Earnings Power, Policy Pressure!

Author: Ash Weston, Head of MPS, 8AM Global

Market overview

Global financial markets presented a cautiously optimistic picture over the past week, with investor sentiment driven by robust corporate earnings in the US, signs of economic resilience in Europe, and policy-driven uncertainty across Asia.

European markets were more subdued, ending the week relatively flat. However, the underlying data indicated improving momentum and investor interest, and positive allocation remains high.

In the UK, inflation rose unexpectedly, driven by increased fuel prices, while the unemployment rate climbed to the highest figure in four years. Wage growth remained resilient, adding complexity to the Bank of England’s interest rate decision-making process.

In Asia, China reported GDP growth slightly above expectations, which temporarily boosted market performance. However, persistent concerns about deflation, weak consumer demand, and ongoing struggles in the property sector tempered investor enthusiasm.

Japan’s equity markets edged higher ahead of its upper house elections, though trade uncertainty and subdued export figures (particularly to the US) kept gains in check.

US

The S&P 500 and the Nasdaq reached new highs, driven by robust corporate earnings reports and generally positive economic data. The small-cap Russell 2000 also demonstrated strong performance, while the Dow Jones and the S&P Midcap 400 Index experienced some downward pressure.

Earnings season began in earnest on Tuesday, with several major banks reporting their results. JP Morgan Chase, the largest bank in the US, and Citigroup both reported better-than-expected results for the second quarter. Then, on Thursday, well-known consumer-facing companies such as PepsiCo, United Airlines, and Netflix released reports that exceeded forecasts.

In other company news, chipmaker NVIDIA announced that it had received permission from the Trump administration to sell its H2O artificial intelligence chips to China. NVIDIA, which reached a market capitalisation of $4 trillion for the first time in early July, saw its stock rally on this announcement.

Investors also reacted positively to economic reports indicating consumer strength and inflation levels that, while not improving, were not cause for significant concern. Notably, the CPI showed its most significant monthly increase in five months, generally aligning with consensus estimates.

CPI increased by 0.3% month over the month in June, up from 0.1% in May. Some economists attributed higher tariffs as a driver of the price increases. On a year-on-year basis, prices rose by 2.7%, compared to 2.4% in May. The core CPI, which excludes the volatile costs of food and energy, increased by 2.9% year-on-year, up from 2.8% in May. Prices for household goods, recreational goods, and footwear have all accelerated since April, although lower prices for cars somewhat offset these increases.

Investors also focused on the Census Department’s retail sales report, which showed sales rising by a better-than-expected 0.6% in June after declining by 0.9% in May. Reports that President Trump was planning to fire Fed Chair Jerome Powell put downward pressure on stocks on Wednesday; however, this trend quickly reversed when Trump stated he would not remove Powell. Trump has been a vocal critic of the Fed chief, particularly as the central bank has paused further rate cuts so far this year.

Europe

In local currency terms, the pan-European STOXX Europe 600 Index ended approximately unchanged, as investors looked for indications of progress in US and European trade talks. Major stock indexes showed mixed results: Italy’s FTSE MIB rose by 0.58%, while Germany’s DAX and France’s CAC 40 Index experienced little change.

The ZEW index of economic sentiment in July increased for the third consecutive month, reaching 52.7, its highest level since February 2022. Analysts surveyed by FactSet had anticipated a reading of 50.2. The economic research institute reported that nearly two-thirds of the experts polled expected an improvement in the economy, driven by potential stimulus measures and expectations for a swift resolution to the European Union’s trade dispute with the US.

Industrial production in the euro area grew by 1.7% in May, recovering from a 2.2% decline in April and surpassing market expectations of an only 0.9% increase. The growth was primarily fuelled by increased output in energy, capital goods, and nondurable consumer goods. Year on year, production growth accelerated to 3.7%, up significantly from just 0.2% in the previous month.

Additionally, the European trade surplus widened to €16.2 billion in May, compared to €12.7 billion a year earlier, as exports rose by 0.9% while imports decreased by 0.6%.

