September Disappoints again…

We focus on the US and bond markets in this week’s Market Matters…

All things being equal, it should have been a good month for financial assets, as economic data continued to suggest that the Fed is delivering the slowdown in inflation we all want, without doing too much damage to the economy.

But as is so often the case, September disappointed and most of the major equity markets suffered significant falls over the month in their local currency. The high flying US S&P 500 led to the downside with losses of -4.77% and only our FTSE 100 bucked the trend with a useful gain of 2.4%, helped by the escalating Oil price and the weakening pound.

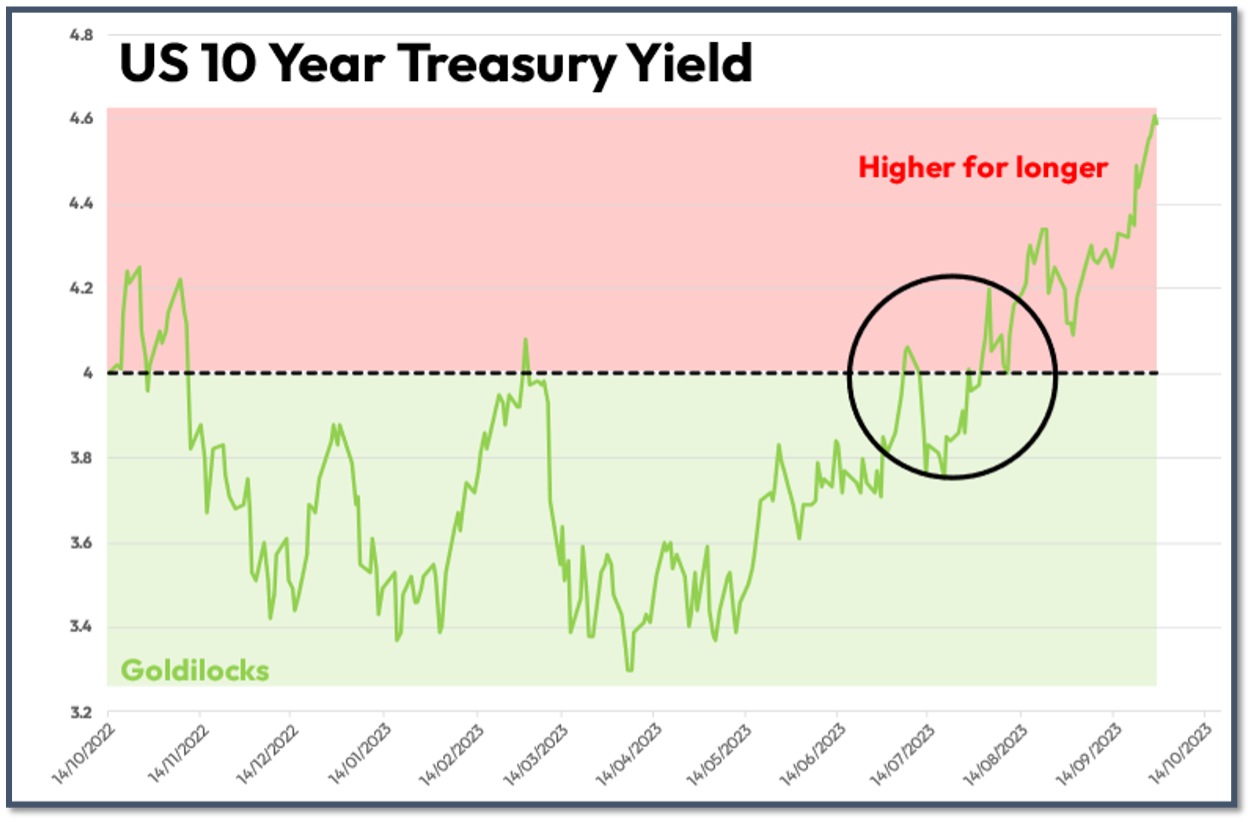

But all things are not equal, sentiment is by far the biggest driver of financial asset pricing over the short term and when it shifts – the data gets ignored or twisted to fit the prevailing story! Good news can become bad news and vice versa. Sometime around mid-July there was a shift in narrative away from the ‘Goldilocks Soft Landing’ to ‘Rates Higher for Longer’ and things have been heading south since that point.

As is normally the case, the bond markets made the first move, as yields that had been creeping up in May and June finally broke higher when the US 10 year yield sailed past the 4% barrier in July and it has hardly paused for breath since.

It is tough to find the catalyst for the change, possibly the higher oil price, possibly the continued resilience of US economic data? When we heard from Fed Chairman J Powell this month; aside from holding rates, he did little to dissuade markets from the notion that interest rates will need to be held higher for longer. Higher yields help tighten monetary conditions and may well remove the need for the Fed to move again.

So I guess it should come as no surprise that after the initial bounce in equity markets from a softer inflation print on Friday, that stocks faded into the close with only the Nasdaq eking out a small gain on the day.

The Personal Consumption Expenditures Index (PCE), which is the primary inflation indicator targeted by the Fed, recorded its most modest monthly increase since the end of 2020. Core PCE, excluding the unpredictable food and energy sectors, rose by 0.1% in August and an essential measure of service costs, which the Fed monitors carefully, also showed its least significant monthly growth since 2020. On a different day (perhaps earlier in the Summer) the latest PCE inflation figure would have seen markets sharply higher, as the numbers were encouraging.

