Bull market rumbles higher

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Review

It was a choppy start to the second quarter as heightened tensions in the Middle East drove the oil price higher, and a blowout jobs report added to inflationary worries. Bonds sold off, and the US 10-year yield finished the week at 4.4%, a level not seen since November last year. Volatility picked up, and a sense of uncertainty about market direction has replaced the complacent optimism of the first quarter.

Gold continued to break into new territory, heading over $2,300 an ounce for the first time in its history, with no one able to offer a convincing reason why. Does it know something the rest of us are missing?!

Update On US Markets

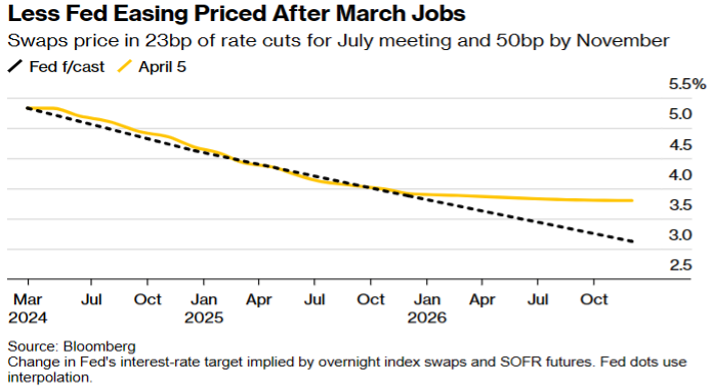

Equity investors are scratching their heads, trying to determine the likely direction of monetary policy from here and the implications for both the bond and equity markets. Only a month or two ago, it looked like a shoo-in, and we would get a June rate cut; J Powell had pretty much tipped the markets off, and that was likely to happen. But following the release of solid job numbers on Friday, the mood music has changed, and it is a flip of a coin if we will see one in June as expectations have dropped to 51% and forward market expectations of more rate cuts are now less than Fed projections.

Now, you might have expected equity markets to sell off alongside the bond markets on confirmation of the strength of US employment, but a curious thing happened as we saw the S&P 500 finish the day over 1% higher. Was that a knee-jerk bounce after a couple of bad prior days, or is it that investors are waking up to the fact that a strong economy is good news for share prices, even if it reduces the chances of rate cuts? I hope so, as I think the economy might be picking up steam.

In fact, last year’s real GDP growth of 3.1% matched the 48-year average. Fiscal stimulus has helped, but the major engine has been robust consumer spending as Baby Boomers spend their wealth, and real wage growth supplements COVID savings. With consumption per household near its record high, Americans arguably have never been better off, and there is no better cohort of the world population at spending. Corporate America is thriving, with record cash flow, capital spending, and profits rising as productivity improves.

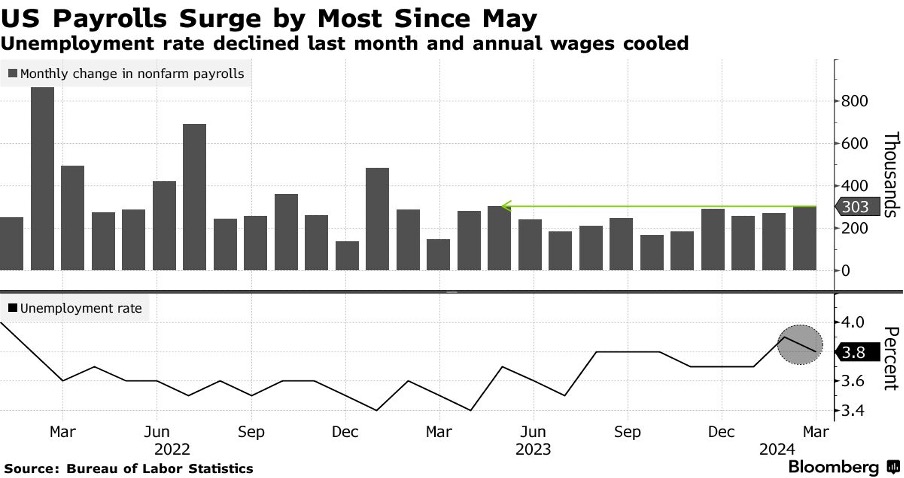

Let’s look at the actual job numbers, as it wasn’t all bad news for those hoping for rate cuts. Nonfarm payrolls advanced 303,000 last month following a combined 22,000 upward revision to job gains in the prior two months. This was way ahead of market expectations and at a headline level inflationary, but the good news was that the unemployment rate fell to 3.8%, with more people joining the workforce. Growth in March was led by faster hiring in health care (baby boomer spending), construction, and leisure and hospitality (more Baby Boomer spending), which has now bounced back above its pre-pandemic level.

