Trade wars, tariffs, and market turmoil!

Author: Tom McGrath, Head of MPS, 8AM Global

Market Overview

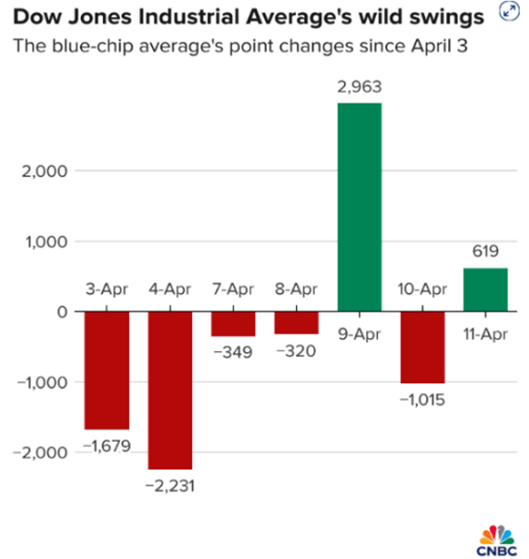

In my entire investment career, I cannot remember a week quite like the one just passed. The speed with which investor sentiment swung from abject fear to sudden optimism was unsettling. The mood did not change day by day but hour by hour. Ultimately, the S&P 500 rallied by more than 5%, finishing above 5,300 after briefly dipping below 4,800. The FTSE 100 was far more restrained, falling by just over one per cent to close at 7,963, having begun the week around the 8,000 level. To truly grasp the scale of volatility in the United States, one only had to look at the wild intraday swings in the Dow Jones Industrial Average. It was quite something.

Tariffs

Here is the simplified version for those fortunate enough to have been living in a cave in the Himalayas over the past fortnight. President Trump and his advisers have decided that imposing sweeping tariffs on imported goods somehow benefits the American economy. In their view, the logic is that tariffs will raise revenue to reduce the deficit and encourage production to return to the United States. The rest of the world can adapt as it sees fit. Markets have strongly disagreed, reacting with concern about both the policy itself and the speed at which it has been implemented.

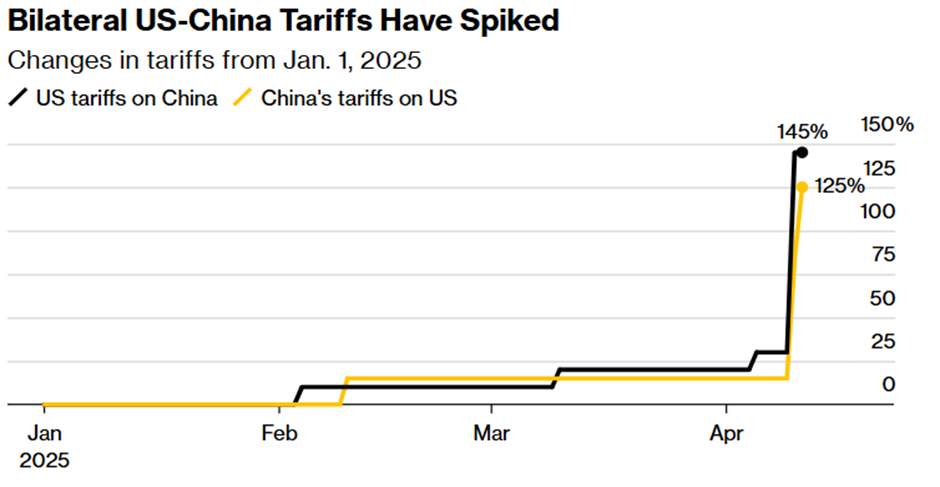

Under pressure from rising bond yields and members of his own party, President Trump stepped back mid-week, announcing a ninety-day suspension of reciprocal tariffs for most trading partners. China, however, was excluded and has become the primary target. By Friday, tariffs on Chinese goods had been raised to 145%, with further increases likely. China responded with tariffs of up to 125% on American goods. A de-escalation does not appear to be on the cards at this stage.

