Iran Retaliates; Inflation Misbehaves

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Geopolitical

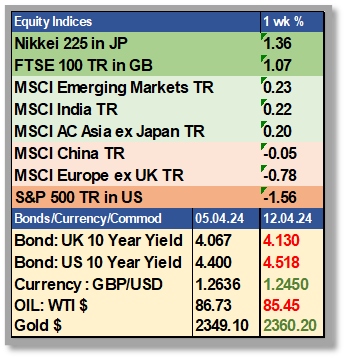

US equities tumbled on Friday night as news leaked out that Iran was planning a strike against Israel. Unfortunately, the intel was accurate, and on Saturday night, Iran launched a wave of missiles and drones toward Israel as regional tensions continued to mount over the war in Gaza. President Biden condemned the attacks and spoke with Israeli Prime Minister Benjamin Netanyahu to reiterate the United States’ commitment to Israeli security. Iranian state media said the attack was in retaliation to an Israeli strike on an Iranian diplomatic compound in Syria on April 1.

Initial indications show that Israel’s highly regarded air defence systems have successfully withstood their most significant challenge to date, countering an intense onslaught from Iran, and according to military spokesman Daniel Hagari, Israel and its allies, including the UK, managed to intercept the “vast majority” of the 200 drones and missiles launched by Iran, neutralising most of them before they could enter Israeli airspace.

The fact that Iranian officials are calling the attack a success despite it causing only minimal damage indicates the aim was always more about sending a message of deterrence than inflicting harm.

The standard line out of Tehran on Sunday is that the operation was a proportionate response to the Damascus attack and that Iran is prepared to hit back harder if pushed. Iran designed its retaliation to cause maximum symbolism but minimum damage. By itself, it shouldn’t lead to anything too catastrophic for equity markets, but if it triggers an Israeli counter-response, then we’re spiralling into somewhere very dangerous.

G-7 leaders have issued a joint declaration firmly condemning the launch of missiles and drones from Iran and reiterating full support for Israel’s security. They underscored the need to avoid further confrontation to defuse tensions in the wider region. They called for an end to the crisis in Gaza through a ceasefire and the release of hostages held there by Hamas. As with all financial assets, the crucial move in the oil price seems to now hinge on what Israel does next. Trading in oil and equity futures resumes at 11 pm London time on Sunday night.

Now, I can’t possibly second guess what will happen in the short, medium or long term.

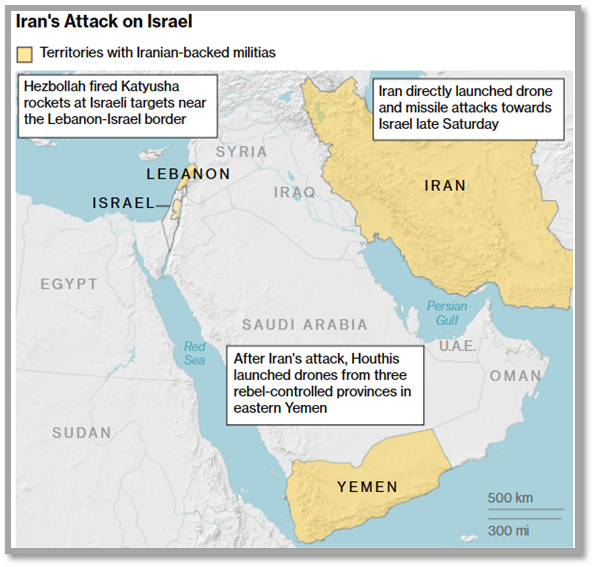

I hope it blows over and some compromise can be reached, but I can say that the ‘potential of a full-on conflict’ had not been priced into risk assets, as at the very least it would undoubtedly cause another surge in the oil price. That would mean we could kiss goodbye to the hope of interest rate cuts any time soon as inflation would surely spike higher. The potential alone may well mean equities are on for a challenging ride over the next few weeks, but it could once more be another storm in a teacup.

