Bull market rumbles higher

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Review

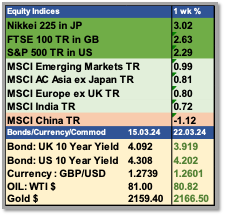

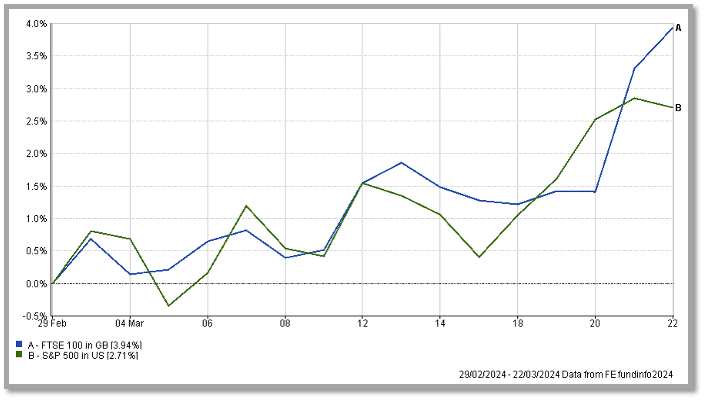

Equities regained momentum after a couple of flattish weeks, and the bull market rumbled higher. New highs were achieved in the US, Japan, and Europe, and even the FTSE 100 is closing in on the 8000 level it achieved in February last year.

Investors had probably been bracing themselves for hawkish news from the Federal Reserve (the Fed) and the Bank of England (BoE). Still, to the surprise of many, we got a dovish tilt from the BoE, and a Fed Chairman was seemingly unconcerned by recent higher inflation prints.

Japan finally moved off negative rates in a move that came earlier than anticipated, but this move was taken in its stride by the market. Bonds liked the dovish tone as yields fell across the board, and gold and oil finished broadly flat.

Federal Reserve Open Market Committee (FOMC) Update

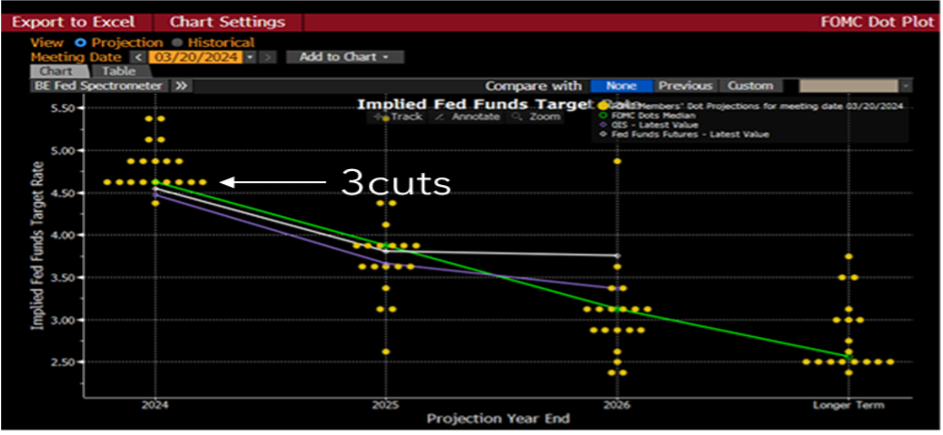

A lot was going on last week, so I will dive straight into the main event: the meeting of the Federal Reserve Open Market Committee (FOMC). There was much concern that recent higher-than-expected inflation numbers would alter the expected course of rate cuts, with the attention focused on the ‘dot plot’ projections.

These are where the 19 FOMC members each give their predictions for the level of future interest rates and economic numbers in the form of a dot. At the median level of the dots, that is where the Fed suggests the most likely path of interest rates will be. Although the outliers are mainly higher, following this meeting, it still looks like we will get three cuts by year-end, with three more in 2025 and 2026. That came as a significant relief to investors expecting a move to only two this year, and we saw the odds of a rate cut in June moving from around 50% to nearly 70%. Bond yields dropped, and equity markets snapped higher.

