US equity market stalls; bond yields rise

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Overview

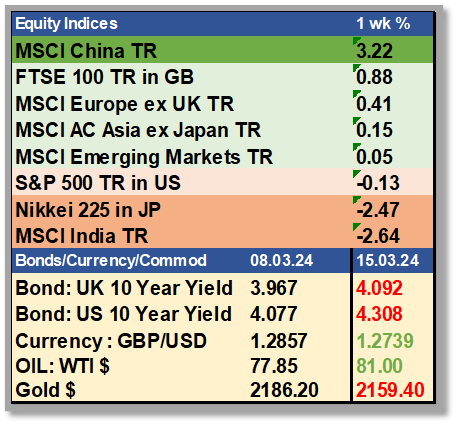

The vertiginous climb of the US stock market that began on 27 October 2023, appears to be plateauing. The S&P 500 fell for the second week running. Bonds also sold off, with a sharp rise in yields last week. Investors are finally waking up to the prospect of fewer rate cuts.

Unexpectedly high Consumer Price Index (CPI) and Producer Price Index (PPI) reports for February suggest the Federal Reserve might delay rate cuts. Unlike previous cycles, when rate cuts followed recessions or financial crises, current indicators don’t forecast such drastic events, supporting a cautious approach to easing rates. Gold headed lower in line with bonds, and Oil nudged higher.

As I have been at pains to suggest all year, unlike in the UK and Europe, the US economy probably doesn’t need any rate cuts. Why would the Fed “Mess with Success”? The economy seems to be doing just fine as it is, and if anything, there is a slight worry inflation could reignite. So, keep the powder dry and only pull the rate cut trigger if we get concrete signs of a weakening in the jobs market. The question is, can the lofty valuations of the US equity market be justified without rate cuts? The answer will probably present itself over the next quarter.

Nvidia Fireworks or Damp Squibb?

So, market momentum has stalled, but I don’t think that is necessarily bad, as letting a little air out of a potential bubble reduces the chance of anything popping. I was relieved to see the Nvidia price take a breather over the second half of the week (unbelievably, it was still up again over the five trading days and more than 80% this year).

Expect Nvidia to dominate the headlines early next week as it is holding the eagerly anticipated GTC Conference on Monday, where we get the whole song and dance from Jensen Huang, which I expect will make the Steve Jobs polo neck Apple appearances look like an exercise in bathos. There will be lots of jargon, but the look-through will be another new, super faster graphics processing unit (GPU) that will be the go-to card for companies training and deploying AI models. Some 300 exhibitors are set to participate in the conference with a wide range of top speakers, including senior executives from OpenAI, Meta and Microsoft.

I wish I had foresight at this moment, as I sense an epoch moment that could either define this conference as a peak bubble moment or confirm the profound and secular impact that AI is going to have on all our lives and that Nvidia is a steal at 37x forward earnings!

We shall see.

US Inflation & The J Powell Dilemma

Fed Chair Powell’s dovish stance and hints at a potential rate cut are increasingly incongruous to me; perhaps his rhetoric is strategic or, without wishing to sound like a conspiracy nut, even politically motivated.

Chucking more fuel on the US economy now with rate cuts could see the economy run hot and the Stock Market even more so, which are ingredients for happy Americans. This would make the incumbent Biden more likely to beat Trump. Could that be allowed to happen, given the supposed impartiality of the Federal Reserve? I don’t know, but stranger things have happened, and I understand that the Central Bank cognoscenti almost universally despise Trump.

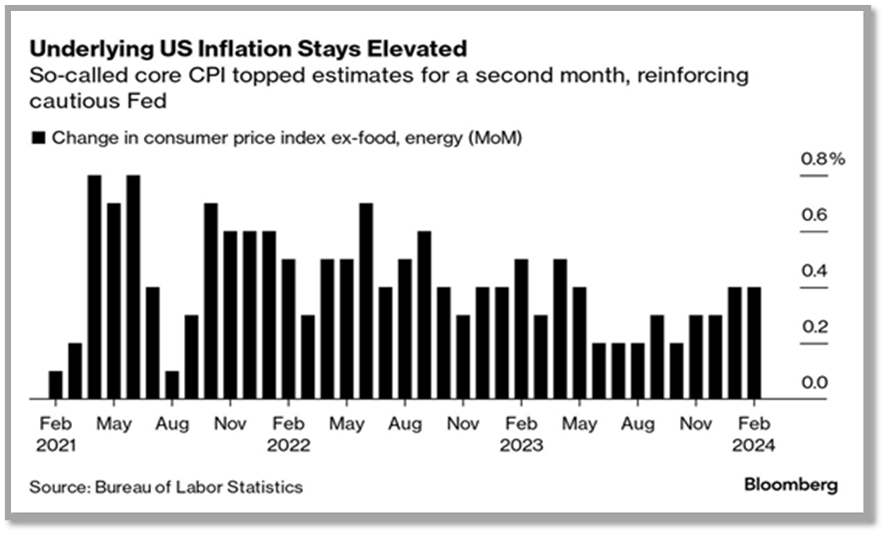

Leaving aside my cynical comments, the Fed would be unwise to dismiss the core CPI’s higher-than-expected figures for another month. The Bureau of Labor Statistics measure of the core consumer price index, which excludes food and energy, increased by 0.4% in February, bringing the year-on-year change to 3.8% (versus 3.9% prior). Under the surface, shelter inflation is at least slowing and likely to keep heading lower, although core goods disinflation appears to have stalled.

