Market Wobbles as Bears Weigh in!

Author: Tom McGrath – Chief Investment Officer, 8AM Global

Market Review

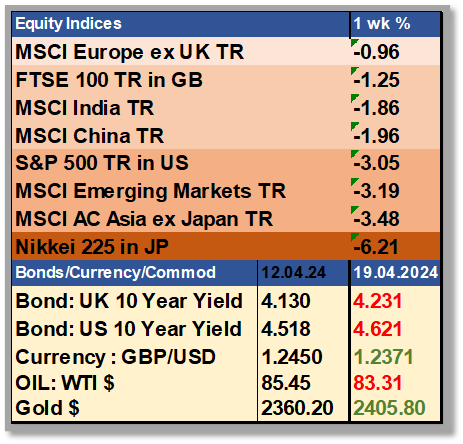

Any week where we see a hostile counterattack in the Middle East is unlikely to be particularly good for risk assets, but on this occasion, I don’t think this was the cause of the strong sell-off we saw in stock market indices. Regardless of the catalyst, it was a painful week for equity investors, with Japan leading to the downside and the S&P 500, dragged lower by tech stocks, recording its sharpest weekly fall in over a year, with the index now having corrected more than 5% from its peak. The UK and Europe faired much better, partly because they had less exposure to technology but more likely because their central banks are still on course to cut rates in the first half of the year. The USD continued its ascent, and treasury yields climbed higher, fitting the narrative of rates being held higher for longer. Gold continued its upward charge, with many reasons given – hedge against uncertainty, hedge against inflation – but I think, more simply put, more buyers than sellers!

Middle East Update

Following last week’s missile and drone barrage from Tehran, Israel launched a retaliatory strike. An explosion was heard early Friday outside Isfahan, Iran’s third-largest city. Despite the explosion, nuclear facilities in Isfahan were confirmed safe by state television and the United Nations’ nuclear watchdog. Neither the Iranian nor Israeli government has officially confirmed the strike. Israel typically does not publicly comment on specific military actions related to Iran. Following the incident, prices for crude and gold surged in early trading on Friday but later moderated as it became clear that the strike was not extensive.

A senior Iranian military official stated that Iran had already responded to Israeli threats, and media from both countries seemed to downplay the incident’s severity. I hope this means that Iran will let this go without further retaliation. Israel demonstrated they could hit Iran’s nuclear facilities if they wanted to cause actual harm but chose not to. I don’t have a crystal ball here, but by “reading the tea leaves”, I can infer the latest response from Israel was very measured and in no way designed to escalate matters. It’s more like they were trying to get the last word in an argument, and the oil price reaction seems to suggest that investors share a similar belief.

Inflation Fears Reduce Rate Cut Outlook

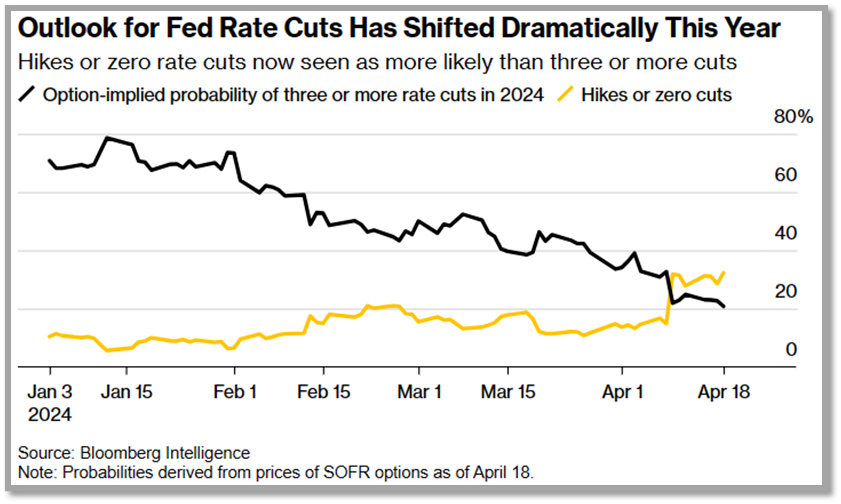

The market sell-off can be attributed to a delayed reaction to high inflationary data. However, what’s more significant is the shift in investor sentiment, with the realization that rate cuts in the US are highly unlikely in the first half of 2024. This has disrupted the ‘goldilocks scenario ‘, which was built on the expectation of rising corporate earnings, falling rates, and lower treasury yields.

Now, with two-year treasury yields back up over 5% and the ten-year heading that way, too, investors have decided that valuations look a little too rich at current levels and have started taking profits in a lot of the stocks that had gone up the most, with Nvidia being a prime example as it fell 10% on Friday, dropping below its 50 day moving average. Netflix also declined over 9% despite surpassing quarterly earnings expectations. The streaming company reported a 16% increase in subscribers year-over-year but announced it would stop reporting paid memberships starting in 2025. Semiconductor stocks faced heightened selling pressure in the afternoon, indicating a significant rotation out of a previously led bull market sector. Super Micro Computer plummeted more than 23%, but the old Dow Jones index was bucking the trend, which was just up for the week.

