Powell keeps Goldilocks hopes alive; jobs data fits narrative

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Overview

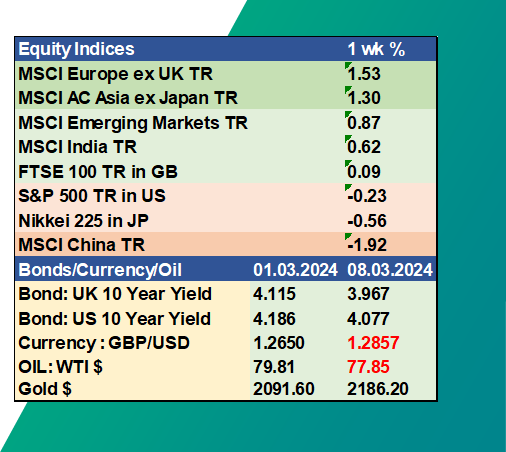

Despite there not being a significant fluctuation in global equity indices last week, plenty was going on with some choppy moves in markets both ways. The market was initially buoyed by an encouraging jobs report, which set the stage for a potential new all-time high. However, a sudden reversal in Nvidia’s share price – a fall of 10% from peak to trough – dragged the markets lower. It’s too early to tell if that is the start of something more ominous or profit-taking after such a meteoric run. Despite the sharp fall, this Leviathan was still up more than 5% last week.

Turning to the more mundane asset classes, bond yields on both sides of the Atlantic drifted lower, weakening the dollar. Oil moved fractionally lower, but Gold was the standout asset last week, up nearly 5%.

US in Focus

Last week presented an instrumental insight into the biggest question for financial markets, ‘When will the Fed cut rates?’ when we heard from Federal Reserve Chair Jerome Powell as he testified to the Senate Banking Committee on Thursday. Powell didn’t provide a precise timetable for when he saw the start of easing, but he noted that the day could be coming soon.

“We’re waiting to become more confident that inflation is moving sustainably at 2%. When we get that confidence, and we’re not far from it, it’ll be appropriate to begin dialling back”.

He qualified this by saying that the cuts (plural) would be so the Fed doesn’t;

“Drive the economy into recession rather than normalizing policy as the economy gets back to normal”.

That was enough for the Goldilocks proponents to feel vindicated, and for the first time in a while, we saw the 10-year treasury yield head back to 4%. In essence, Powell adhered to expectations, providing the market with the assurance that the Fed is cautious about possible rate cuts. Still, his tone’s absence of a more aggressive or hawkish shift came as a relief. We will likely see the first rate cut in June, with market expectations coalescing around 3 or 4 rate cuts over this year.

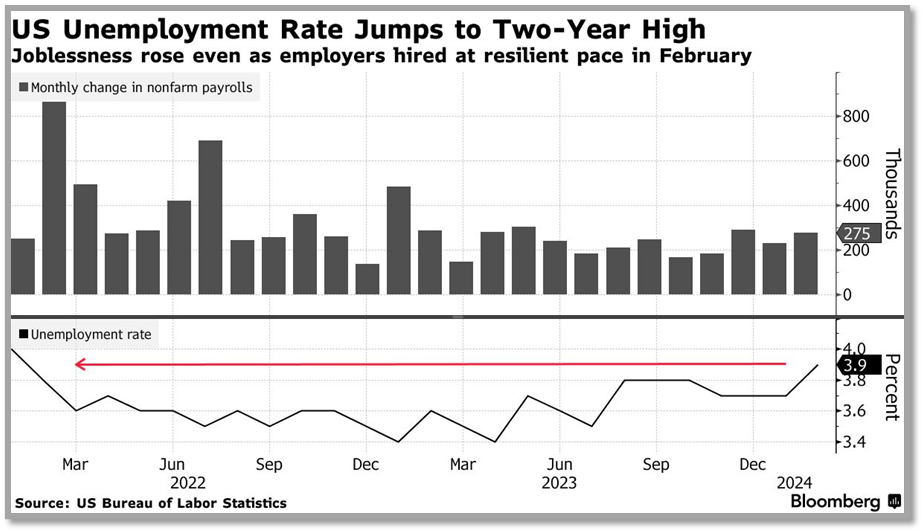

Along with Powell’s rhetoric, we got the job numbers out of the US on Friday, providing data that both bulls and bears could latch onto! For the bears, there is a significant worry that the job market is too strong to allow the Fed to cut. The headline increase in nonfarm payrolls by 275,000 looked to confirm their fears. However, a downward revision of 167,000 for the previous two months, an unemployment rate that increased to 3.9% and a deceleration in the wage growth rate provided relief for investors hoping for imminent rate cuts. The report could not have been better news for the Fed. The data suggests that the labour market is subtly shifting gears, and the economy is likely to continue its expansion with a reduced likelihood of inflation picking up again.