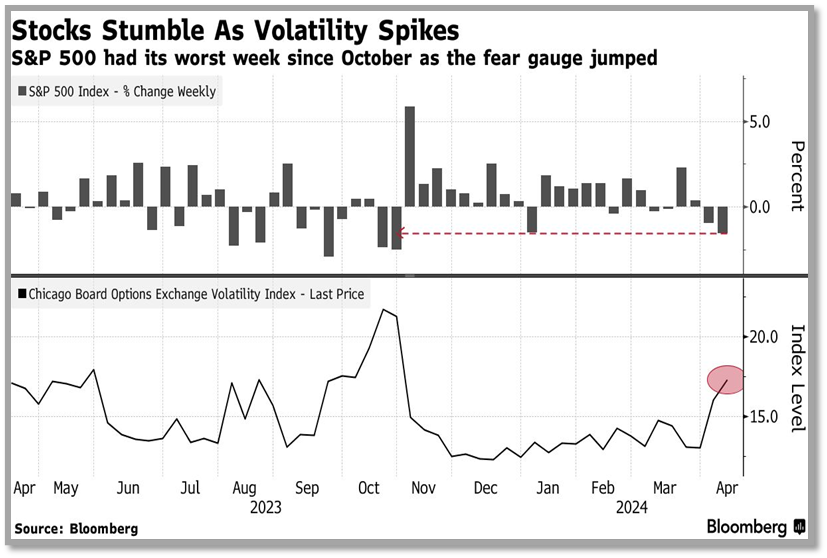

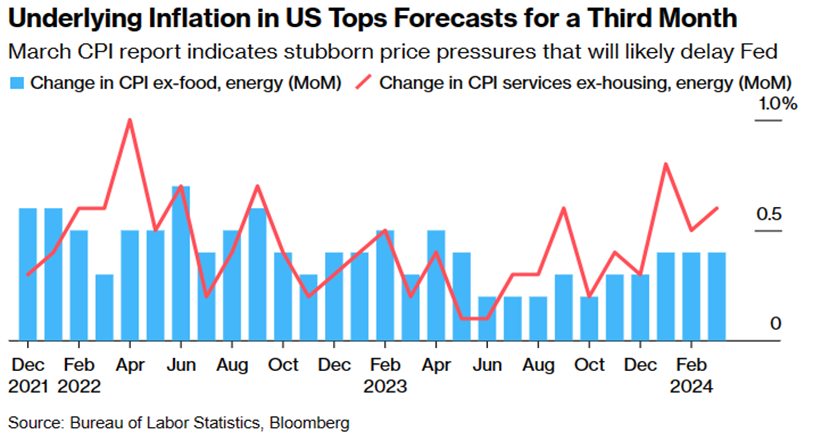

US Inflation

Putting aside the geopolitical issues, data on inflation last week hasn’t increased the prospect of the Fed cutting rates anytime soon. According to government data from Wednesday, the so-called Core Consumer Price Index excludes food and energy costs, which increased by 0.4% from February. The year-over-year rate remained at 3.8%, defying expectations for a downtick. Further interrogation of the data revealed that the ‘Super Core’ measure is trending up as services inflation escalates.

The US equity market sold off on the news, and bond yields headed higher as you would expect, but we did then get some good news on Thursday as Producer Price Inflation came in lower than expected. That calmed things, and we saw a sharp move higher from the Nasdaq that day, as investors still of a bullish disposition came wading back into the market, buying big tech in particular. Bond investors didn’t buy into the optimism as yields continued upward, with the US 10-year yield rising above 4.5%.

As I’ve been emphasising, for this equity market to sustain its current levels and make further progress, it’s crucial that the market’s focus shifts from rate cut expectations to the more traditional metrics of economic growth, which drive corporate earnings. The US earnings season has just begun, and the market’s direction now hinges on these numbers.

First, we got the ‘Big Banks’ reporting on Friday, and investors didn’t like what they saw. Despite JP Morgan, Citigroup, and Wells Fargo all beating Wall Street expectations when they reported earnings Friday morning, investors chose to focus on the challenging outlook. All the management emphasised the uncertainty their operations face from macroeconomic, geopolitical, structural, and regulatory challenges. JPM cautiously reported that net interest income was unlikely to rise as hoped.

