We recognise that periods of market turbulence are worrying for clients and disruptive to normal operations for our adviser partners. As such we’ve compiled some talking points and resources to support you in your client comms.

In addition, please feel free to schedule 15-30 minutes with the team or request any specific data or analysis from our portfolios team.

Likely Client Q&A

Q: How much worse could this get?

A: The market is responding to a potential new paradigm for global trade – as well as the inherent volatility of US policy. Whilst unpleasant over the short term, this is a normal response to resetting investor projections and is a functional feature of capital markets.

What remains to be seen is if the negative sentiment triggers any kind of recession, which could see markets fall further as they adjust to poorer earnings potential. However, data and policy are being monitored day-by-day and simply disengaging with global markets creates the even-greater risk of not effectively capturing the market rebound when it comes. Flexible adaption to changing regimes is something that sits at the core of the AQ process and the Investment Team is monitoring the situation daily.

Q: Given that the catalyst is Trump policy-based, would it be best to simply not invest in the US or equity markets more broadly until the mid-terms and the republicans no longer have complete control?

A: Whilst an understandable and logical response, history tells us again and again, that the punitive costs for selling out completely during periods of heightened volatility are extremely destructive to investor returns.

In simple English, timing any re-entry to the market is statistically extremely unlikely to capture the initial rebound, which is usually the strongest period of recovery. Whilst the initial 2-year term of the President is likely to be beset with volatile policy, this is a reason to tactically soften your exposure to the sector itself and more sensitive areas – which the 8AM Investment Team has already performed.

Q: What are the likely timescales for recovery?

A: Of course, any answer will be an educated prediction but over 150 years of stock market corrections, bear markets and crashes gives us some insight. At the time of writing, most pundits and analysts are still pointing to positive annual equity returns by the end of 2025, but bear markets and recoveries can persist longer, depending on the severity and nature of the underlying cause. Statistically, the vast majority of crashes and corrections between 15%-25% have regained their previous highs within 12-24 months. More extended bear market periods, akin to that of the 1970’s and the years following the Global Financial Crisis (GFC) had deep foundational issues, whereas the current catalyst is based much more on short term policy fears.

Q: What did my Investment Manager do to manage these risks?

A: A key feature of the AQ investment process is in its ongoing dispassionate monitoring of your portfolio and its ability to ‘adapt’ quickly to a changing marketplace. This was exemplified in the mid-March review of your portfolio, of which these data-driven changes have provided portfolio protection.

- Reduced portfolio equity levels overall and added to Bonds – decreasing risk as far as possible within our mandate.

- Altered the focus of our US equity screens to ‘Defensive’ – ensuring our active fund managers are appropriate for a negative market environment.

- Moved allocation from Corporate Debt to Sovereign Debt – decreasing risk

- Decreased exposure to US equity overall – decreasing risk

- Increased exposure to Europe, Japan and the UK – (all of which have weathered extremely well relative to the US)

- Complete removal of direct Smaller Companies exposure, significantly decreasing risk – Smaller companies have been some of the hardest hit by the volatility.

- Continued tactical use of Absolute Return and Shorter Duration debt – decreasing risk and softening short term downside repricing in bond funds.

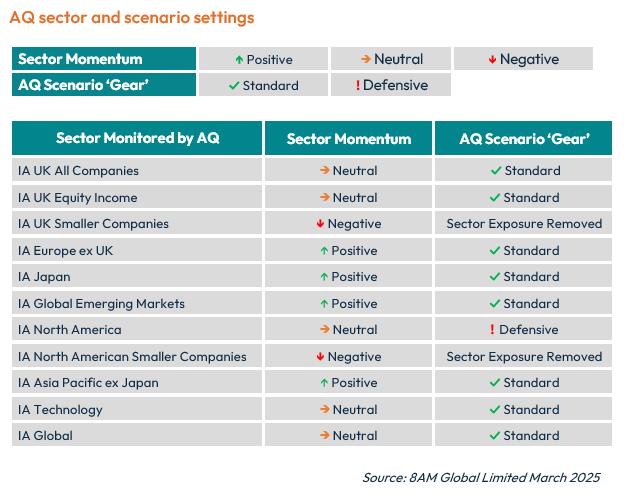

Some of these changes are clearly seen in this snapshot from our March AQ Webinar.

Read more here in our longer form March AQ Change Report

Q: How is my Investment Manager monitoring the situation?

A: The 8AM AQ portfolios have always been positioned with data-led diversification at their core. Utilising a vast dataset of professional investor portfolios, we position the 8AM AQ investment models relative to the crowd-sourced consensus for each asset class. In practical terms, we provide a responsible and balanced blend of assets to help manage volatility in periods like this.

By way of a simple example; the market capitalisation of the US is something in the region of 70% of the global market. Exposed neutrally to this market, a fall of -20% in US equities is felt as a fall of -14% for an investor holding 70%. The 8AM AQ portfolios hold a much more diversified blend of asset classes, holding only 40% of your equity assets in the US meaning a proportionate fall of only -8%.

Holding a diversified portfolio is only half of the story though…

The AQ investment process is focused on continual reappraisal of both investment funds and asset allocation data to ensure our investors are always invested in funds offering consistent and adaptable investor value as well as portfolios that are diversified and allocated tactically based on the current consensus view of experts.

Our job is to analyse and rapidly parse new data, to make clear, logical decisions on your clients behalf.

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production