added fuel: chipmakers Nvidia and Broadcom rose ~5–6% on Tuesday, Tesla jumped 5%, and internet giants like Meta and Amazon also advanced. These gains helped the S&P recoup its 2025 losses and return to modest year-to-date profits.

Aside from the ongoing positive narrative of some breathing room on tariff policy, the key datapoint for the week was US CPI. A phrase used by Bloomberg commentators was ‘comfortingly dull’ as the headline rate of 2.3% was announced. Whilst not directly linked to the fundamentals of a potential US recession, a falling or ‘boring’ CPI number is one that may well increase the odds of Fed cuts – a notion supportive of future valuations and very positive for equity market sentiment.

A key factor of the core components of the data is the ‘sticky’ services inflation, which as you can see, is slowly (slowly) trending down…

In fact, all of the interestingly named inflation sub-categories are within or approaching the Fed’s upper boundary.

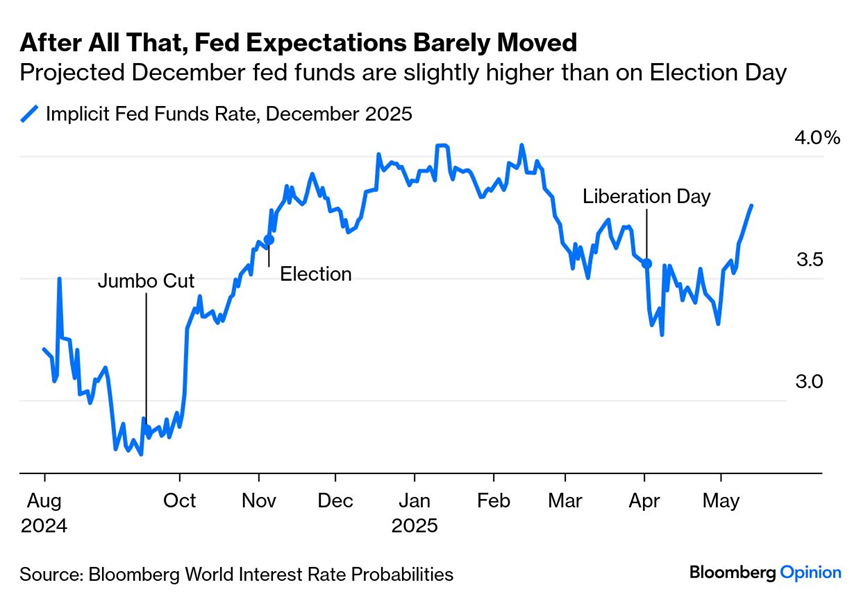

Regardless of all this positive news, expectations for Fed rate cuts are essentially somewhere between where we started the year and Liberation Day – in short, the jury is still out!

Lots of similarities are being drawn to the start of historic bull markets by other market commentators, but the next few months are likely to be dictated by policy rather than the fundamental ingredients of a more ‘traditional’ bull market.

Parking tariff policy for a moment (given the outlook is at best speculative) it’s interesting that 75% of BofA fund managers recently polled believed that the projected H2 2025 tax cuts will likely increase the US deficit, but would also be a significant net positive for equities.

On the same theme, Moody’s downgraded the United States’ debt on Friday, which previously held an outstanding rating of AAA. Moody’s dropped the US debt rating to Aa1, citing concerns about the nation’s growing $36 trillion debt amid gridlock in Congress over The White House budget bill. The Committee for a Responsible Federal Budget estimates this bill will add $3.3 trillion to the debt in the next 10 years.

Scott Bessent told CNN on Sunday that he “does not put much credence” in the Moody’s downgrade. Fiscal austerity from this administration would be perhaps the greatest surprise of all!

A final point is a data point historically raised by your regular author – the Fund Manager sentiment indicator, which has bounced off the bottom, which could set up this rally for a while longer…

Europe and the UK

European markets broadly participated in the global rally, albeit with more modest weekly gains. However, European markets are trading off their straight fifth weekly advance so…apples to apples and all that!

Among sectors, industrial and defence stocks were prominent movers. Defence contractors rallied on reports that Russia and Ukraine would hold peace talks – “defence companies rise on Russia-Ukraine peace talk uncertainty” – as investors hedged geopolitical risk. Industrial conglomerates also helped, even though headline earnings were mixed. For example, Thyssenkrupp’s Q2 profit plunged (its shares fell) and Siemens missed cash-flow targets. However, these company-specific setbacks were more than offset by gains in autos and machinery.

