US Economy picks up steam & Nvidia underwhelms

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Review

There was no shortage of economic indicators released last week, and of course, we got quarterly earnings from Nvidia. Much could have gone wrong, but the data matched expectations by and large; the upshot was a relatively quiet finish to the month for the financial markets. Most equity markets ended the week slightly higher, although mid and small-cap lagged, and US tech was dragged lower by the fall in Nvidia (-8.5%). Yields on the treasury markets backed up a little, and the UK 10-year moved back above 4%, as economic data came in a little firmer than bond investors would have liked. Currencies and commodities were stable as nothing flared up in the Middle East. With hindsight, the drama at the start of the month over fears of a US recession now looks like nothing more than a storm in a tea cup and any knee-jerkers that pulled out mid-month must be feeling a trifle foolish..

Nvidia Underwhelms

Before we look at the economic data, let’s get the excitement of the Nvidia results out the way. While meeting or exceeding most analysts’ expectations, Nvidia failed to impress investors with a drop in profit margins, a slightly underwhelming forecast, and challenges in the rolling out of the Blackwell chips. Nvidia projected third-quarter revenue at around $32.5 billion, slightly above the average analyst prediction of $31.9 billion but lower than the highest estimates of $37.9 billion.

Despite delivering excellent numbers that any other large-cap company would be proud of, with revenue up 122% yearly, Nvidia’s investors were still disappointed because they had come to expect exceptional, blowout quarters. However, this disappointment could lead to a positive outcome. If the bubble in the share price of this Leviathan can be allowed to gently deflate rather than pop, it will be much better for the health of the market as a whole, providing a sense of stability and reassurance.

US Macro

The Federal Reserve’s preferred measure of underlying U.S. inflation, the core personal consumption expenditures (PCE) price index, came in as expected with a rise of 0.2% in July. On a three-month annualized basis, it grew by 1.7%, marking the slowest pace this year. Not only did we get confirmation that inflation is trending lower, but we also got news of a pickup in household spending, adding further weight to the likelihood of the Goldilocks scenario playing out. Admittedly, spending increased primarily as a result of a decrease in household savings. However, the fact that wages are rising and asset values are increasing should reassure your average Joe, who finally feels more relaxed about spending more of his pandemic savings.

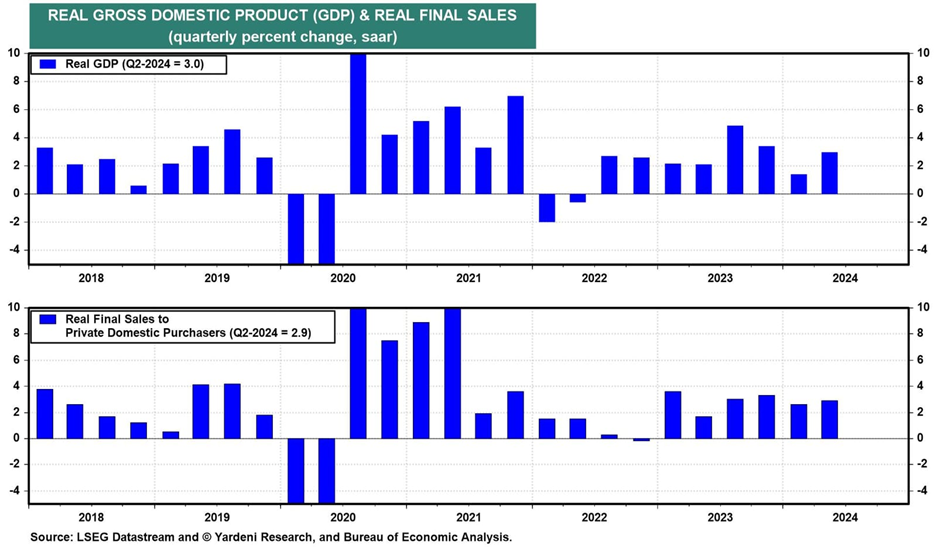

We also got more good news on the growth front, as real GDP growth was revised from 2.8% q/q to 3.0% in Q2. We know J Powell keeps an eye on real final sales to private domestic purchasers, which increased from 2.6% to 2.9%. This number, which excludes inventory investment, government spending, and net exports, provides a clear signal of underlying demand.