While the Trump administration views tariffs as a source of revenue and a lever for reshaping global trade, the immediate effect is more straightforward. United States consumers will end up paying more. Higher import costs feed directly into inflation and tend to reduce consumption. The idea that supply chains can be reshored quickly, or that consumers will happily pay significantly more for domestically produced goods, is fanciful. A home-made iPhone at $3,500? It seems unlikely.

The bond markets

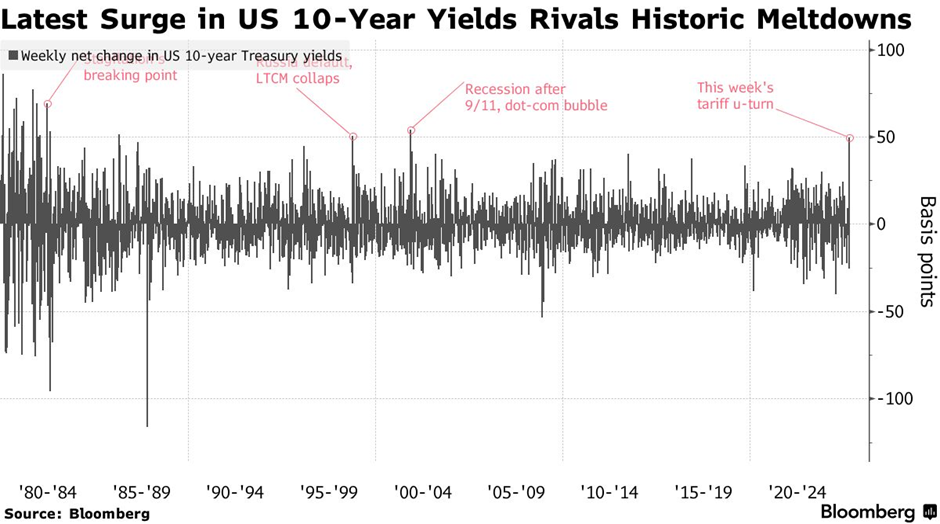

A more structural issue is now emerging, which the Treasury Secretary, Scott Bessent, appears increasingly aware of. If the United States steps back from its role as the world’s primary consumer, it cannot expect the rest of the world to continue financing its deficits at favourable rates. This is now being reflected in the bond market. Yields have risen sharply, and the ten-year Treasury yield recorded its largest weekly increase since 2001. Even if equity volatility begins to settle, the message to policymakers in Washington is clear: investor confidence in US bonds can no longer be taken for granted.

After years of aggressive borrowing and growing tensions with key international creditors, the perception of United States Treasuries as a risk-free benchmark is being questioned. These bonds underpin everything from sovereign debt to mortgage rates, and serve as collateral across vast parts of the global financial system. Their strength depends on global confidence in American fiscal and monetary policy. That confidence, at the margin, appears to be shifting.

It would be premature to suggest that Treasuries are being repriced en masse. There are still many fiscal off-ramps available. The decision to delay tariffs on most trading partners is one such example, and Jay Powell remains a steadying influence at the Federal Reserve. Last week’s thirty-year Treasury auction saw $22bn of bonds taken up with strong demand, despite ongoing market unease. However, the rise in yields also undermines the administration’s stated aim of lowering borrowing costs. Bessent himself had flagged the ten-year yield as a key metric of success. That measure is now pointing in the opposite direction.

Further policy reversals may follow, and I am not surprised if any climbdown is presented as a strategic win. The most likely candidate is China, where the US language is already being softened. On Friday evening, President Trump referred to his counterpart, Xi Jinping, as “a very good leader, a very smart leader”, when asked about the current trade dispute. Clearly, that door remains open.

US economy

My primary concern now is not so much where we end up but how much damage has already been done. The United States economy entered the year in good health, but the risk is that it slows abruptly. The soft data is already weakening, and this week’s releases confirmed the growing divergence between sentiment and actual economic activity.