Over here, UK equities outperformed slightly. Data showed UK Q1 growth ahead of forecasts, which gave Blue-Chip stocks a lift despite the BoE’s recent hawkish stance on growth. Investors were counting on the fact that the BoE would cut rates after April’s softer guidance, but robust GDP figures made future cuts seem less certain. Financial stocks and industrials led, while the domestically focused FTSE 250 was flat. Notable movers included Hikma Pharmaceuticals and National Grid.

It should be noted that the 0.7% GDP expansion in Q1, was the fastest quarterly growth since Q1 2024 and the strongest among G7 economies. It has provided a welcome boost to investor confidence in the resilience of the UK; however, by undershooting expectations for an imminent slowdown, these figures have also reduced market expectations for near-term Bank of England rate cuts, which may constrain upside momentum in rate-sensitive sectors. UK PLC will likely see some positive attention, particularly among domestically oriented, cyclical stocks, offset by a more cautious tone in high-dividend sectors.

The prospects for the UK cannot be expressed more clearly than in the most macro research I received this evening: ‘Modest Positive Bias’.

Asia Pacific

In Japan, the market ended the week slightly up overall. The index was propelled by exporters (yen weakness helped profits) and tech strength (Nvidia-related chip demand).

Unsurprisingly, Hong Kong’s Hang Seng recovered sharply from earlier losses: it surged ~3% on Monday before fading on Tuesday, ending the week with a solid gain of roughly 2.5% in GBP terms. Chinese Mainland stocks (CSI 300) also rallied midweek. Reuters reported that Bessent’s old hedge fund buddies (implied) aggressively re-entered China in anticipation of a deal. In fact, both CSI 300 and the Hang Seng almost recovered to their pre-tariff-war levels. A fairly straightforward reaction to the tariff news, but it was noted that in addition, Chinese regulators had stepped in with various support measures (state fund buying, regulatory easing), which also supported the rebound.

To put some numbers on the scale of inflows back into Asia – Taiwan equities saw net inflows of $4.4 billion and India $1.7 billion in May so far. The MSCI Asia-Pacific ex-Japan index has surged c18% since early April on these inflows and the trade policy relaxation.

Emerging Markets

There isn’t a huge amount to add that hasn’t already been said relative to overarching US policy. With respect to smaller composite components of Emerging Markets exposure, Latin American markets generally rose. For example, Brazil’s Bovespa index was up ~2–3% (as of Friday) on higher commodity prices and (again) broadly positive US signals. Mexico’s Bolsa gained on dollar weakness and a stable trade outlook. In addition, commodity exporters (e.g. South Africa’s JSE) also benefited from higher industrial metals and oil.

Summary

Across all regions, the US–China trade truce was the dominant factor, sparking a broad equity rally. The pause in new tariffs alleviated short-term recession worries and shifted investor focus back to growth and earnings. Inflation data played a supporting role: the surprisingly mild April CPI in the US (2.3%) and stable Eurozone inflation (2.2%) implied a continuation of current central bank trends, which was supportive and soothing to markets.

Corporate earnings were mostly positive, especially in tech and cyclical sectors, further anchoring the rally. High-profile earnings misses (e.g., in US health or European industrials) caused some intra-week swings but did not derail the broad upward trajectory.

Finally, geopolitical events had mixed effects: the India–Pakistan conflict pause lifted South Asian markets, while tentative Russia–Ukraine talks briefly buoyed European defence stocks. Overall, the week saw a synchronised global upswing, with a few pockets of caution.

These market movements could be inferred as ‘back to business as usual’ concerning assumptions about the US’s participation in global growth. This administration has already proven its willingness to go further than anyone predicted in pursuit of its goals. This relaxation of policy, whilst reassuring in the short term, doesn’t fundamentally alter the fact that the odds of ‘unknown unknowns’ during a Trump presidency are exponentially higher, and investors should remain wary.

I’ll leave you with a statement from Scott Bessent from the same CNN interview I cited earlier – “tariff rates will return to ‘reciprocal’ levels if countries don’t reach trade deals with the US”.

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production