On another day, these results – all strong beats – could have been taken well, but on the back of events in the Middle East and the rising inflation backdrop, investors were in the mood to see the glass as half empty. I think I detect in management’s forward guidance a desire to underpromise and then potentially over-deliver in the future, so I don’t think we should read too much into the share price declines as the big banks look to be in rude health to me. However, it tells us that the bar for earnings this quarter has been set very high indeed and that any companies that fail to meet expectations or deliver a rosy outlook are likely to see their share prices fall.

ECB ( The 13th Federal Reserve District?) likely to move first on rates

The European Central Bank has often unfairly been referred to as the 13th District, with the implication being that it is under the gravitational pull of the US and will merely follow the policy decisions set down by the Federal Reserve. However, when we heard from Lagarde last week, she was at pains to suggest that this is not the case: ‘We are data dependent — we are not Fed dependent’. That is great to hear, as I was worried that the ECB, and in turn the BoE, would not perhaps have the stomach to part company with US policy and go it alone on the rate cuts that both economic regions surely need.

Whilst services inflation is still a little sticky on both sides of the Atlantic, albeit lower in the Euro area, there is a marked difference in the direction of economic trajectory, as the PMI differentials highlight pretty clearly. US Manufacturing is recovering and progressing upward; European manufacturing is slipping. The Eurozone needs rate cuts; the US does not.

The reason why it is more complex comes down to currencies. If the Eurozone moves ahead of the US, the new interest rate differential could cause the Dollar to strengthen versus the Euro, which has secondary inflationary impacts. But it would seem that now looks like the lesser of two evils, and I think, barring a potential oil price shock, we will see a rate cut in June. You can already see the currency markets begin to factor that in as the Euro has fallen from 1.10 to 1.06 against the USD since the beginning of the year.

UK

More good news: In February, the UK economy experienced growth for the second consecutive month, reinforcing indications that the brief, mild recession at the end of last year has concluded and a recovery is taking shape. The Office for National Statistics reported a 0.1% increase in GDP from January, aligning with economists’ predictions. Additionally, January’s growth was revised upward to 0.3% from an initial 0.2%. The numbers could have been even better, but for the weather, as the amount of rain, we had undoubtedly curtailed the building sector and retail sales.

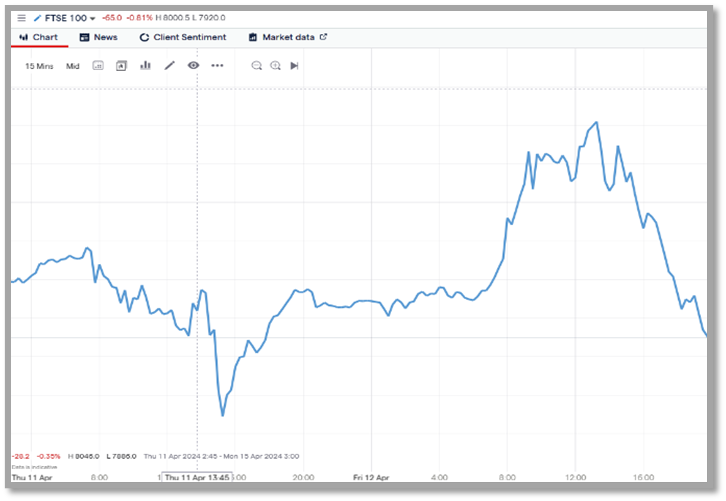

Now, this level of growth is not so scary as to reignite inflationary pressures and should not undermine the BoE pressing ahead with a rate cut this quarter, especially if Europe is going to take the risk. This prospect has already begun to show up in the currency markets, with the Pound falling to a year low of 1.245 against the Greenback. For more than a moment, I thought the FTSE 100 would break through meaningfully above the 8,000 level and hold it to the close, but the selloff in the US dragged us down.

Still, there is some positive momentum behind the UK stock market now; oil and mining stocks have been charging, and I see many reasons to be much more upbeat on our market than ever since Brexit.

Let’s hope for common sense to prevail in the Middle East…

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production