Recovery Continues!

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Review

It was another excellent week for risk assets, as every equity market we report on enjoyed positive returns led by Japan and the US. The 2024 August wobble will go down in history as another occasion when buying on the dip was the correct strategy. We didn’t have any standout earnings results or macro releases to fuel the market. It was just another case of sentiment flipping on a dime, with the hard landers banished to the sidelines as the soft-landing goldilocks scenario moved back front and centre of most likely outcomes. Inflation figures last week came in much as expected, meaning the first rate cut from the Fed looks nailed on for September. Bond yields held steady without being affected by the change in tone in the equity markets. It would seem that Gold is now also in a bullish mood, where any news is perceived as good, and with more buyers than sellers, up it goes!

US Inflation behaves

Inflation is still moderating pretty much any way you skin it, and there are a plethora of ways of skinning this particular cat. Last week, we got the PPI and CPI data, which highlighted a big breakthrough, with headline consumer price inflation dropping below 3% for the first time since 2021.

The core change in the price of goods is now negative, and food and fuel prices have stabilised, so it now comes down to the cost of services. Within this component, the ‘cost of shelter’ remains stubbornly high, having even ticked up slightly in July. Shelter inflation is one of the most controversial components of both CPI and, to a lesser degree, PCE inflation, within which it has a lower weight. Instead of focusing on just the most recent month’s data, it averages prices and rents paid over the entire year, which means it often lags current housing market trends.

Private-sector metrics, which track rent changes in leases signed within the last month, provide a more immediate indication of where the market is heading. For instance, Zillow’s measure of rental inflation would have signalled a significant spike in 2021 and has been indicating for about a year that the issue is largely resolved. However, this shift still needs to be reflected in the official data, but the FED are undoubtedly aware of this.

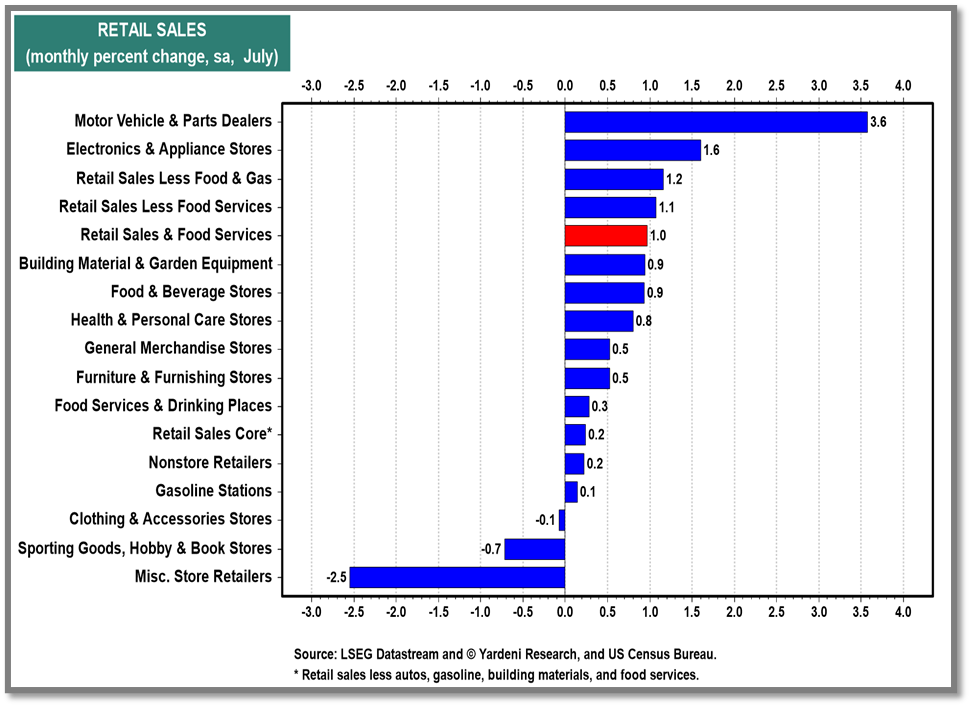

US Consumer Still Spending

US retail sales accelerated in July by the most since early 2023 in a broad advance that points to a resilient consumer, even in the face of high prices and borrowing costs. The value of retail purchases, unadjusted for inflation, increased 1% in July, way above estimates, and was helped by a sharp snapback in car sales. Adding weight to the argument that the consumer is still in a good place was the news that Walmart had raised sales guidance for the year. While indicating shoppers are becoming more discerning, Chief Financial Officer John David Rainey pointed out that the company isn’t “seeing any incremental fraying” of customers’ financial health. So much for the hard landing! The solid gains were widespread, especially when you remember that the CPI for goods fell 0.1% m/m during July.

