Earnings fail to calm markets before sharp rebound on Friday

Author: Tom McGrath, CIO, 8AM Global Ltd

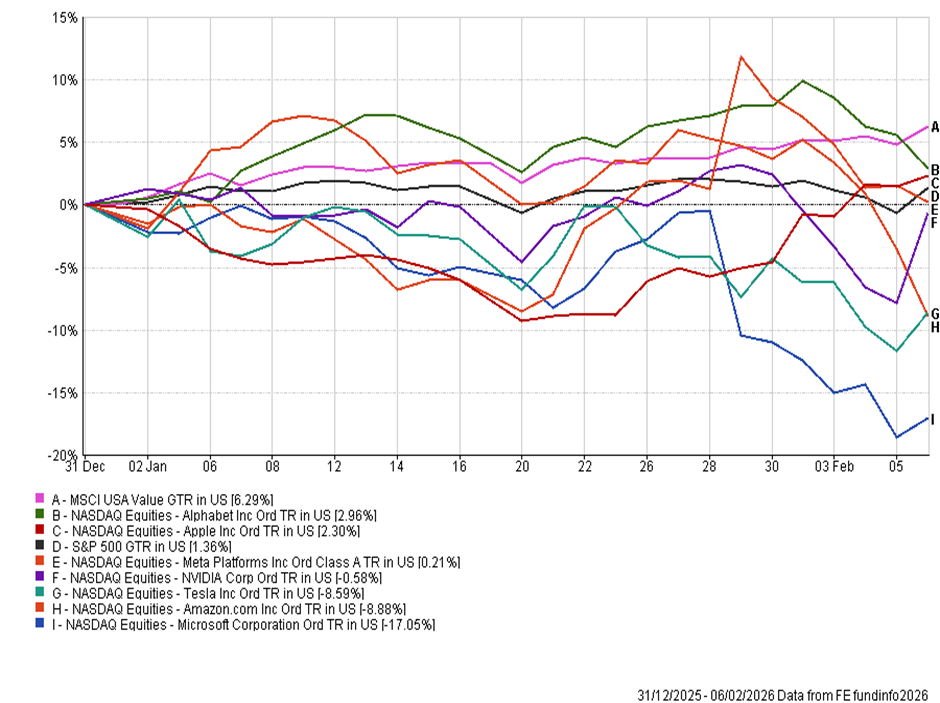

The most striking market development so far this year is not a collapse in equities, but a shift in leadership. As the chart above shows, US value has quietly outperformed all of the major mega-cap technology names year-to-date – that’s extraordinary! That is a meaningful change in tone after a market that has spent many years rewarding duration, scale and AI-linked growth at almost any price. Last week accelerated that rotation, with sharp, often indiscriminate selling across parts of Big Tech and software, even as earnings were broadly solid and guidance remained reasonable. The mood was simple: shoot first, ask questions later.

That backdrop matters because the week was less about macro shocks and more about a sudden change in what investors are willing to pay for. The debate around AI has not disappeared. If anything, it has become more serious. But it has shifted from ‘AI is inevitable’ to ‘AI is expensive, and we want proof of payback’. The hyperscalers have all made it clear that capital expenditure is rising sharply. Markets are now demanding clearer evidence that this spending is translating into incremental earnings, rather than simply escalating an infrastructure arms race. That scepticism spread rapidly, starting in software and spilling into the mega-cap complex and by mid-week, it had the feel of a sentiment unwind rather than a genuine deterioration.

It is important to separate what happened in prices from what happened in fundamentals. We believe that the sell-off was too broad. The physical layer of the AI ecosystem, including foundry, memory, equipment, networking, and power, remains in good health, and in many cases, earnings evidence is strengthening rather than weakening. Even within software, the most durable workflow platforms and cybersecurity leaders look more like beneficiaries than casualties. Nobody is ‘vibe coding payroll’. What markets are really doing is repricing the timing and distribution of value: who captures the economics first, chips, cloud, or applications and how long the payback period will be. That is a more sophisticated debate than last year’s blanket enthusiasm, but it does not amount to the death of the AI productivity dream.