I am convinced that J Powell (if not all of the Fed committee) wants to get a June rate cut ahead of the presidential election. Still, this data will leave him with a headache as Fed officials have flagged moderation in job gains as a possible precursor to interest-rate cuts. This data will undermine that stance, so next week’s inflation data is starting to look ever more critical. Unless we see some unexpected cooling, I don’t know how the Fed can justify cutting rates any time soon, especially if the oil price is heading higher.

Here’s what Bloomberg economists anticipate with next week’s data: “We expect the March CPI report to reveal a modest slowdown in the monthly pace of core inflation to 0.3% — a figure that still aligns with the Fed’s annual core PCE inflation target of 2.0%. Even if annual headline inflation hovers around 3.0% through year-end, the persistent disinflation in the core should provide the Fed with the leeway to cut rates this Summer.”

Gold Prices Rising

I haven’t written about the gold price for a long time, but as mentioned above, given that it has just broken above $2300 for the first time, I think it is more than entitled to receive some column inches. However, the problem is that it is tough to find any conclusive reason for the move other than the cliché, ‘more buyers than sellers’.

The recent surge has yet to spark the usual buzz within the gold investment community or prompt significant discussion about the implications for the US dollar. Unlike previous peaks, this rise has been under the radar, possibly overshadowed by excitement in other asset classes like the S&P 500 and Bitcoin. Even seasoned market analysts need clarification on gold’s ascent, noting a lack of enthusiasm for gold ETFs and an unclear shift in speculative interest. Factors like central bank purchases and Chinese demand may influence gold prices alongside algorithmic trading strategies, or perhaps gold isn’t buying into the notion that inflation is coming down. Nevertheless, it has overtaken the S&P 500 for gains in 2024, and few asset classes can claim to be doing that.

In truth, gold has always confused me; I was raised on the notion that it was a solid hedge against inflation, a hedge against geopolitical tension, or that it would do well if money were cheap (interest rates were low). These arguments would have worked occasionally, but they have been just as likely not to. The best explanation I have ever heard for why you should hold gold in your portfolio came from Martin Taylor, the ridiculously gifted hedge fund manager of the Nevsky Capital fund. He was asked why he always had 5% of his portfolio in gold; he responded: “I don’t know.”

Correlation Equals Causation?

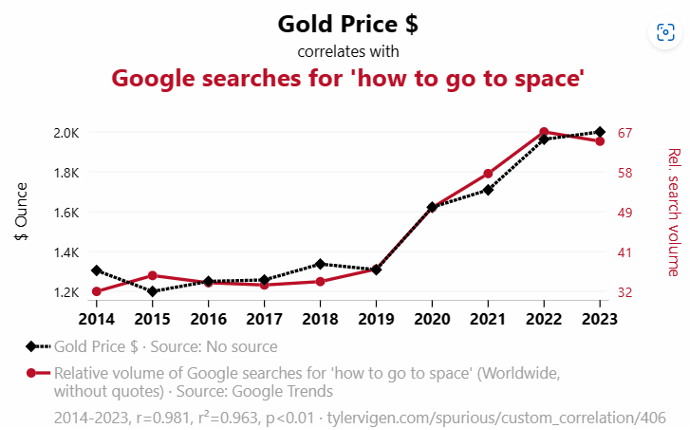

I agree with him but didn’t find that particularly edifying… so I continued my search, hoping to uncover something the rest of the world had missed, and I think I might just have done that.

With a very high correlation, the R Squared score of 0.98 (above 0.75 indicates meaningful correlation), the ‘Gold Price’ appears to follow the volume of Google searches for ‘how to go to space’. I am not entirely sure what to do with this information. Still, given global warming and Elon Musk’s desire to head to Mars, I think it is a reasonably sure bet that the number of searches on this topic is likely to increase; ergo, gold is heading higher (caveat emptor)!

That’s All for This Week

In the absence of any other meaningful economic data or moves in the European or Asian markets, I will sign off on this week’s Market Matters.

Company earnings and US inflation data start next week, so let’s see how markets react. I expected a choppy second quarter after the strong first one, and I see no reason to alter that view.

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production