5 Years of AQ & An Independence day high!

Author: Tom McGrath, CIO, 8AM Global

What a five years it’s been…

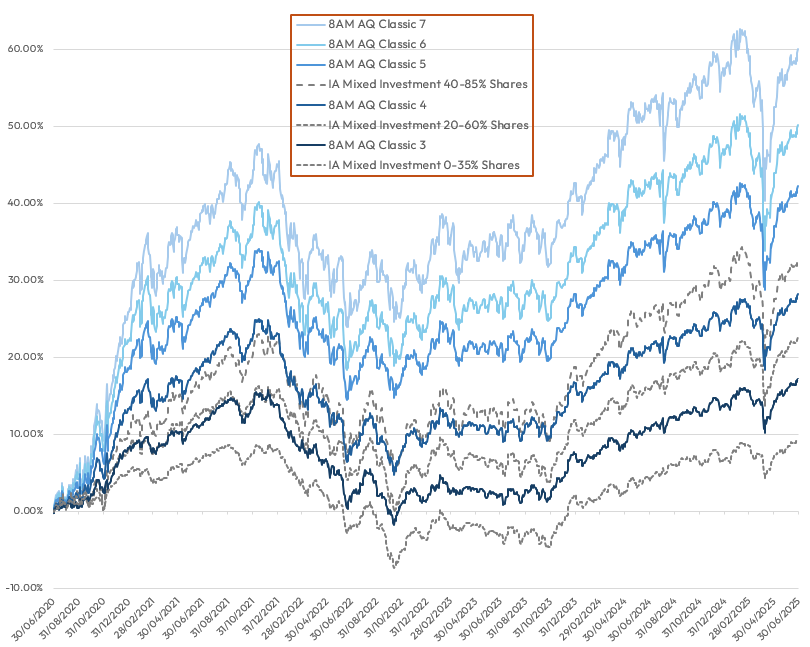

Forgive the indulgence; we don’t usually use this medium to promote our portfolios directly, but having just passed the five-year mark with AQ, it’s worth taking a moment to reflect. From June 2020 to June 2025, the 8AM AQ Classic models have delivered strong, risk-adjusted returns through some of the most turbulent conditions in living memory. When we launched the 8AM AQ portfolios in the aftermath of the pandemic, we couldn’t have anticipated what lay ahead: war in Europe, an energy shock, the highest inflation in decades, and the sharpest rate hikes in a generation. Add to that constant political upheaval, Middle East conflict, a cost-of-living crisis, bond market volatility, and now the return of Trump and tariffs to centre stage.

Throughout it all, volatility has been constant but so has our process. The 8AM AQ portfolios were designed for this: to deliver robust, repeatable outcomes, not just in good times, but especially when markets get difficult. That’s precisely what they’ve done.

Market overview

Equities ended last week on a positive note, with broad gains across most regions and an especially strong showing from the US as the S&P 500 set another record high ahead of the July 4th break. There are also signs of a market broadening out, as Small Caps led the way, a phenomenon that has already been at play in the UK and Europe, as highlighted in previous Market Matters. The catalyst for the move in the US was primarily a solid jobs report that underpinned growing signs that the US economy is still holding firm, at least for now.

Trump’s OBBBA tax bill cleared the House after markets had closed, giving him something to cheer, but whether bond and equity markets share the mood will become clearer today (Monday) when investors return after the long weekend. The looming tariff deadline also adds complexity, with the President hinting at further letters and potentially punitive rates. So far, bond markets have been relatively calm. US Treasury yields were steady, while gilts were thrown around by political noise before settling as Starmer reaffirmed support for Chancellor Reeves (more on that later). First, we turn to the US labour market, which once again provided the key economic signal of the week…