So, except for the housing market, this is not an economy that needs the Fed to cut interest rates to prop up growth – but it will anyway! The consequences are more robust growth, steadily rising corporate earnings, and likely higher stock prices. I am also sticking to my view that a more robust economy than expected is likely bearish for long duration government bonds, even if rate cuts are coming. Barring geopolitical flare-ups, the 10-year US Treasury Yield will likely spend most of the rest of the year above 4%, but the equity markets are resilient enough to deal with a modest backup in yields.

US Politics

I will update you on how the polls look periodically and with greater frequency as we approach election day on November 5th. With Kamala Harris now the Democratic candidate, the left-of-centre party has taken the lead, crucially in several of the swing states.

Kamala Harris has maintained the momentum she gained in the presidential race, now leading or tying with Republican Donald Trump in all seven key battleground states. According to a Bloomberg poll conducted after the Democratic National Convention, Harris has closed or reversed Trump’s lead on critical economic issues. She is now seen as more trustworthy than Trump in protecting personal freedoms. Among registered voters in these crucial states, Harris holds a 2-point lead. Coming completely off the fence for this one – I don’t want to see an unhinged Trump in the White House for a second term – among likely voters, she is only ahead by 1 point, and before we pop open the champagne corks, this is within the margin of error, making it a statistical tie! But for me, it sure looks less grim than it did a few weeks ago.

Europe

In August, inflation in the eurozone dropped significantly from 2.6% in July to 2.2%, mainly due to lower energy prices. However, core inflation, which excludes energy, remained steady, rising at the same pace as in previous months. Notably, service inflation increased slightly, partly because of temporary price hikes in France linked to the Olympics.

Despite the headline inflation drop, a thorough analysis reveals that there’s not much evidence of cooling in underlying price pressures beyond energy. However, core inflation will likely gradually ease later this year, thanks to moderating price expectations and softer wage growth. The significant drop-in headline inflation and subpar economic growth numbers suggest to me the likelihood of a 25bps rate cut at the European Central Bank’s next meeting in September. That would probably provide a near-term boost to the equity market.

UK

The steady decline in mortgage approvals that started in April stopped in July, with approvals for new home purchases rising to 61,985, up from 60,61 in June. This increase likely reflects the slight drop in mortgage rates since May. Swap rates have been falling as the Monetary Policy Committee (MPC) hinted at beginning a rate-cutting cycle. While this suggests mortgage rates dip further in the short term, the MPC’s cautious approach means we won’t see significant drops. Mortgage affordability remains tough compared to historical standards, so don’t expect a sudden massive increase in mortgage demand; nevertheless, it is a good sign.

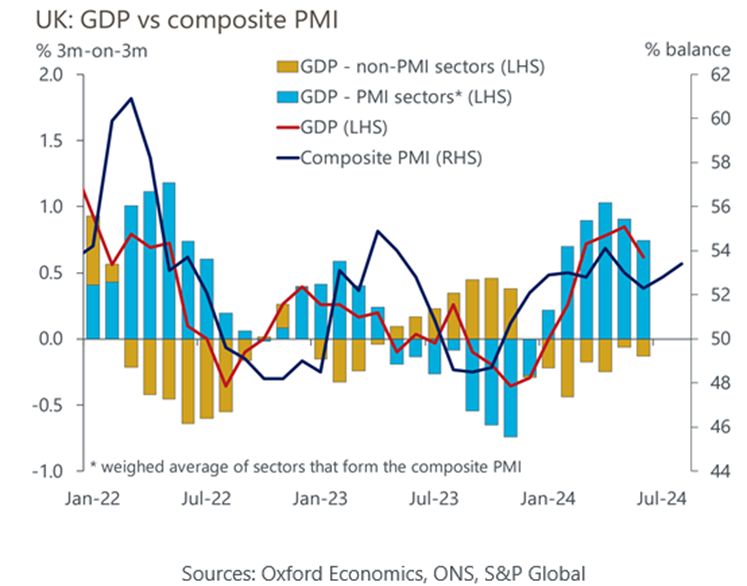

The UK has been doing better than other economies recently, with stronger-than-expected economic activity. The latest data shows that the UK’s recovery continued into August, with business activity improving. August’s flash S&P Global survey reported an increase in the Composite PMI to 53.4, from 52.8 in July. The increase was driven by stronger growth in the services sector, which also saw new orders and hiring rises. This positive trend in the UK economy should likely keep boosting UK-focused stocks.

