J Powell fails to keep financial conditions tight

After a tremendous November for both equities and bonds, December got off to a solid start, with yields backing down and equities (for the most) part heading higher. So much so, that it turned what looked like a flat week into another good one for the western equity markets. India too, enjoyed a stellar week in marked contrast to Chinese equities, which continued to disappoint. Friday’s turnaround was in reaction to an economic update from Fed Chairman J Powell, which after investors digested the speech, was deemed to offer confirmation that interest rates had most likely peaked.

US Focus This Week…

I am pretty sure J Powell hadn’t intended for his speech to be interpreted so ‘dovishly’, this was more a case of investors hearing only what they wanted to hear to fit their current narrative. While the Fed chief said officials are ‘ready to hike further if needed’, he also noted that policy is ‘well into restrictive territory’, and it was as if ‘Mr Market’ ignored the first bit and just latched onto the latter! Therefore, concluding that we are nearing a less restrictive phase, i.e. rate cuts are coming! That was enough to send 10-year treasury yields tumbling from 4.35% to around 4.20% at close of play, sending the S&P 500 to within touching distance of the year high.

We have been here before, most notably the last time the S&P 500 was at the year high was around 4,600 at the end of July. But crucially, there does appear to be more solid evidence to justify the optimism this time round, with the release of the PCE inflation data for October providing confirmation that inflation is heading lower.

As I am sure you are all bored of hearing from me by now; the PCE matters. We have been told repeatedly that this is the Fed’s favoured measure of inflation. Both the core measure and the ‘trimmed mean’ (within which outliers are excluded and an average taken of the rest), showed continued steady declines, no more than was expected by pundits but very much behaving as hoped for. If you look at the chart, you can see that over the last six months, the annualised trimmed mean has dropped below 3% and seems to be inexorably heading down to the 2% target level, suggesting the one-year averages will follow accordingly.

What happens next remains hotly debated. Will inflation continue to behave and keep falling at the same pace? Or will the journey down from 3% to 2% prove to be much… more… gradual? Or will the journey down be (as many believe) unachievable unless rates are held higher far longer than is now expected? If it were all about just controlling inflation, life would be simple for the Fed. They could just raise rates aggressively high enough to curb consumption and leave them there until inflation hits the target – simples! But the Fed has a dual mandate of not only price stability (control inflation) but also to maximise employment (robust economic growth). Of course, other corners of the economy still matter to Fed officials. U.S. central bankers keep a close eye on pretty much every economic measure out there, from manufacturing and real estate to financial market stability and consumer spending. But if you boil it down, inflation and employment are the overarching economic figures that influence virtually every other aspect of the financial system.

The Fed pretty much only has one weapon in its armoury to achieve those goals and that is the federal funds rate. Lower the rate to combat joblessness, with the act stimulating economic growth; raise them to lower inflation and achieve price stability. As the bars on the chart above show, expectations have changed dramatically in little over a month, with the first cut now expected as early as March of next year.

Most of 2023 has been about the Fed’s first objective in tackling inflation, but I suspect that 2024 will be much more about the second challenge of maximising employment and maintaining economic growth. This Santa Rally has been predicated on the notion that the Fed has got inflation falling as it would want, but not so much that it will cause a sharp fall in economic activity. Yes, everyone expects and understands that growth will slow, but the ‘Bulls’ are hoping that this is not to a standstill, or worse a contraction.

This is another area that is hotly debated with an ever-growing number of people thinking that the Fed tightening, with a lagged effect, has already put the US on course for a recession. If that were the case, then consumer spending would dry up, unemployment numbers would accelerate and by the middle/end of next year company earnings would be dropping as would no doubt the equity markets. As a money manager, this is probably the most important thing to get right next year. If we do slide into recession, then equities are most likely to struggle, but bonds in contrast would enjoy price appreciation as yields fall. If we avoid recession and growth is resilient then it is probably best to be overweight equities in favour of bonds.

