Liberation Looms!

Author: Ash Weston, Head of MPS, 8AM Global

Market Overview

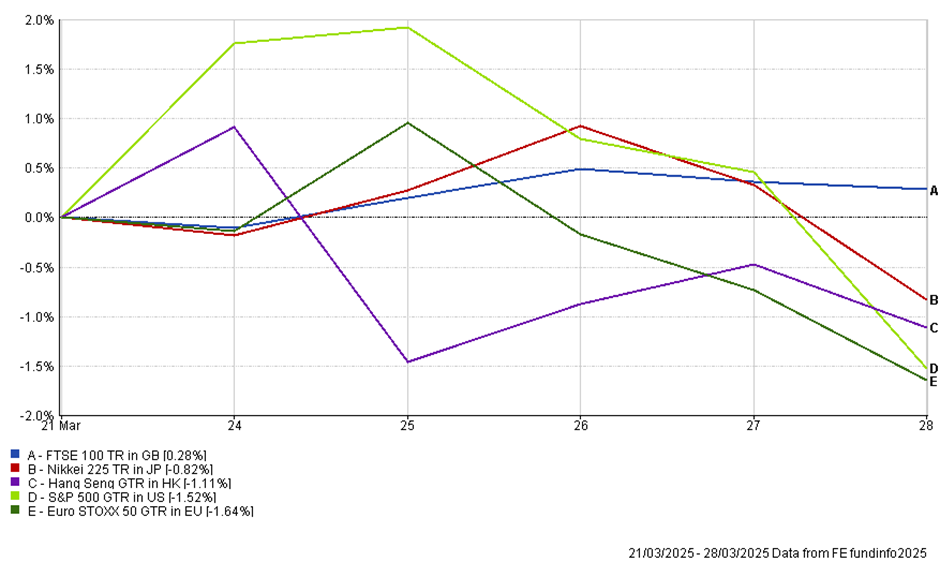

Global equities have been marked by cautious sentiment amid escalating trade tensions. US markets have slipped by roughly 1.00 -1.5%, while UK equities remained relatively subdued. In Asia, markets, especially in the auto sector, have shown modest weakness. Chinese equities and broader emerging market indices have experienced declines in the low-to-mid single digits as investors weigh the impact of Trump’s ongoing trade war – more specifically ‘Liberation Day’, which is still scheduled to kick into force this coming Wednesday 2nd April.

UK – Fiscal credibility restored – but only just…

I’m going to shake things up by starting with the UK for once. Chancellor Rachel Reeves took to the dispatch box this week with a simple goal: keep the bond market quiet. She just about managed it. By announcing a £14 billion package of cuts and clawbacks, she restored her precious fiscal buffer to exactly where it stood in October – £9.9 billion. Not a penny more. Not exactly a war chest, but just enough to calm the nerves of rating agencies and gilt traders alike.

The OBR slashed its 2025 growth forecast in half, from 2% to just 1%, so Reeves did what any Chancellor with shrinking headroom might: she cut back. The so-called ‘bonfire of the bureaucrats’ (10,000 civil service roles to go) is headline-friendly, but the real muscle came from welfare. Personal Independence Payments and Universal Credit face the chop, helping fund a modest uptick in defence spending, a small boost for housing, and an above-inflation rise in the National Living Wage.

The political gamble is clear. By doing just enough to meet her fiscal rules, Reeves avoids tax hikes – for now. But with growth faltering and departmental budgets tightening, she’s left herself hostage to fortune. Any deterioration in the economic outlook, or another surprise on inflation or borrowing costs, and the Autumn Statement could bring a fresh round of fiscal reckoning, likely with tax rises in tow.

Markets didn’t flinch, but they didn’t cheer either. Sterling was steady, gilt yields barely budged, and UK equities continued to drift with broader global sentiment. Investors seem content with competence over charisma – for the time being. But with the tax burden still on track to hit a post-war high by 2027, and the structural growth story still elusive, the bigger fiscal questions remain unanswered.

This stability historically would have resulted in the UK being left behind global equities, but in this instance, taken alongside the more positive spin of the UK potentially being left out of the ‘Trade War’ crosshairs due to a lack of trade imbalance, has resulted in this being the only global sector to finish in positive digits for the week!

US & ‘Liberation Day’

The chart at the start of this piece tells you much of the narrative of the last week in markets, but it’s important to view this data in context of the last month:

In the context of the last 30 days of Trump-Turbulence (Trumpulence?) you can see the US and Japan have fallen back to (roughly) their prior low points from earlier in the month – which makes sense – given that we appear to be barrelling towards Liberation Day without any indication of Trump doing a last minute ‘bait and switch’.

To be fair, there were a confluence of factors in addition to tariff fear that pushed markets lower at the end of last week;

- Inflation Data: The core Personal Consumption Expenditures (PCE) index, a key measure for the Fed, rose more than expected, heightening fears of sticky inflation – lessening the odds of the Fed cutting.