Indeed, UK consumer stocks, which generate most of their revenues in the domestic market, have seen positive EPS revisions in recent months, so I think investors who have started to rebuild positions in the small and mid-cap sectors should keep the faith.

Asia/China

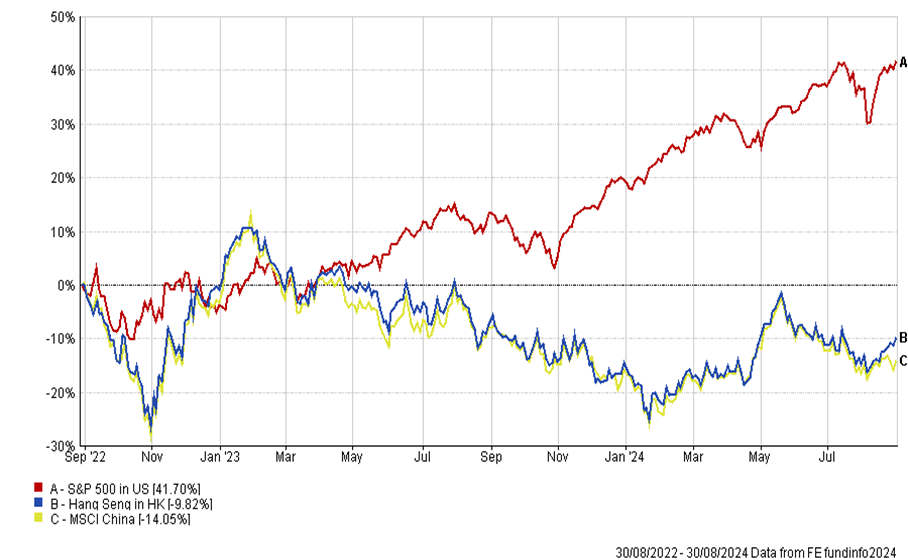

While it may seem like I’m clutching at straws, the recent underperformance of Chinese equities could be a sign of a potential rebound. This is not a data-driven assessment, but rather a hunch. Rest assured, this won’t lead to any impulsive moves in the AQ portfolios. However, it’s worth noting that last week, Asian equities ended a strong week and month on a high note, particularly in Hong Kong and Mainland China.

The fact that the market managed to rally last week, in particular, is very noteworthy, as Chinese stocks were a net sell in MSCI indices following an index rebalance, which sees India as the primary beneficiary of the reduction in China’s weight.

That is a powerful sign.

Looking back at the big picture, how many investors know this was the 4th positive week for Hong Kong-listed stocks? How many investors know that Hong Kong-listed stocks beat US stocks in August? Probably very few as attention has turned elsewhere, but one of the classic tenets of successful contrarian investment is finding opportunities where others are not looking. There was also a strong rotation into growth stocks. China will not be able to sustain a successful rally without solid market leadership. Still, we might have just witnessed a start and companies like Tencent, Alibaba, and Meituan are the type of stocks that foreign investors could gravitate to.

There was a catalyst, with news that China is thinking about letting homeowners refinance up to $5.4 trillion in mortgages to lower their borrowing costs, which could help boost spending by millions of families. The plan would allow homeowners to renegotiate their mortgage terms with their current banks before January or switch to a different bank, which hasn’t been allowed since the global financial crisis. While this could reduce profits for state-run banks, it would show that the government is serious about supporting the economy, protecting household wealth, and encouraging spending. It is, at the very least, a straw to cling to!

Below, the Hang Seng outperformed last month, just in case you missed it!

This Week…

1. Manufacturing and Services PMIs (USD, EUR, GBP): Throughout the week, various countries, including the US, Eurozone, and the UK, will release their final purchasing managers’ index (PMI) data.

2. U.S. Jobs Data (USD): On Wednesday and Friday, the US will release its ADP Non-Farm Employment Change, Job Openings (JOLTS), and the highly anticipated Non-Farm Payrolls report, along with the Unemployment Rate

3. Interest Rate Decisions (CAD): The Bank of Canada will announce its interest rate decision on Wednesday. This decision will be closely watched for any signs of changes in monetary policy.

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production