Markets drift up in shortened Easter week

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Overview

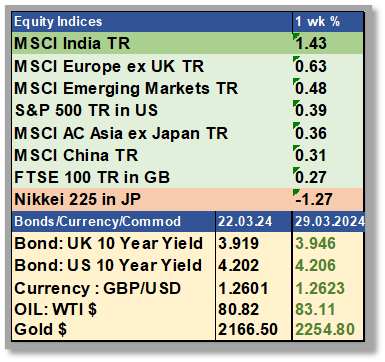

It was another quiet week for equities and bonds, with most markets shutting early for Easter, but the US registered another new high, and the FTSE 100 is closing on 8000. Investors may have been on holiday, but we did get a vital inflation report out of the US and more views from J Powell on Good Friday, and it will be interesting to see how markets react when they open up this week.

Oil firmed up, and gold moved to new highs driven by central bank buying rather than any change in financial conditions, as far as I can discern.

Personal Consumption Expenditures Price Index (PCE)

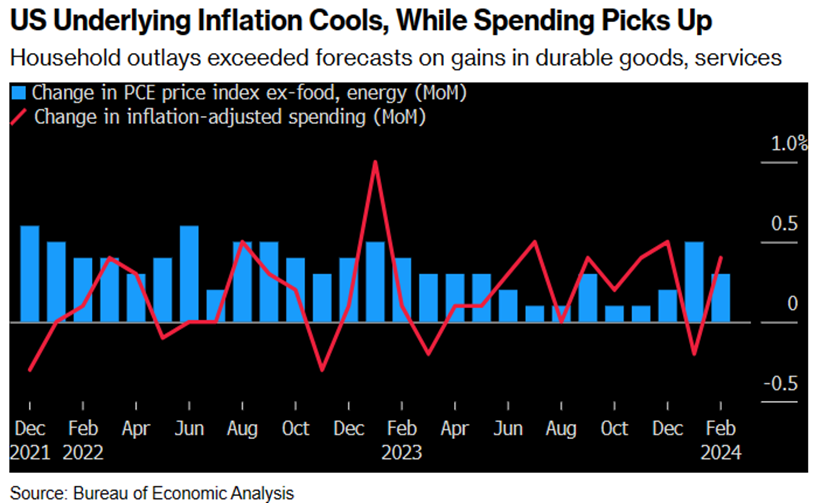

Last month, the Federal Reserve’s key indicator of core inflation, which excludes food and energy, rose by 0.3%, showing a cooling from January’s 0.5% increase. This data point marks a significant moderation compared to the past year’s trends. Meanwhile, adjusted for inflation, consumer spending came in above expectations, undoubtedly helped by higher wages. This combination of cooling core inflation and robust consumer spending does fit nicely with the ‘Goldilocks’ scenario and should offer some relief to the Federal Reserve. All things being equal, when markets open next week, it could still provide fresh impetus for markets to break higher.

We got to hear from Powell shortly after the report was released, and he was keen to downplay the good news as he stuck to the same script as the debrief after the FOMC report the week before. He said that inflation is ‘pretty much in line with our expectations’, as he reiterated it ‘wouldn’t be appropriate to lower rates until officials are sure inflation is on track toward 2%’, the rate they see appropriate for a healthy economy. Separate data from Thursday showed that consumer spending was revised higher at the end of last year, and the fourth-quarter core PCE inflation was revised slightly lower. We also got an upward revision to Q4 GDP to 3.4%. That all seems like good news to me, as I remain convinced the primary long-term driver of this bull market will be economic growth and corporate profits, not just the current focus on rate cuts.