Since the start of the year, the anticipation for interest rate reductions has moderated, aligning now with the Federal Reserve’s indications of up to three rate cuts by the year’s end, with the first cut most likely in June. The Fed’s FOMC March meeting next week and subsequent updates to their rate projections are pivotal. The focus will be on any shifts in the ”dot plot,” a chart summarising each FOMC member’s rate expectations, which could indicate changes to the median forecast for rate cuts. The outcome could refine market expectations and impact the bond markets, possibly more than the equity markets, which still seem to ignore the possibility of a delay in rate cuts past June.

I don’t really want to spook anyone, but the next few inflation readings could be disappointing, as base effects alone could lead to higher inflation over the next three months.

(Base effects—last year, we had lower inflation numbers in March, April, and May, and these components will drop out of the one-year annualised numbers as we move forward, mechanically raising the headline one-year number, all things being equal.)

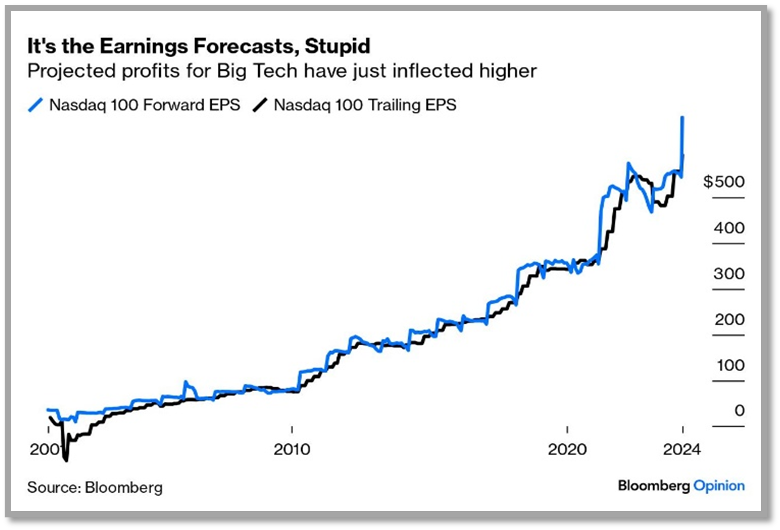

Climbing off the fence that I typically inhabit, I think investors will likely have to deal with the fact that we will not get a rate cut in June and that this prospect will increasingly dawn on the markets over the next few months. This probably means bond yields are heading higher and an uncomfortable period for the equity markets as investors digest this new reality. This negativity should be countered by something very comforting for long-term investors: forward earnings projections are heading higher again.

Over the long term, earnings are the most significant driver of stock market performance, much more so than the vagaries of monetary policy. If US corporate earnings can deliver this year, then I think after a period of turbulence, the market will get over the sparsity of rate cuts and finish the year significantly higher than it currently is. The chart from Bloomberg underpins a very healthy outlook in projected profits for Big tech, and where Big tech goes, so go the averages.

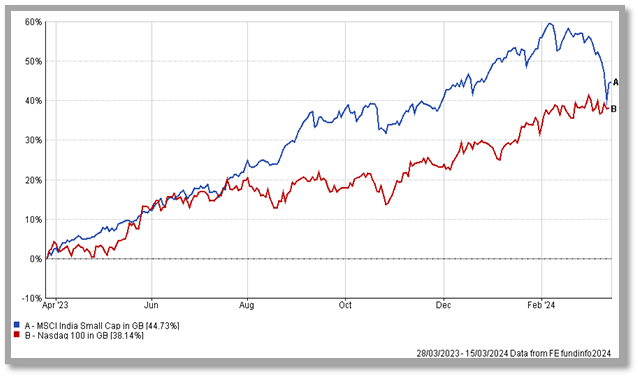

The Bubble You Were Probably Unaware Of…

You have to search hard to find an index that significantly outperformed the Nasdaq over the last year, but up until last week, Indian Small Caps had that honour. Now, I sit on several investment committees and have the privilege of listening to the views of many other very experienced investment managers. The subject of India has cropped up across the board. Specifically, the need to have market exposure to this rapidly growing economy and without a shadow of a doubt, the Indian economy will have a much more significant impact on the global economy. It offers the growth that China once did, without the threat of a politically controlled state – unbridled capitalism. Who wouldn’t want to fill their boots with high-growth Indian equities?

All the ingredients are ripe for bubble formation, and the authorities have noticed the potential dangers. The Securities and Exchange Board of India (SEBI) has raised concerns over the significant investment in small- and mid-cap stocks, fuelled by a notable rally in this high-risk market segment. SEBI advised funds to develop strategies for controlling these investments to protect investors from potential losses due to sudden market drops. Additionally, SEBI suggested allowing fund managers to include more large-cap stocks in their small-cap portfolios to mitigate risk and highlighted issues with price manipulation in new listings on platforms for smaller companies. In response to SEBI’s guidance, ICICI Prudential Asset Management and Kotak Asset have introduced measures to manage fund inflows.

We have witnessed a greater than 10 % correction, but we saw at least a little bounce at the end of last week. The correction could offer investors who have missed out a chance to get in. Or it may be the start of something more sinister. I think it is probably prudent to sit this one out for a few months, but this is definitely a market worthy of direct long-term exposure and an addition we are considering for our own AQ models, just not quite yet….

With apologies to the UK and European markets for not covering them this week (they behaved fine) and Japan, where we saw encouraging signs of wage increases, but in the interests of brevity, I will sign off on this week’s Market Matters here as I am told by Ash to try and limit the amount of content!

It’s a big week ahead with the Nvidia conference and the FOMC, and I suspect the world could look a little different by next Monday.

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production