US job market

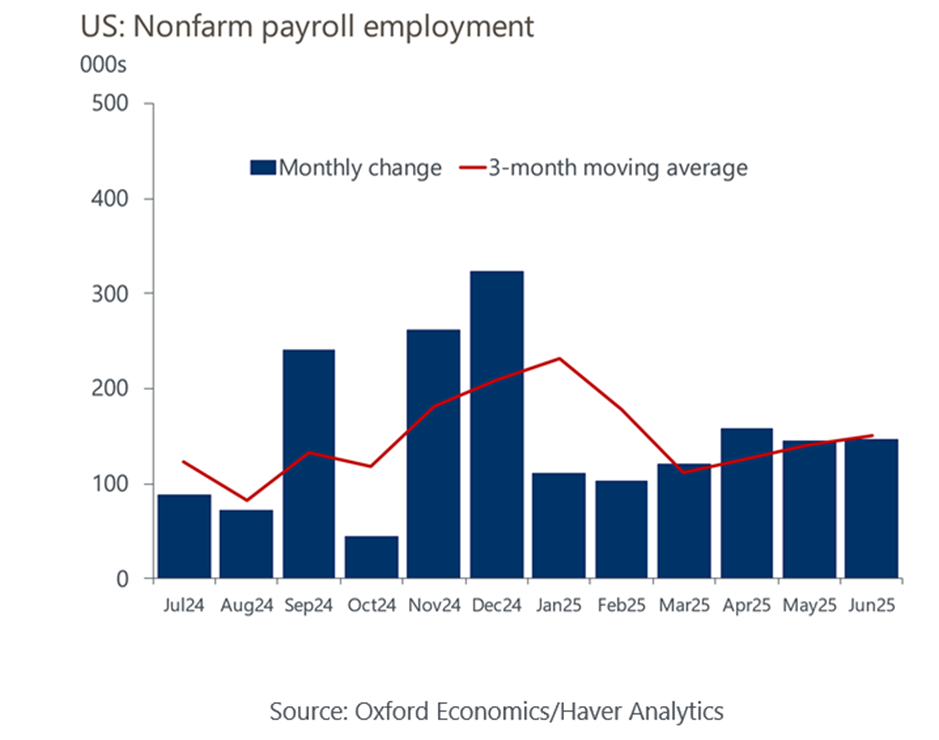

The US labour market delivered a surprisingly strong showing in June, with nonfarm payrolls rising by 147,000, well ahead of expectations. But beneath the headline, the details were more nuanced. Much of the gain came from government hiring — likely flattered by seasonal factors — while private sector job growth slowed. Still, key measures such as prime-age participation and the employment-to-population ratio ticked higher, and the unemployment rate unexpectedly fell. Most importantly for markets, wage growth remained subdued, increasing just 0.2% month-on-month, keeping it in line with the Fed’s 2% inflation target.

For most investors, this was a ‘just right’ report. It suggests that the economy remains resilient but not overheating, and that the labour market is cooling in a controlled and ‘non-alarming’ way. That gives the Federal Reserve justification to ignore Trump and room to remain on hold as it assesses the impact of tariffs and fiscal policy on inflation. With no urgent pressure to hike and inflation risks appearing manageable, the door remains open for rate cuts later in the year, most likely in December. In short, the data keeps the soft-landing narrative alive, which explains the calm in bond markets and the continued appetite for risk.

Trump’s One Big Beautiful Bill Act (OBBBA)

That calm may soon be tested. Just after markets closed for the week, OBBBA cleared the House, a sweeping package of tax cuts and business incentives aimed at boosting near-term demand. The headline economic impact is modest but front-loaded: estimates suggest the bill could lift GDP growth by 0.1% this year and up to 0.5% in 2026. That might help sustain the expansion, particularly as the drag from tariffs and immigration policy intensifies. But the stimulus is largely temporary, with many provisions set to expire by 2028, leaving a longer-term fiscal hangover.

The inflationary impulse is expected to be small and delayed, allowing policymakers to remain on hold until year-end; however, bond markets may prove more sensitive. The combination of significant upfront tax cuts, rising debt issuance, and the use of tariffs as a defacto revenue source adds complexity to the fiscal outlook. Section 899, a less-discussed provision targeting foreign tax structures, could also discourage overseas demand for US assets, even if Treasuries are nominally exempt. So far, yields have been stable, but the risks are skewed toward stickier inflation, higher term premiums, and a more cautious rate-cutting path in 2026.

Tariffs about to regain centre stage!