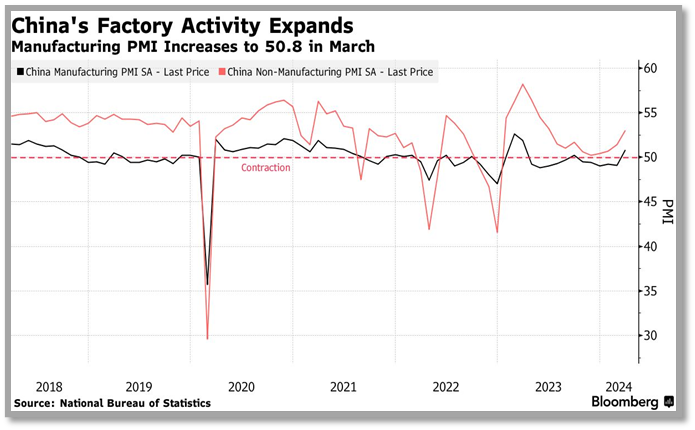

Chinese Upswing

Most of the good world economic news this year has come out of the US, but I am pleased to confirm there are more than glimmers of hope for the world’s second-largest economy: China. Data released over the weekend showed that for the first time since September, China’s manufacturing activity showed expansion in March, indicating signs of economic stabilisation. The official manufacturing PMI increased to 50.8, surpassing expectations and marking the highest reading since the previous year. Alongside, the non-manufacturing PMI also rose, reflecting confidence in future business.

China has been trying to boost domestic spending and has pledged to provide government funds to encourage consumers and businesses to replace old goods, including cars, home appliances and other equipment. These measures do seem to be kick-starting a recovery. Add in a recent uptick in exports and various fiscal and monetary support measures, and it increasingly looks like the economy could legitimately hit its 5% GDP growth target this year.

Europe

Now, if world GDP is on an upswing (and shouldn’t be taken for granted, although the signs are positive), then Economic Textbook 101 would suggest that Europe’s cyclical export companies should be particular beneficiaries.

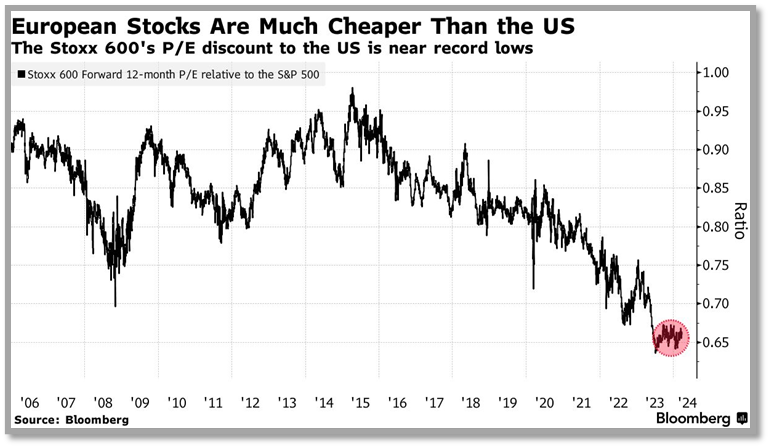

I came across a compelling piece of news; according to Goldman Sachs and Bank of America, investors are strategically shifting their focus to Europe for the next phase of the global stock market rally, driven by the high valuations in the US market. This shift is further underscored by the following chart spanning the last 20 years, which reveals a significant gap that is now showing promising signs of narrowing.

However, as highlighted earlier, it isn’t just a valuation argument now; the interest in Europe is also fuelled by the potential for economic recovery to boost corporate profits. Europe is much more cyclical, contrasting with the US market’s heavy reliance on high-valued growth stocks. A drop in short positioning also shows sentiment toward European stocks is improving, according to S&P Global. Estimated short positions in the region were cut to less than 0.2% of total market capitalization at the end of last year, the lowest level in at least a decade. And if the big US investors do start the hunt for value outside of the American powerhouse, even the UK may hit their radar, as it makes European stock markets look expensive!

Still, as US exceptionalism continues, it would take a brave fund manager to stray too far from home. Without a shadow of a doubt, it is home to the companies that have proved themselves best at driving earnings consistently higher. And given the strong US economy, we can expect more good news.

In mid-April, the upcoming first-quarter earnings season will start with key reports from financial giants such as JPMorgan Chase, Wells Fargo, and Citigroup. Expectations set by FactSet analysts suggest a 3.4% earnings growth for S&P 500 companies, potentially marking the third consecutive quarter of earnings expansion… Who would bet against this group of world-leading companies…?

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production