US Earnings

There’s no sign of an imminent recession in the latest earnings reporting season, and we are nearly at the end, with more than 90% of the S&P 500 companies having reported their earnings for Q2. However, Nvidia looms large on the horizon with its numbers next week. Collectively, S&P 500 operating earnings per share (EPS) rose 10.9% y/y during the quarter to a record high of $60.19. Forward earnings rose to yet another record-high $265.67 during the week, suggesting that the jobs market remains robust as profitable companies tend to expand their payrolls. The weekly S&P 500 forward profit margin rose to 13.4%, a record high that leans into the continued prospect of a technology-led productivity growth boom.

I have been confident all year (yes, even when the market was sliding at the beginning of the month) that the US economy will avoid a recession this year and that a soft landing is the most likely outcome, supporting my bullish views on global equity markets. Others are becoming more confident, too, and economists at Goldman Sachs lowered the probability of a recession in the United States over the next year from 25% to 20% based on recent data.

UK – Inflation

UK inflation rose less than expected in July, with the Consumer Prices Index (CPI) increasing by 2.2%, slightly below the 2.3% predicted by economists. Despite this being the first increase in the headline CPI rate this year, the overall trend was described as a “dovish turn,” offering some reassurance to the Bank of England’s Monetary Policy Committee, which had forecasted a sharper rise. Services inflation cooled to 5.2% from 5.7%, the lowest reading in two years and below the 5.6% the BOE forecasted. This lower-than-anticipated rise prompted traders to adjust their expectations for future interest-rate cuts.

UK – Retail Sales

Brits love football tournaments, and the spending in pubs and home BBQs around the Euros helped the economy as retail sales rebounded in July, increasing by 0.5% after a 0.9% decline in June. While the rise was slightly below economists’ expectations of 0.6%, the revised June figures showed a smaller decline than initially reported. This suggests a stronger start to the third quarter and hints at improving consumer confidence as inflation nears the Bank of England’s 2% target and hiring picks up. With moderating inflation, further interest rate cuts are expected, which will help reduce household debt burdens. With wage growth continuing to outstrip inflation, the uptick in consumer spending should continue.

Japan

In a week when any stock market bounces more than 8%, it would be remiss of me not to mention it. Japan’s Nikkei jumped 8.67% in Yen last week, less for global investors as the Yen depreciated, but a massive one-week move as it claws its way back to levels in touching distance of the 40,000 level. Much of that has just been a sentiment-driven move, and ‘buy on the dip’ investors are piling back in, but there was also some unequivocally good news. Japan’s economy returned to growth in the second quarter, driven by a rise in private consumption. This increase indicates that a long-anticipated cycle of rising incomes leading to increased spending may be beginning. The country’s GDP expanded at an annualised rate of 3.1% from April to June, surpassing the 2.3% consensus estimate after a revised 2.3% contraction in the first quarter. This is no small thing, and if we get continued confirmation of the willingness of the Japanese people to spend, it bodes very well for the economy and the fortunes of domestic Japanese companies.

The good news wasn’t enough to stop Japanese Prime Minister Fumio Kishida from opting out of the ruling Liberal Democratic Party’s leadership race in September, clearing the path for a new leader to take over as premier.

This Week

After a sharp rebound last week, I am looking at the level of volatility to see if this rebound will hold without drama. But we do have a host of things to observe, and at the top of the list will be the views of the Fed Chair. J Powell will deliver a speech at the Jackson Hole Symposium on Friday, following the release of the Fed’s July meeting minutes on Wednesday. Investors hope this will confirm that a rate cut is likely and that economic growth, whilst moderating, is still healthy. Investors will also watch preliminary surveys on manufacturing and services activity in the Eurozone, UK, and US, as well as the UK’s public sector borrowing data and consumer confidence survey. China’s interest rate decision and Japan’s July consumer price data will also be a focus in Asia.

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production