The committee’s positive outlook continued with a boost to the economic growth forecast. GDP is projected to rise to 2.1% for the year, up from 1.4%. Additionally, the committee slightly lowered their unemployment rate projection to 4% from 4.1% for 2024, indicating optimism about the future.

Following the data, J Powell’s comments provided reassurance. Despite the opportunity to express concern about recent inflation data, Powell took a measured approach, suggesting the path to 2% inflation could be bumpy. Similarly, he refrained from expressing concern about the buoyancy of the equity markets, instead suggesting that financial conditions remained restrictive. This indicates that the Fed is comfortable with the economy and stock markets running hot, with less concern about inflation, and may even consider a rate cut in June.

Much could have gone wrong last week, but in the end, it could not have worked out better. All major US equity indexes climbed from small caps to industrial shares, and even the hyped Nvidia conference did not disappoint. Shares of the chipmaker advanced for a record 11th straight week as Chief Executive Officer Jensen Huang unveiled a new processor design called Blackwell, which, as I accurately predicted, has enormous implications for productivity increases.

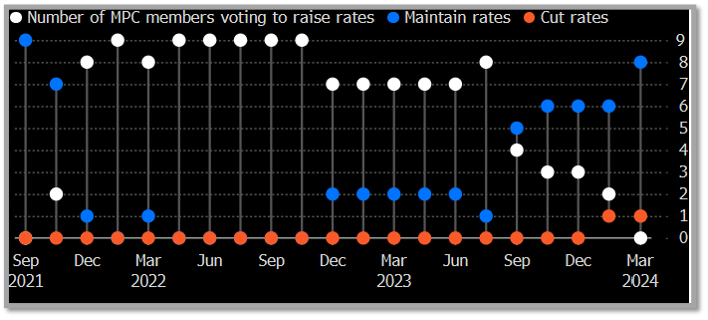

Bank of England Update

Good news: The Bank of England is moving closer to reducing interest rates, and it increasingly looks as if this will happen in June. Two key members, who previously advocated for rate increases, have now aligned with the majority in maintaining the current rate at a 16-year peak of 5.25%. This shift marks a significant change since September 2021, when the committee unanimously opted against raising rates.

This dovish shift doesn’t come out of the blue as inflation data has been weakening in the UK, with economists now predicting that the Consumer Prices Index could soon fall below the bank’s 2% target when energy prices drop as forecast in April. Data on Wednesday showed inflation falling to a 30-month low of 3.4% in February, with services inflation cooling to 6.1% in line with the BoE’s forecasts. Last week’s job data also showed unemployment rising for the first time since last summer and wage growth edging lower.

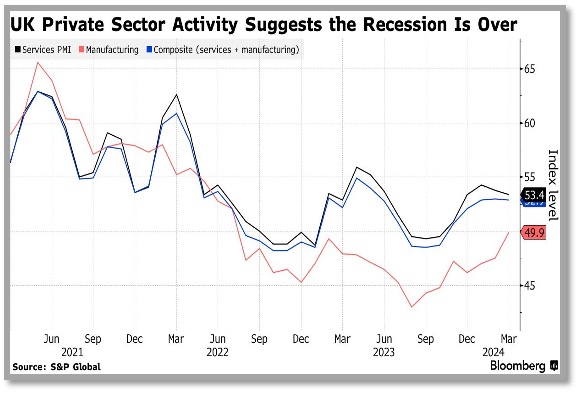

Falling rates are only one piece of the jigsaw puzzle that could solve the problem of our lagging UK equity market, but arguably the more critical piece is the growth part of the equation and here we got signs of life from the economy. Britain’s private sector firms continued to report output growth, adding to growing evidence that a rebound from last year’s recession is underway. S&P Global said its composite purchasing managers’ index registered 52.9 in March, above the crucial threshold of 50, signalling growth for a fifth month.

While service providers posted a drop in confidence, optimism in the manufacturing sector hit the highest since April 2023. Businesses expect higher sales over the year thanks to improving consumer confidence, tax cuts, easing inflation and the prospect of rate cuts in 2024. Retail sales also came in slightly better than expected for February, albeit flat!