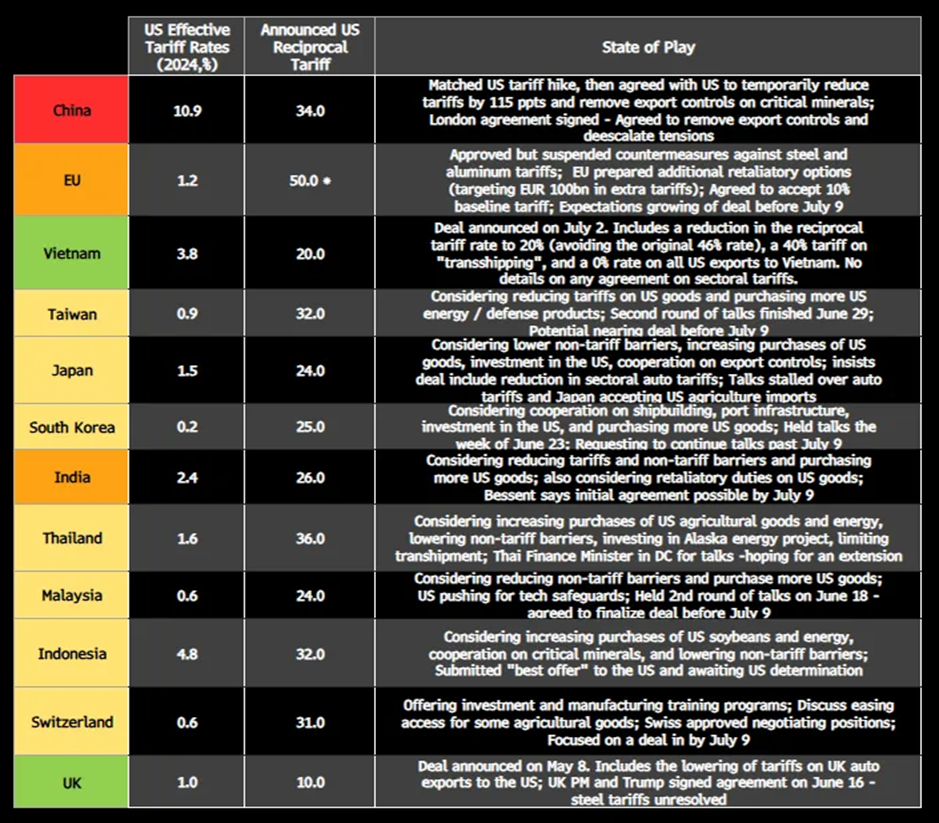

With OBBBA passed just in time for the 4th of July deadline, Trump’s attention is now expected to turn squarely toward trade, and this is where things could become more difficult for markets. The 90-day reprieve on his so-called ‘reciprocal tariffs’ expires this Wednesday, clearing the way for a new round of protectionist measures aimed at narrowing trade deficits and reshoring US manufacturing. While the tax bill offered near-term stimulus, tariffs remain Trump’s real policy lever, politically popular, revenue-generating, and symbolically potent.

That also makes them unpredictable. Trump’s approach to trade, a mix of last-minute threats, partial deals, and ‘art of the deal’ brinkmanship, means volatility is likely to rise as negotiations intensify. Many countries are still in talks, but few have clarity on what comes next. The updated state-of-play map shows most US trade partners oscillating between negotiation and retaliation. While some deals (like with South Korea and Japan) are progressing, others, notably with China, the EU, and Mexico, could turn confrontational very quickly.

This phase will test investor nerves. Tariffs may help fill the Treasury’s coffers, but they also risk disrupting global supply chains and fuelling inflation just as consumer demand shows early signs of softening. Markets have so far looked through the noise, comforted by solid jobs data and a dovish Fed. However, if Trump follows through on threats to impose tariffs of 20% or more on key partners, the average US import duty could rise to 20% from 3% pre-Trump. This shift would have a material impact on margins, input costs, and corporate planning.

Trump has often claimed that tariffs are paid by foreign countries, but in practice, the burden falls on US importers, who must choose between squeezing suppliers, raising prices, or absorbing the hit. That creates a complex feedback loop for inflation and Fed policy. For now, the central bank is watching rather than reacting. But this coming week may offer the first real glimpse of how far Trump is willing to go and how far markets are willing to follow.