One of the most important datapoints of the week came late, with Nvidia rebounding sharply on Friday after Jensen Huang pushed back against the market’s capex anxiety. He argued that the roughly $660bn hyperscaler build-out is justified, appropriate, and sustainable, and framed it as the largest infrastructure build-out in modern history. The key line was not promotional but practical: even older-generation Nvidia chips are still being rented, implying utilisation remains high and demand is not being ‘satisfied’ as quickly as some fear. It helped explain why the week ended with a sharp rally across many AI-linked names.

If the story is real (or real enough to maintain belief to bridge the gap), the biggest beneficiaries over time may not only be the Magnificent Seven, but also a wider range of industrials, financials, infrastructure names, and domestic cyclicals. In other words, the market may be shifting from ‘AI as a narrow leadership trade’ to ‘AI as an economy-wide diffusion trade’.

Gold, Silver, Bitcoin

Beyond equities, the week also saw extreme volatility in areas that have increasingly become sentiment barometers. Precious metals experienced violent swings, with sharp rises followed by brutal sell-offs as margin requirements were raised and leveraged positions were forced out. Gold and silver did not behave like slow defensive assets. They behaved like crowded trades. Crypto followed a similar pattern: a major sell-off sent Bitcoin down towards $60,000 before a sharp rebound into Friday. I do not believe these moves were signalling systemic stress, but they were a reminder that leverage and crowded positioning remain significant features of this market.

Macro Data

Away from the noise, the macro data in the US was constructive. US manufacturing activity expanded at its strongest pace since 2022, reinforcing the view that the economy is still running hotter than many expected. Consumer confidence was mixed across the week: earlier measures looked weak, but the Michigan confidence survey rebounded sharply on Friday, reminding us that sentiment data can swing with markets and news flow. The bigger point remains that the US is not showing the dynamics of a recession. Growth is resilient, productivity appears to be improving, and corporate earnings, outside a few pockets, are broadly holding up.

UK

The BoE announcement was the key event. The vote was notably narrow at 5 to 4, and gilt yields fell as markets interpreted the meeting as a step closer to rate cuts. The Bank’s tone was more confident that inflation is easing, and the shift in voting balance reinforces the idea that policy is shifting to more accommodative. Data was also somewhat better than expected: the PMI showed factories posting their strongest growth in 17 months. That is not a boom, but it is consistent with the view that the UK economy is stabilising, and that the rate environment is moving from headwind to potential tailwind.

Europe

The ECB held rates as expected. The central bank continues to communicate patience, but the direction of travel remains towards gradual easing as inflation pressures cool. For markets, the ECB story remains less dramatic than the Fed story. Europe is not in a capex arms race, and European equities are increasingly being viewed as beneficiaries of a broader rotation away from concentrated US tech leadership.

Japan

Also had a constructive week, with equities moving higher ahead of weekend political developments. Markets appear to be pricing a more pro-growth outcome, with Takayichi seen as a supportive candidate from a market perspective. The Japan story remains attractive in the context of global diversification, although it continues to carry meaningful risks from policy normalisation and currency volatility.

Earnings

An important point worth making is that, beneath the week’s volatility, the earnings season itself remains in good shape. More than halfway through the fourth-quarter reporting season, the S&P 500 is delivering solid results, with the percentage of companies beating expectations and the size of those beats broadly in line with long-run averages. The blended earnings growth rate has risen steadily as results have come in, and the index is now on track for a fifth consecutive quarter of double-digit earnings growth. Revenue growth has also been robust, and surprises have been broad-based across sectors, led by Information Technology, Industrials and Communication Services. Put simply, the market may be debating valuation and payback, but the underlying corporate profit engine remains alive and well.

This week…

The coming week is earnings-heavy, and the market’s tolerance for capex and guidance nuance will be tested again. In the US, investors will be watching whether the technology complex can stabilise after the week’s de-rating and whether the Friday rally marks the start of a broader rebound or simply a reflex bounce.

Macro-wise, markets will focus on further US activity and inflation-linked releases. In the UK and Europe, attention will remain on policy messaging and on whether improvements in PMI data are sustained. After a week defined by narrative volatility, the key question is whether the market can shift back from ‘shoot first’ mode to ‘analyse and discriminate’ mode, and whether the earnings evidence is strong enough to force that change.

We promised a volatile year, and so far, it is living up to that expectation. I still stick to my belief that we are in a bull market, one which will try and throw you out at various points, but if you can hang on in there and live through a few squeaky moments, you will be amply rewarded!

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production