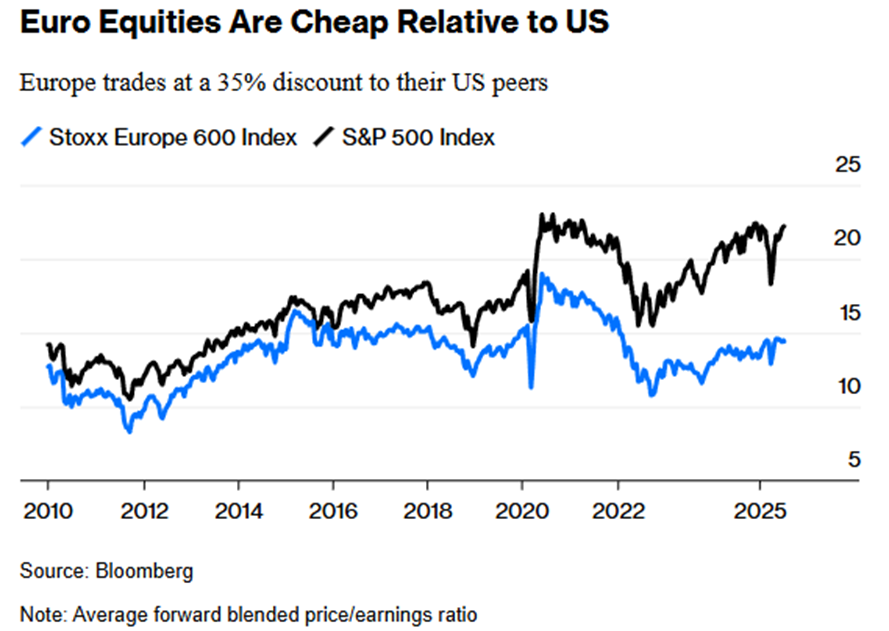

Investors remain optimistic that the euro stock rally will continue to gain momentum. According to Bank of America Corp.’s European fund manager survey, confidence remains strong, as the Euro Stoxx 50 has increased by 9% this year, outperforming the S&P 500 index by roughly three times in euro-denominated terms. A net 41% of respondents reported being overweight euro equities compared to their benchmark, marking the highest level in four years. In contrast, a net 23% of participants indicated they were underweight US stocks.

UK

The FTSE 100 ended up 0.57% up and briefly breached the 9000 barrier before settling at 8992.12 to close the week.

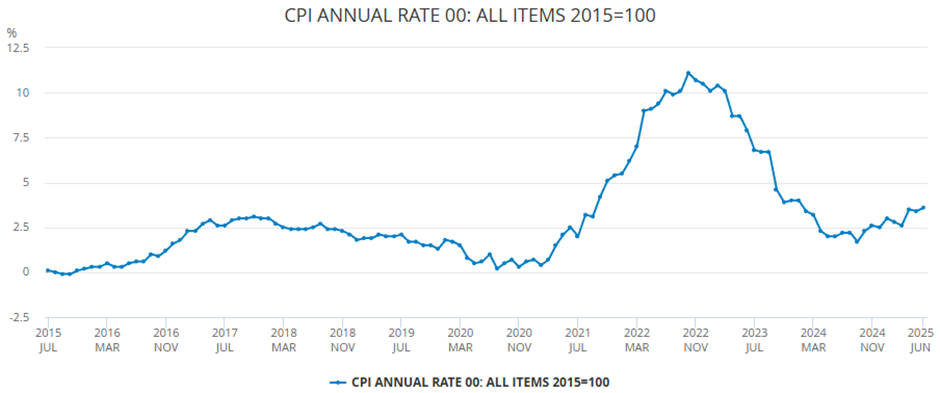

On Wednesday, we received data showing that in June, the annual rate of consumer price inflation in the UK unexpectedly rose to 3.6%, up from 3.4% in May. This marks the fastest pace of inflation since January 2024, primarily driven by higher transport costs, particularly for motor fuels. Services inflation, a crucial measure for the BoE, remained steady at 4.7%, suggesting ongoing underlying cost pressures, despite expectations that it would decrease.

The UK labour market appeared to cool further in the three months through May. The unemployment rate ticked higher to 4.7% from 4.6% in the three months through April, the highest level in four years. The number of payroll employees declined by an estimated 41,000 in June, after a drop of 25,000 in May. Meanwhile, annual pay growth excluding bonuses was slightly higher than analysts had expected, coming in at 5.0%. This latest figure was down from an upwardly revised 5.3% the previous month.