I cannot be the only market watcher that thinks that the data supports the perspective that the Federal Reserve’s inflation predictions might be overly negative? Unless there’s a sudden surge in this monthly rate (which seems improbable considering the slowing labour market and significant drop in housing inflation) I anticipate that the core PCE inflation could be much lower than the Fed’s 3.7% forecast by year’s end. The combined impacts of elevated prices, a jump in gas expenses, and the restart of student loan repayments should also take the wind out of the consumers sails.

Perhaps we should listen to corporate updates, rather than the Fed, to get a better feel of the state of the US economy… CarMax Inc, a used-car dealer, announced on Thursday that some customers are opting for more affordable vehicles to manage their monthly payments. Earlier in the week, retailer Costco Wholesale Corp indicated that their promotional prices on high-value discretionary products didn’t boost demand as anticipated. Concurrently, JetBlue Airways Corp gave a heads up about its earnings, pointing out a decline in leisure travel bookings for September. Finally, Darden Restaurants Inc highlighted last week that some patrons are now choosing less expensive alcoholic beverages compared to the previous year.

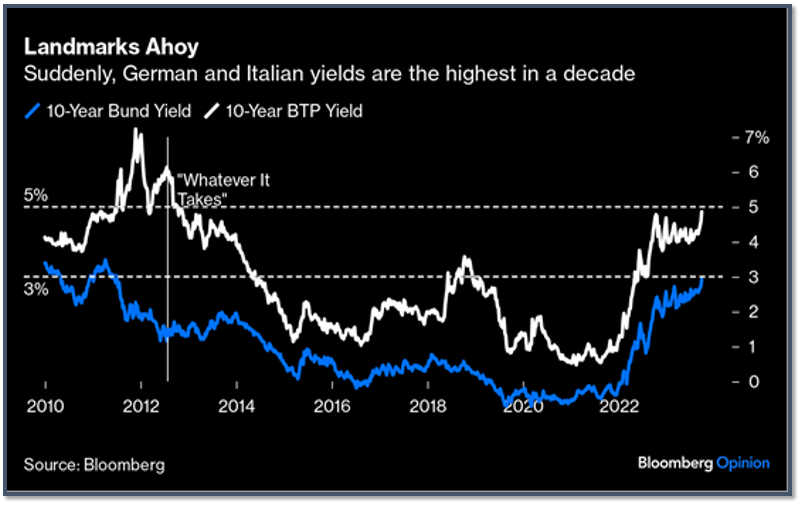

Just as equity markets can get ahead of themselves, so too can bond markets and yields on long term debt look excessive to me here. Any further signs of economic slowdown (as I expect we will start to see soon) should succeed in driving yields back down towards 4%. For the US 10 year and that would provide welcome relief for the equity markets. It’s not just in the US that yields are looking attractive. The selloff in bonds has gone global and in Europe, the 10-year yields of Italian BTPs and German bunds are up close to the 5% and 3% barriers and 10 year Gilt yields went above 4.5% last week.

The bond selloff so far has been driven by the belief that the economy is too strong, an assumption that until recently has allowed equities to make progress. If you think it’s possible the Fed will fail to curb inflation, then I think bonds’ yields are justified at these higher levels. If on the other hand, these higher rates do the trick, either via an accident or inducing a recession, then bond yields will go down. The next part of the jigsaw puzzle is how equities might fare in such an environment… Will looser monetary policy trump a slowing economy and drive equities higher – or – will the likely faltering in earnings that a slowdown brings, prove too much for equity investors in the face of a richly valued market? With that question unanswered, I expect choppy market conditions over the next few months and it seems sensible to be positioned a little lighter in equities with cash and fixed income actually looking like good alternatives at the moment.

Stop Press Sunday – Debt Ceiling Temporarily extended

On Sunday we heard that the US Congress narrowly prevented a government shutdown by approving a compromise legislation that will keep federal agencies running until November 17. This move gives both Democrats and Republicans more time to discuss long-term federal funding. Although the bill was passed with significant bipartisan support, it notably does not provide new funding for Ukraine. President Joe Biden ratified the bill, highlighting the collaborative effort in Congress. House Speaker Kevin McCarthy was instrumental in ensuring the bill’s passage, even as he faced threats from some far-right Republicans who opposed it. The legislation includes $16 billion designated for disaster relief. While aid for Ukraine was excluded from this legislation, there are plans to address it in a separate bill. That might give the markets a short term boost, but expect increasing drama as we run up to the next deadline in mid-November.

Quick Guide – US Debt Ceiling

It’s a self-imposed cap on the total amount of money that the US is authorized to borrow to pay its bills – such as social safety net programmes, interest on the national debt and salaries for government workers and members of the armed forces. Because the government runs a budget deficit, where it spends more than it raises through taxes and other revenue, it must borrow money. Lots of it. According to the Constitution, Congress must authorize borrowing and the debt limit was introduced in 1917 so that the Treasury would not need to ask for permission each time it had to issue debt to pay bills. As and when each new limit is reached, Congress has to agree a new ceiling and that leads to political squabbling with the party out of office blaming the incumbent and refusing to pass the higher limit unless their policy demands are met. Ukraine and Immigration are the contentious issues this time round.

Production

Production