Indeed, up until the reversal in the Nvidia share price, the market seemed to have leapt to the same positive conclusion, as the S&P 500 broke new ground, threatening the 5,200 level before shifting lower to close out at 5,123, down -0.65 % on the day. All in all, the combination of Powell’s testimony and the jobs report should be taken well, as it suggests that we may have a period of economic expansion accompanied by rate cuts later in the year if inflation continues to behave, which would be mojo juice for equities!

However, it’s crucial to maintain a balanced perspective. We must acknowledge that we are investing in an expensive market, with much of the positive news already factored in. If the Nvidia instability persists into this week, we could witness a significant downturn in the Nasdaq and the S&P 500, potentially dragging the entire technology sector down. This sector, undoubtedly, has some froth in it!

Europe

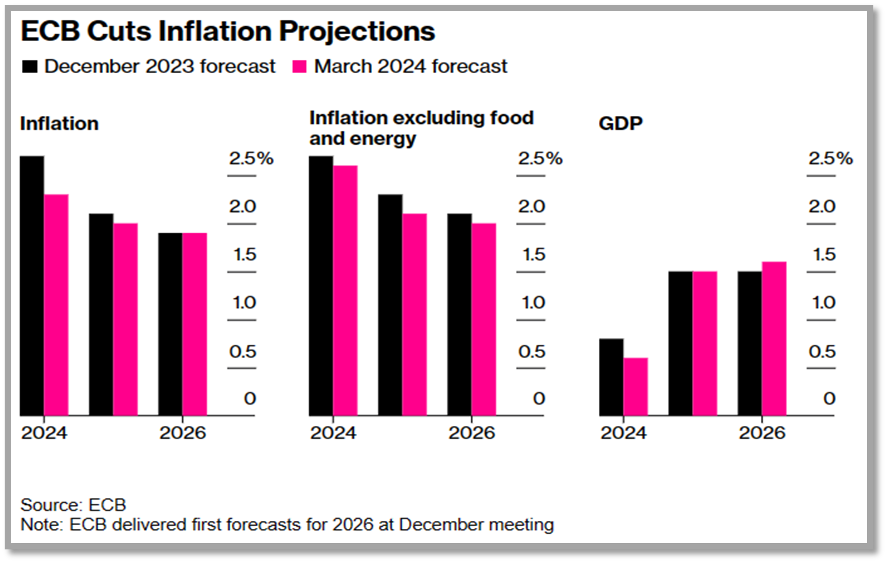

Last week, European Central Bank (ECB) President Christine Lagarde made significant remarks, hinting at a potential interest rate reduction by June. This comes after new forecasts projecting inflation to reach the 2% goal by 2025. Despite maintaining the deposit rate at 4% for the fourth consecutive session, Lagarde acknowledged the noticeable deceleration in inflation rates. However, she also noted the need for more confidence before initiating immediate monetary policy easing.

It’s intriguing to consider whether the heads of Global Central Banks coordinate their views before presenting them as ‘independent’. The current synchronicity in their views, as seen with Lagarde and Powell, raises such questions. Both have stressed the importance of further data, particularly on wage trends, suggesting that more comprehensive information is expected in the coming months. A phrase that encapsulates this anticipation is “We anticipate having a clearer picture in April, but a much better understanding by June”, a phrase which I plan to try and remember to include in future’ Market Matters’.

This adjustment in inflation means that the ECB is also now odds to cut in June, with predictions suggesting total cuts in 2024 similar to the US of 0.75 to 1%. One downside that had been expected was that the economy’s growth forecast for 2024 has been adjusted to 0.6%, down from the previous estimate of 0.8%. However, that remains much better than the recession that looked on the cards only a few short months ago.

The UK Market

I am sure your inboxes have been swamped with views on the UK budget, so I won’t be offering any grand critique! Unusually, I watched the whole spectacle live and was struck by the comedic nature of the event, with the nonstop heckling and barbed jokes, something quintessentially British and old-fashioned that I couldn’t help but like. I doubt if the new £5k British ISA will suddenly reverse the fortunes of our domestic market, but it is at least a start and, if nothing else, improves sentiment.