Asia inc China

Mainland Chinese stock markets were positive for the week. The onshore benchmark CSI 300 Index increased by 1.09%, and the Shanghai Composite Index rose by 0.69% in local currency terms, according to FactSet. In Hong Kong, the benchmark Hang Seng Index advanced by 2.84%.

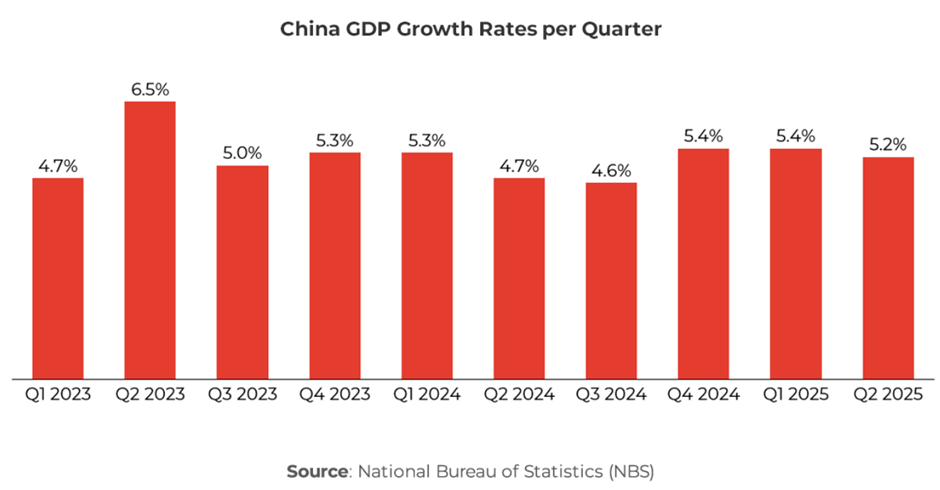

According to the country’s statistics bureau, China’s GDP grew by 5.2% in the second quarter compared to 5.4% in same period last year. Analysts suggested that this higher-than-expected growth in the second quarter may reduce the pressure on Beijing to introduce further stimulus measures in the near term.

However, analysts warned that growth is expected to slow in the second half of the year due to worsening deflationary pressures, weak retail sales growth, and the potential for renewed trade tensions with the US after a temporary deal expires in mid-August. Earlier this month, China reported that its producer price index fell to its lowest level in nearly two years in June, marking the 33rd consecutive month of factory deflation.

The ongoing weakness in China’s housing market has also sparked new calls for additional stimulus from the central government. The statistics bureau reported that new home prices in 70 cities across the country decreased by 0.27% in June compared to the previous month, while prices for existing homes dropped by 0.61%. Residential sales fell by 12.6% in June compared to a year earlier, representing the sharpest decline this year, according to Bloomberg. The data indicates that China’s property slump, now in its fifth year, continues to impact consumer demand.

Japan

Japan’s stock markets experienced modest gains over the past week, with the Nikkei 225 Index rising by 0.63% and the broader TOPIX Index increasing by 0.40%. However, returns were limited due to political uncertainty ahead of Japan’s Upper House election scheduled for 20 July. A potential outcome of this election could see the ruling coalition of Prime Minister Shigeru Ishiba’s Liberal Democratic Party and Komeito losing its majority control.

Investors are likely focused on how pro-economy and reform-oriented the new cabinet will be, as well as whether it will adopt a dovish or hawkish fiscal policy. The yield on the 10-year Japanese government bond rose to 1.53%, up from 1.49% at the end of the previous week. This increase reflects investor expectations that the election may result in a more fiscally dovish cabinet aiming to increase government spending. Meanwhile, the yen weakened to approximately the middle of the JPY 148 against the USD range, a drop from JPY 147.4 previously.