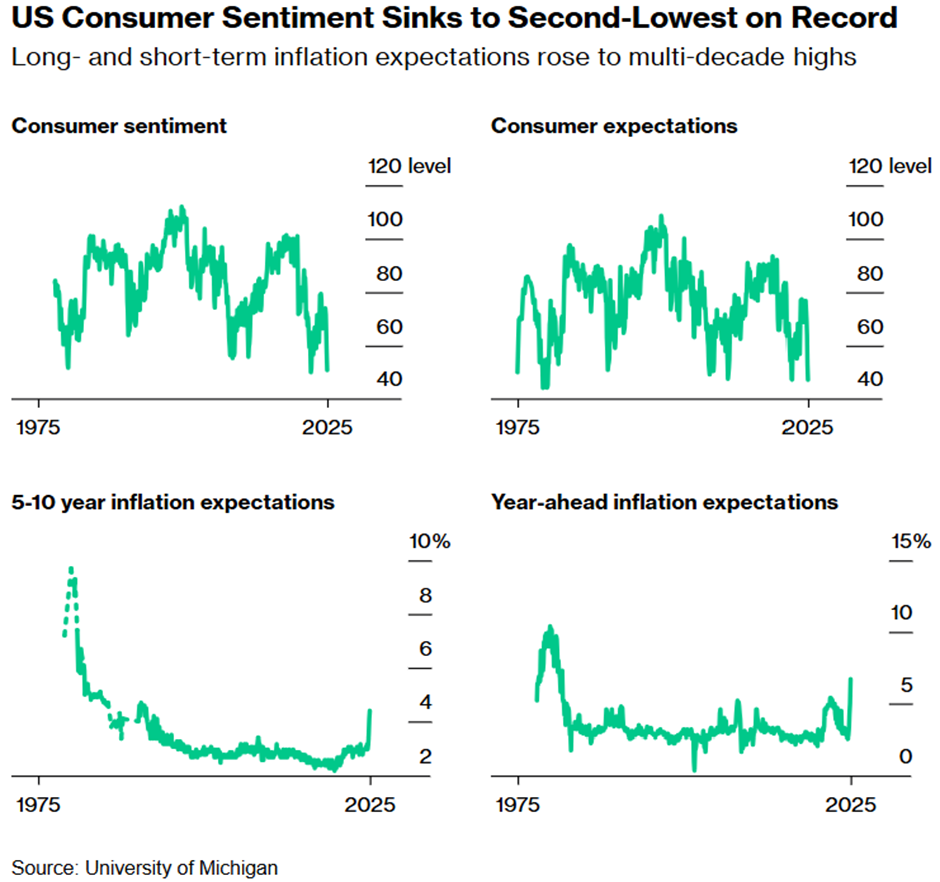

The University of Michigan’s preliminary consumer sentiment index for April showed a sharp decline, falling to 50.8 from 57.0 in March. That is well below expectations and represents the second-lowest reading in the survey’s history. The drop was broad-based and highlights increasing anxiety around inflation, employment, and future economic conditions. Of particular concern was the jump in short-term inflation expectations, which surged to 6.7% – the highest since 1981.

This disconnect is important. While households feel pessimistic and inflation expectations are rising, the actual inflation data for March was significantly more encouraging. Headline CPI fell by 0.1% on the month, taking the annual rate down to 2.4%. Core inflation rose by just 0.1%, and the year-on-year figure declined to 2.8% – the lowest since April 2021. The underlying measures also moved in the right direction. Trimmed mean and median inflation both softened, and the Federal Reserve’s preferred services measure, excluding shelter, fell below 3% for the first time in two years.

Shelter costs, which have been a major driver of inflation, also began to ease, falling below 4%. Excluding shelter, the remainder of the CPI basket is now rising at a pace below 2%, which should be more manageable. This progress is welcome but may prove temporary. Some of the softness in prices, particularly in travel-related sectors such as airfares and hotels, may reflect a cooling in demand, potentially exacerbated by trade-related uncertainty. For example, Canadian tourism to the United States appears to be declining due to the growing tariff dispute.