Now, forgive me if I am clutching at very short-term straws here… Under the radar and in the shadow of other global equity markets attaining new highs this month, the UK has snuck in some outperformance. The contrarian in me can’t help but think that the UK might finally be about to deliver some relative outperformance. It’s not just a hunch; the smart corporate money has spotted the opportunity (a catalyst I have been waiting for), and takeover deals are starting to come thick and fast, with premiums being commanded.

Part of the problem with the FTSE 100 lies in the constituents, as instead of a meaningful tech weighting, we are overweight resources. Still, there are signs of life in the copper price, an excellent early indicator of a recovery in global economic activity. If our mining stocks start motoring and the FTSE 100 can bring itself to poke its head back above the 8,000 level and then break to new highs, it may capture the attention of global investors who are significantly underweight the UK. We shall see, but with much of the world already at all-time highs, many will look around for the next hot market.

The Japanese Market

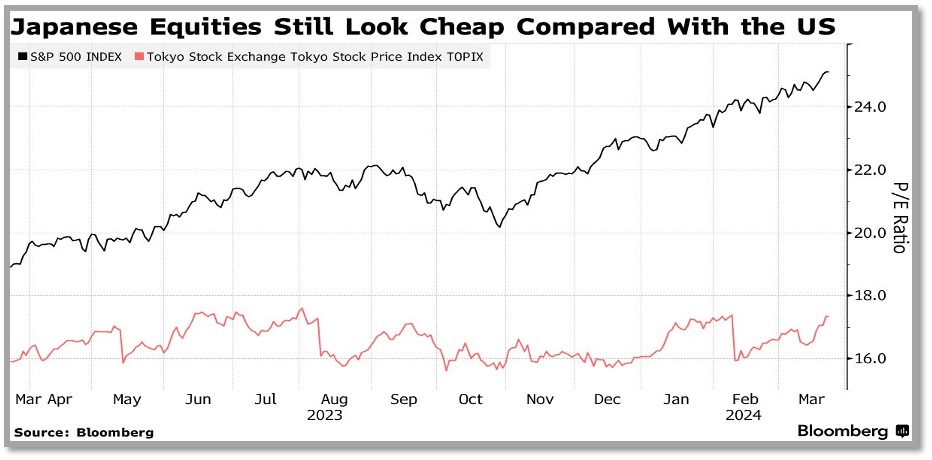

Not even the first interest rate increase for the first time since 2007 has slowed the record-breaking surge in the Nikkei. Signs of the end of deflation are driving investors to bet ever more on Japan’s economic growth, while a weakening Yen continues to boost exporters. The official push on companies to improve shareholder returns is improving the equity culture for domestic and overseas investors, and the record high will attract newcomers to the market.

Despite the recent surge in the index, to put it into context, the market valuation still looks attractive compared to the US. No wonder Japan was the favourite Asian market for investment in a recent Bank of America survey. Rarely do we see the unusual combination of both overseas investors and domestic individuals being favourable and committing cash to the Japanese market.

Even rate increases are unlikely to rock the boat too much, as the move is small and will likely have only limited impact in Japan, as companies and households have solid balance sheets, and the government has financial flexibility. The cause of the move – the fact that Japanese companies are increasing wages – is broadly positive, as it will improve people’s purchasing power and greatly benefit domestic demand companies. Perhaps we may see Japanese small caps now pick up the baton from the large caps; either way, we have appropriate exposure within the AQ portfolios.

It would seem that the outlook for the global economy and equity markets is as rosy as it has been for a long time. Indeed, the tone of investors is bullish, with the latest American Association of Individual Investors (AAII) sentiment survey confirming more than 43% are of a positive disposition. Although it has been higher recently, and the number of bears is creeping up, suggesting we are not in a euphoric meltup. What could go wrong from here? It would be wise to keep an eye on the oil price, which has been creeping up, and a meaningful shift higher could reignite inflation. And, of course, we have the distinct possibility of Trump being in the White House again, which is a complete wild card for markets. But for now, it looks like the trend is higher, and I would love to see the FTSE 100 set a new high this week!

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production