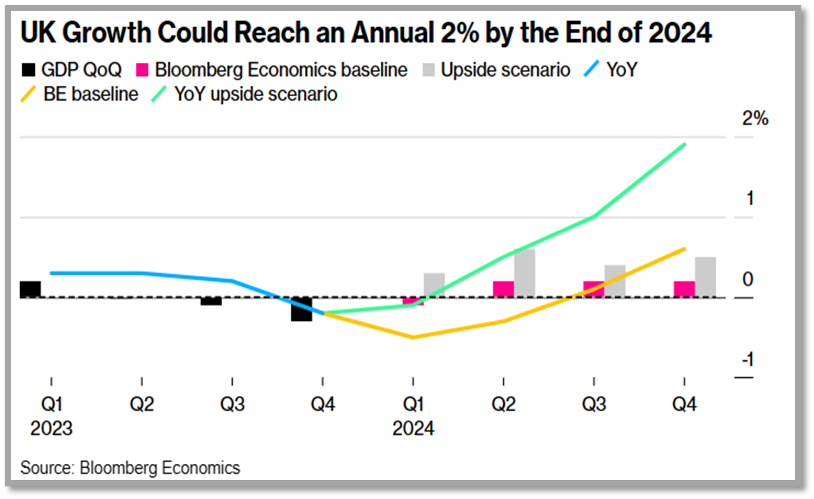

I think it is fair to say that there seems to be an air of optimism about the economy on both sides of the house. According to the latest Bloomberg analysis, the economy is expected to grow by 1% by the start of next year, and the expansion could accelerate to as much as 1.9%. While that hardly places us in boom times, it would be enough to push Britain towards the top of the G-7 table, signalling a promising future for potential investors.

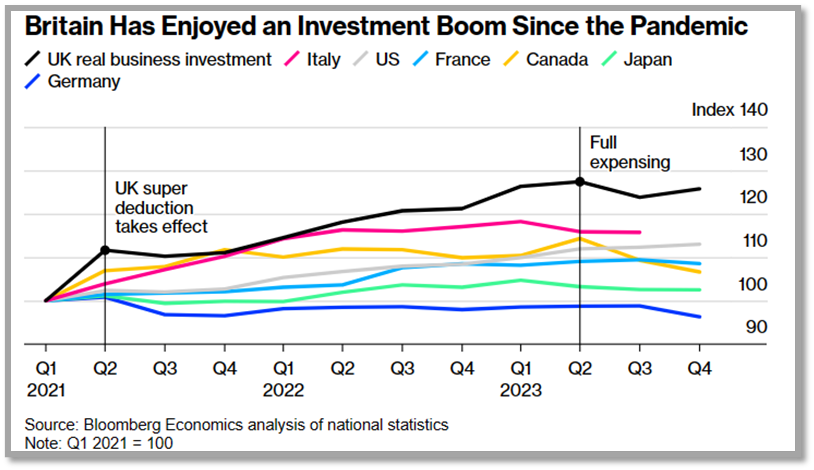

Although the optimism is yet to feed through into our listed equity markets, it would appear that business investment, stimulated by government policies that allowed companies to write off first 120% and then 100% of capital expenditures, has grown faster than any G-7 nation since the tax relief was introduced in April 2021.

Irrespective of the result of the next election (which still looks like a Labour shoo-in), both Sunak and Starmer are very pro-business and looking for this route to grow the economy. In the longer term, the artificial intelligence revolution promises a more fundamental revival as the technology plays to the UK’s strengths.

The big picture for the economy isn’t that bad. Unemployment continues to hover at historically low levels, with wage growth outpacing inflation for half a year. The Bank of England (BOE) predicts that living standards will improve in 2024 and 2025. According to the central bank, household financial health is at its strongest since 2002. Furthermore, businesses have significantly cut down their debt levels, and banking institutions maintain robust capital reserves.

When I think about the valuation placed on UK equity, which, as we all know, is showing a huge discount to other markets, it looks too cheap. Now, cheap can always get cheaper, but when there has been a catalyst for change, which we sense is underway , I think there could be an opportunity when global investors wake up to the improving UK fortunes. This undervaluation of UK equities should make potential investors feel they are getting a good deal, enhancing their interest in the investment opportunity.

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production