Elsewhere, the labour market remains in good shape, and wage growth continues to outpace inflation. Real earnings posted another gain in March, providing households with some breathing room and supporting consumption, at least in the short term. Notably, non-management workers saw the strongest increases – timely, given that they are the most exposed to the impact of rising prices. However, financial conditions are tightening. Loan rejection rates, particularly for mortgage refinancing, have reached their highest level in over a decade. This will limit the ability of households to draw on accumulated housing equity, which has been a major support for spending. Although household balance sheets are still relatively strong, the wealth effect is fading.

Looking ahead, the key issue is whether the current tariff regime remains in place. If it does, the recent disinflationary trend may reverse, and the economy could slow more sharply than expected. Growth will likely approach stall speed later this year, and inflation could climb back towards 4.5%. That would make it extremely difficult for the Federal Reserve to cut rates in the near term. A soft landing is still achievable, but the window is narrowing. The damage to sentiment, financial conditions, and global confidence in US policy is already visible. What happens next will depend not just on data but on whether this administration is willing (or able) to change course.

UK – some good(ish) news

While much of the week’s market drama has centred on the United States, assuming the UK will remain immune would be a mistake. Our equity market may have been less volatile in headline terms, but the broader global repricing of risk will inevitably ripple through. And, increasingly, signs of stress are beginning to emerge.

However…

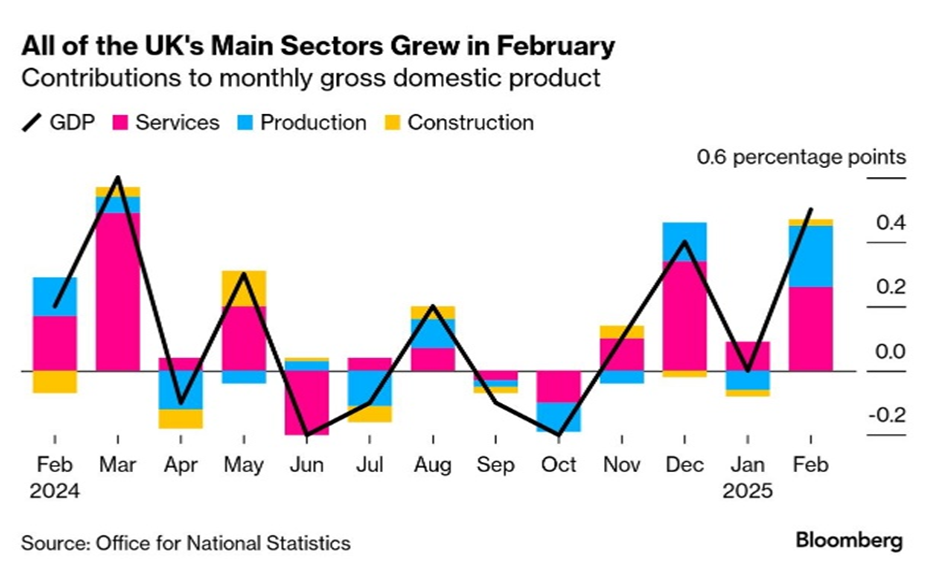

The latest GDP data for February showed a 0.5% month-on-month increase; the strongest reading since March last year. On the surface, this appears encouraging. However, much of the strength likely reflects seasonal distortions rather than a genuine pickup in momentum. The underlying picture remains subdued. Domestic demand continues to struggle under the weight of prior interest rate increases, and business investment remains cautious. More importantly, the UK’s export-facing sectors now face a new headwind. As the United States pursues a more protectionist trade stance, British exporters will likely see reduced access to the American market, limiting one of the few sources of external growth available.