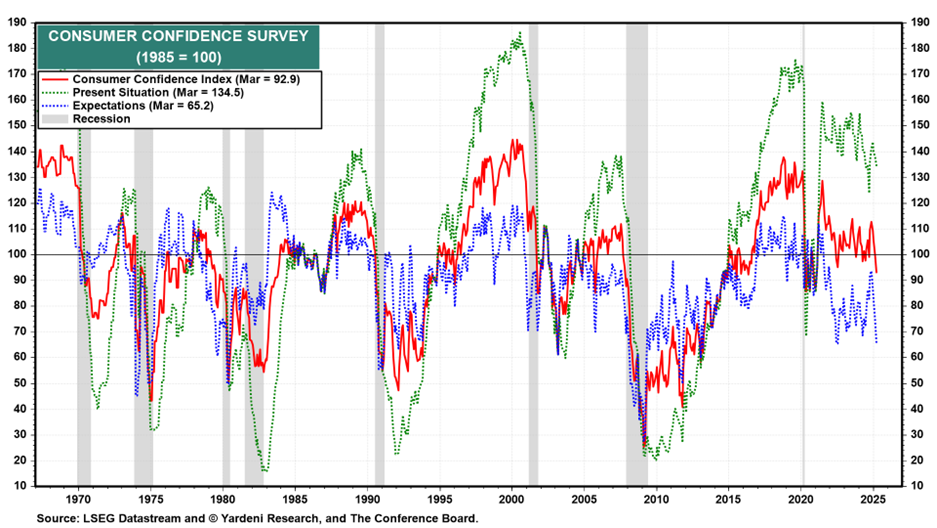

- Falling Consumer Sentiment: Surveys, notably from the University of Michigan, showed consumer confidence at its lowest in two years. This erosion in sentiment raised concerns that households might cut back on spending.

However, you can draw a straight line through the correlation of trade uncertainty for each geographic region and major stock market performance over the past 30-day period and is very much the primary driver.

So, for anyone living under a rock, here is the state of play in a nutshell RE the Trade War;

Trump argues that by imposing these tariffs, US companies will be incentivised to re-shore production, which he claims will ultimately generate jobs and secure domestic manufacturing. However, this aggressive approach is likely to trigger retaliatory measures from affected trading partners, thereby increasing global trade tensions.

What are the possible trajectories if Liberation Day goes ahead as described?

Short Term

In the immediate aftermath of Liberation Day, equity prices may decline as investors reassess earnings forecasts. For instance, indices in regions highly exposed to US trade such as the auto sectors in Japan and South Korea could see declines. Tariff-induced cost pressures are likely to contribute to higher input costs, which may push up consumer prices and further dampen investor sentiment in the near term.

The odds of a consumer-led US recession in 2025 remain less than random chance, but as of Friday has increased to the highest point since 2022, with consensus estimates sitting between 30-40%. A key measure of consumer sentiment from the University of Michigan fell to 57.0 this month, down from 64.7 in February, and 28% lower than a year ago.

Liberation Day also has the fundamental effect of increasing inflation which could cause the Fed to delay or even tighten fiscal policy from here.

Medium Term

Over the medium term (6–12 months), companies might begin to adjust by diversifying their supply chains or relocating production to mitigate tariff risks. While this reconfiguration could create pockets of opportunity, especially for domestic US producers, it also introduces transitional inefficiencies and costs.

As trading partners respond with their own countermeasures or enter negotiations to ease tariff pressures, we could see a period of recalibration. Global equity growth will likely be pretty benign during this period as the market absorbs the mixed signals from both the US policy stance and retaliatory actions abroad.

Longer Term

For the US, success in re-shoring production could bolster certain domestic industries and support higher valuation multiples over time, but from a much lower place in the global pecking order. Persistent trade barriers may well reduce overall efficiency and slow global economic growth – a factor that could dampen long-term equity performance internationally.

Aside from the obvious, these changes could reshape fundamental assumptions about global market and trade, from the consistent bet on US exceptionalism to the ubiquity of the Greenback as the default global currency…

Who owns who? The other imbalance…

Before tariffs, TikTok bans and MAGA baseball caps, there was a more elegant macro panic – the terrifying idea that China owned too many US Treasuries. Back in the 2000s, Beijing’s vaults were bursting with export profits, and like any respectable James Bond villain, it chose to hoard them in US government debt. Cue the geopolitical horror;

“What if they dumped them all at once and tanked the US economy?”

At the time cooler heads eventually prevailed. Turns out, crashing your own reserves isn’t the sharpest tactical move even in our hypothetical ‘Bond’ universe.

But the US ownership imbalance hasn’t gone away. Its just shape shifted. Fast-forward to today, and America’s net international investment position has fallen to between -5% and -10% of US GDP which means foreign investors own more of the US than the US owns of them.

For now, the party continues, foreign money is coming in, drawn by strong demographics, resilient earnings, and the irresistible appeal of exceptionalism. But capital, unlike trade, doesn’t need paperwork or ports. One click, one shift in pension policy, one nasty tweet from the State Department, and billions can flow back out faster than you can say ‘diversification benefit’.

The truly surreal part? This potential new capital war doesn’t need armies or tariffs. Just a polite nudge from a regulator or a populist speech about ‘national security’ and voilà – flows reverse. Ask the Mexicans, who once halted a currency crisis mid-GFC by forcing public pensions to bring their money home. It worked. The peso jumped, and the local stock market rallied like someone had found oil in Guadalajara!

So, while the dollar’s dominance is safe for now, the trust underpinning those capital flows looks shakier by the day. And if foreign investors do decide that America’s geopolitical behaviour is a bit… much, we could be heading toward a world where everyone keeps their capital closer to home.

Stranger things have happened.

Summary

We remain laser-focused on US economic indicators and policy. Advisers and investors in 8AM AQ models will recall that we altered the state of our US exposure to ‘Defensive’ at our last review and have positioned the portfolios as ‘underweight’ US equities relative to the peer consensus positioning.

Clients can be assured that their portfolios remain diversified globally, reviewed and optimised frequently, and will adapt quickly to new information quickly and dispassionately, as our investors have come to expect.

If interested, an article I penned for FT Adviser last week addresses the need for responsive and pragmatic positioning more fully;

‘What Covid and Trump do and don’t teach us about managing portfolios’ – FTAdviser

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production