UK drama

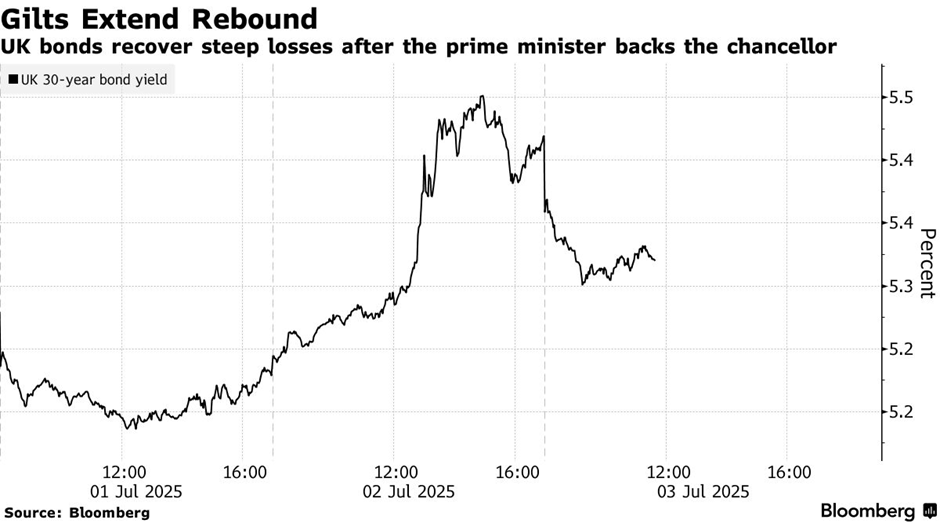

The UK also had a moment last week, and not a reassuring one… Bond and equity markets sold-off sharply midweek after Prime Minister Keir Starmer hesitated to publicly back his Chancellor, Rachel Reeves, during Prime Minister’s Questions. The timing couldn’t have been worse: concerns about fiscal slippage were already simmering, and the prospect of Reeves, viewed by markets as the architect of Labour’s fiscal credibility, stepping aside was enough to trigger a mini sell-off reminiscent of the Truss era.

The damage was quickly (and visibly) contained. Starmer moved fast to reverse the impression, appearing on the BBC to give Reeves his ‘full backing’. At the same time, the Chancellor herself made an unusual public appearance to reassert her commitment to the government’s fiscal rules. Bond yields fell back, though not fully, and the pound regained ground, while UK equities rebounded and briefly outperformed their European peers.

Still, the episode has left a mark. UK 30-year gilt yields experienced their sharpest single-day spike since April. While they later retreated, the message from markets was clear: fiscal discipline matters and Labour, however large its majority, is not immune to the bond market’s watchful eye. A £5bn U-turn on welfare cuts earlier in the week had already raised eyebrows. With weak growth, high debt servicing costs, and little room to manoeuvre, the summer may bring more moments of tension ahead of the Autumn Budget.

There is no immediate crisis, but the comparison with 2022 lingers, not because we’re headed for a repeat of the Truss fiasco, but because the risk premium that crept back into UK assets won’t vanish overnight. Investors will be watching closely for signs of slippage, especially if political pressure grows to spend more or delay unpopular tax rises. For now, Starmer and Reeves are presenting a united front. The challenge will be sticking to it once the fiscal trade-offs start to bite.

Everywhere else!

The US and UK dominated the overarching market narrative last week, with Trump’s fiscal fireworks dictating the reactive movement for most other global equity markets and the UK’s brief bond wobble taking centre stage. So, with apologies to the rest of the world’s equity and bond markets (alongside 92% of the global population who don’t live in either country), we’ll move on.

This week…

- While tariffs may dominate the headlines, this week marks a shift in focus. The macroeconomic calendar is busy, featuring important US Consumer Price Index (CPI) and Producer Price Index (PPI) data that are likely to influence the near-term policy debate. Additionally, the UK GDP report will provide an early indication of economic momentum following the recent elections.

- In China, credit and trade figures could clarify whether recent policy adjustments are translating into actual demand.

- Earnings season will ramp up on Friday with reports from US banks. Expectations have been lowered in recent weeks, as analysts have cut Q2 estimates more significantly than usual. This creates an opportunity for positive surprises, especially if the economic data remains strong and cost pressures are kept in check.

- Notably, the weak US dollar could serve as a potential catalyst for growth. For large tech firms and multinationals with considerable overseas exposure, currency fluctuations may quietly contribute a few extra percentage points to revenue and profit. This benefit seems to be undervalued in current forecasts.

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production