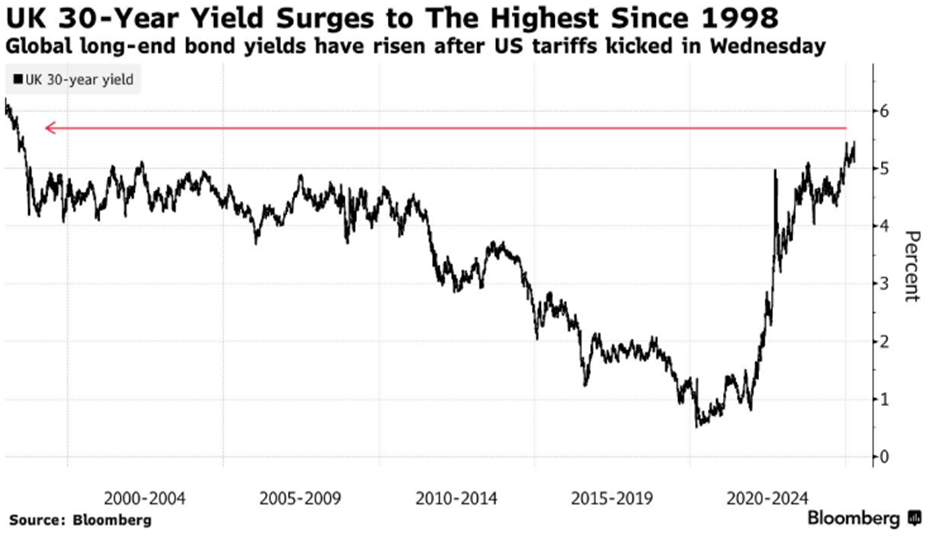

Meanwhile, developments in the gilt market are drawing increasing attention. The Bank of England made a notable move last week, suspending sales of long-dated gilts under its quantitative tightening programme. This decision followed a sharp sell-off in government bonds triggered by the broader volatility surrounding US tariffs and the rise in global bond yields. Long-dated gilt yields rose by sixty basis points to 5.66%, the highest level since 1998, and the BoE’s pivot towards short-dated issuance is clearly a response to market fragility.

It is a reminder that while the UK has not been the epicentre of the latest bout of volatility, we are still very much part of the system. Higher borrowing costs, currency pressure, and weakening external demand will all weigh on the outlook as the year progresses. And as global investors reassess the risk-free status of US Treasuries, gilts may also come under pressure — particularly given the UK’s own fiscal challenges and the market’s relatively low tolerance for political uncertainty.

In short, the UK may not be caught in the eye of the storm, but the same winds are certainly buffeting us. The margin for policy error is also narrowing on this side of the Atlantic.

US earnings season

Friday marked the unofficial start of the US earnings season, with the major banks reporting mixed results. JPMorgan delivered a strong beat, with record quarterly revenues sending its shares up 4% on the day. However, even as the numbers impressed, Chief Executive Jamie Dimon struck a notably cautious tone, warning of “considerable turbulence” ahead and suggesting that many companies are likely to suspend forward guidance altogether.

Elsewhere, results were more muted. Wells Fargo’s net interest income came in below expectations, while Morgan Stanley reported record earnings from equities trading but offered little clarity on the outlook for the rest of the year.

This quarter’s challenge is not necessarily the Q1 results themselves (expectations have already been lowered) but the absence of visibility going forward. While some investors are beginning to prepare their shopping lists, few appear ready to commit capital decisively. As one strategist said, the market appears to have reflated into a new, higher-volatility regime. With unresolved policy uncertainty, inflation risks, and global bond markets under pressure, caution remains the dominant mood.

This week

Brings another deeper set of earnings tests, with results from Goldman Sachs, Citigroup, Bank of America, Johnson & Johnson and Netflix, among others. These names will provide a broader read on the consumer, credit conditions, healthcare demand and digital subscription trends, all useful indicators of resilience or fragility beneath the surface.

Meanwhile, the broader earnings outlook continues to deteriorate. Analysts now expect year-on-year earnings growth of 6.7% for the S&P 500 in the first quarter, down from 11.1% in early November at the time of Trump’s re-election. More notably, according to Bloomberg Intelligence, profit forecasts for the full year 2025 have been revised down to 9.4% from 12.5% at the start of the year. The slow erosion in expectations reflects the squeeze on margins, growing uncertainty around costs and tariffs, and a reluctance by corporates to offer firm guidance.

Earnings season may still deliver some upside surprises. But at an aggregate level, it is more likely to reinforce what the macro and market data have already been suggesting — that we are entering a more fragile, less predictable earnings environment, where sentiment, volatility and policy risk are doing just as much to shape the investment landscape as fundamentals.

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production