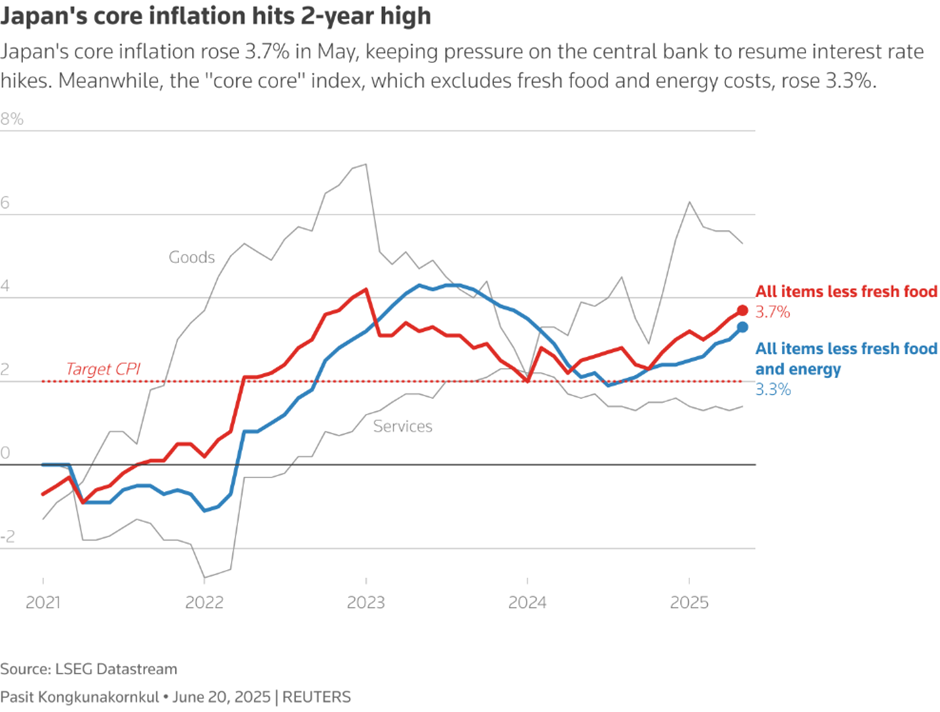

Inflationary pressures appear to be easing slightly, as Japan’s core CPI rose by 3.3% year-on-year in June. This increase was less than the consensus estimate of a 3.4% rise and down from 3.7% in May. The moderation in core inflation is primarily attributed to declining contributions from energy costs, partly due to government subsidies.

On the trade front, Japan’s exports declined by 0.5% year-on-year in June, marking the second consecutive monthly decline and falling short of consensus estimates, which had predicted a 0.5% increase. Exports to the US dropped significantly due to weaker shipments of automobiles, auto parts, and pharmaceuticals, while sales to China also decreased. The US has announced the implementation of a 25% reciprocal tariff on Japanese imports, effective 1st August. However, ongoing bilateral trade talks between the two countries may lead to a formal agreement.

Emerging Markets

Trawling for specific stories in Emerging Markets that diverged from the broader narrative of tariffs was challenging. Still, weakness continued in India, as the Nifty index fell for the third consecutive week, dropping below 25,000, with foreign portfolio investor (FPI) outflows surpassing ₹10,700 crore in July, notably breaching its short-term 20-day moving average. Analysts are now predicting significant market movements in the upcoming week due to these oversold levels. However, it’s important to note that this ongoing weakness may also be a result of investor fatigue and declining interest in the region.

This Week…

- Signals from Powell could shift US yield curves and set the stage for late July’s monetary policy decisions.

- Mixed macro data — housing, labour, manufacturing — will help investors assess whether the US economy remains resilient or risks slowing.

- Earnings season intensifies with high-profile reports from Tesla and Alphabet, which tend to impact sentiment across the tech and broader markets significantly.

- Geopolitical & trade headlines may amplify swings, especially around tariffs and election-driven policy shifts.

Tuesday 22 July…

8:30 am ET: Fed Chair Powell opens the banking conference — widely seen as a preview to the Fed’s 29–30 July policy decision.

Throughout the week…

June existing & new home sales figures are due, alongside weekly jobless claims and the durable goods orders report — all essential for gauging consumer and manufacturing momentum.

Alphabet (Google) reports Q2 results — expectations centre on ad revenue strategy and AI progress.

Tesla releases Q2 earnings following a decline in vehicle deliveries amid growing interest in its robotaxi program.

Other “Magnificent Seven” and tech peers, such as Intel, SAP, and ServiceNow, will also report earnings.

India’s earnings wave: Over 95 companies, including Infosys, Nestlé India, Bajaj Finance, Paytm, Kotak Mahindra, and others, will report between July 21 and 26, underscoring economic trends in Asia.

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production