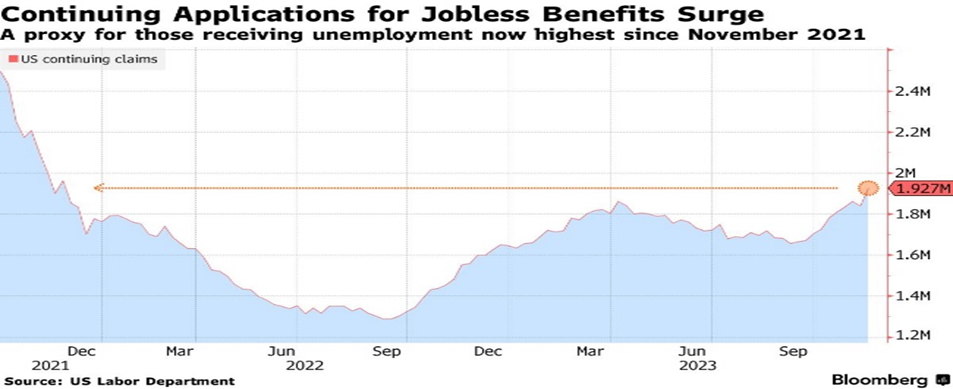

There are definitely signs of cracks appearing in the US economy. Data on Thursday showed recurring applications for unemployment benefits rose to the highest in about two years. Economic activity in the US manufacturing sector declined in November for the 13th straight month, according to the Institute for Supply Management’s (ISM) latest purchasing managers’ index (PMI), which was unchanged from October at 46.7, with figures under 50 representing a contraction in activity. So far it has been the bigger services component that has kept the economy growing, and we get the next reading on Tuesday 5th December, with it expected above 50, with consensus suggesting a reading of 52.

I happen to think it would be unwise to write off the US economy just yet. The most-anticipated recession in history, following the Federal Reserve’s execution of the most aggressive rate hiking cycle in decades, has still not arrived and it remains possible that we can avoid it next year. Perhaps it’s because of the unexpected resilience of the US consumer still cushioned by their pandemic savings? Or Federal Reserve policymakers proceeding carefully — and so far successfully — on their interest-rate moves as they curb inflation? Or maybe employers are trying hard to avoid layoffs and are delaying a downturn. The last print for Q3 GDP was also just revised up to 5.2% annualised, the fastest in nearly two years. Consumer spending advanced at a less-robust 3.6% rate, according to the government’s second estimate of the figures issued Wednesday, but that still hardly suggests an economy about to move into recession.

One opaque theory for economic resilience that I think holds a lot of water but that is hard to substantiate, is based on the accumulated wealth of the ‘Baby Boomers’. Some of the industries that are expanding their payrolls are doing so because of strong demand for their services by Baby Boomers, most of whom now are seniors. These include financial activities, health care, social services, leisure & hospitality. Retired Boomers have an estimated $75 trillion in net worth and will be spending much of it as they grow older. Many of their adult children likely anticipate inheriting some of their parents’ net worth, prompting them to save less and spend more of their incomes. Also keep in mind that they still have a record amount of money coming in from unearned personal income (from interest, dividends, rent). High interest rates are obviously good for those with buckets of cash in savings accounts. That’s got to be trickling back into the economy somewhere.

Another factor that will clearly influence how well the equity market performs next year is corporate earnings, and here we can also sprinkle just a little Christmas cheer. After a strong third quarter reporting season where companies delivered gains of around 4% (expectations had been for a fall), analysts are now suggesting that growth will accelerate to 6.7% for the first quarter and 10.5% for the second quarter of 2024*. Productivity gains are also being made and we think this can accelerate through an increased adoption of artificial intelligence, cloud computing, e-commerce, healthcare innovation and many more exciting new digital technologies.

Whatever the reason, continued economic growth has been a positive surprise and we hope that we will see the World’s largest economy muddle through next year, before growth reaccelerates toward the end of next year as monetary policy eases. That is the soft-landing scenario that the markets are now close to fully pricing as the above chart from BCA perfectly captures. However, with some of the optimism effectively already reflected in prices following the recent rally, it clearly leaves the markets vulnerable to disappointment.

* Source: FactSet

Production

Production