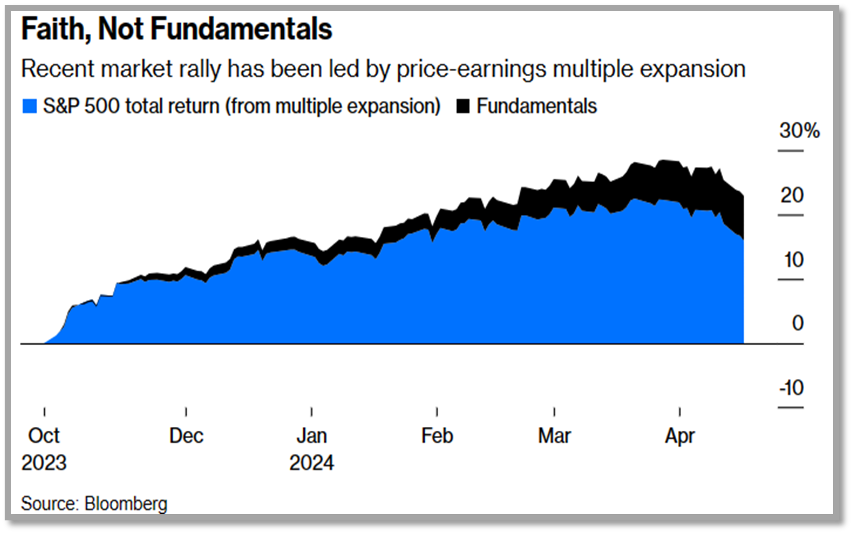

Ben Graham, a pioneer of value investing, coined the phrase that the market is a voting machine in the short term and a weighing machine in the long term. Over the past six months, bullish investors have been giving the market a thumbs-up vote, with the market-driven more by valuation expansion than fundamentals. Now that yields have turned upward and we are getting the earnings data, the bears are demanding a weigh-in, questioning why the market deserves a higher multiple.

So far, company results have been solid, with around 75% beating forecasts. However, this seems to have already been factored into prices, and woe betide any company that misses. The early conclusion is that valuations might need to ‘lose a little weight’, and the S&P 500 has shed 5% from its peak.

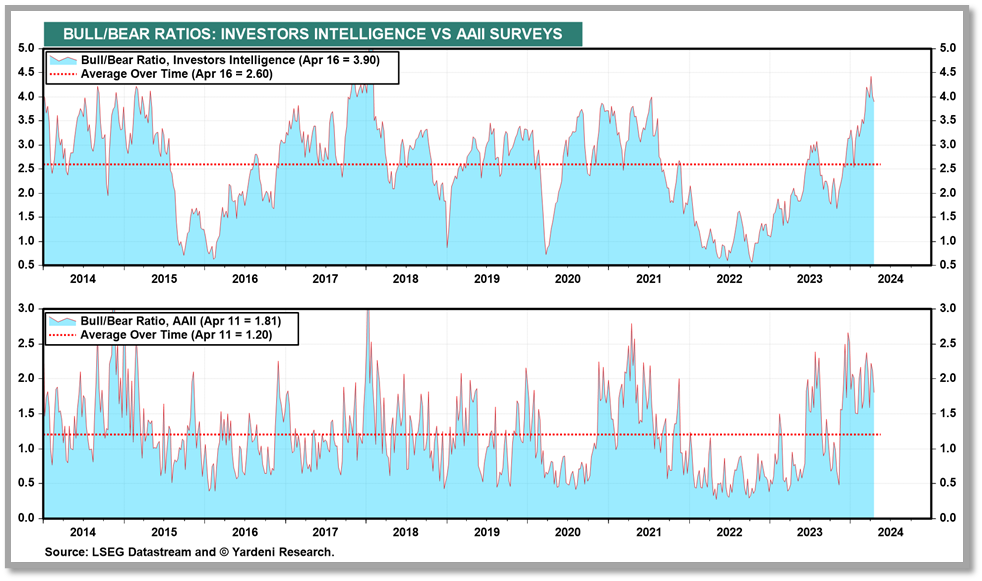

That recent wobble might be enough of a fall if the heavy-weight companies reporting over the next couple of weeks can deliver. But if investors’ confidence continues to wane or yields head even higher, then the 5% blip might head toward correction territory (-10%). Part of the problem going into this earnings season was that investors were overwhelmingly bullish and positioned accordingly. Both Bank of America Corp.’s and the Association of Individual Investors sentiment indices have reached high points of optimism. This technically positive sign could be a contrarian indicator that the market is overextended. Sentiment may need to turn less bullish to set the stage for a resumption of the rally, or significant tech earnings may even exceed the market’s high expectations and give the bulls the boost they need to lift the markets.

US Inflation, what’s really going on…

For the next quarter or two, the pace of inflation will likely hold the key to market direction. Further out, it may be GDP or earnings growth, but investors are still fixated on monetary policy, how many cuts we might get, or even if the next move will be up. Given that the market has started to expect insufficient inflation data, there is room for average data to be taken well. That makes me cautiously optimistic about the market’s reaction to upcoming inflation data. The last inflation print we got was the Consumer Price Index (CPI), but due to differences in cost calculations, particularly for Owner Equivalent Rent, Medical services and Durable goods, it seems to be running hotter than the Personal Consumption Expenditures (PCE) that the FED looks at. Either way, there are still some downward trends slowly working through the system, with housing or the cost of shelter being the most important. In many parts of the US, mainly where there has been a lot of housing construction, rental costs are dropping quite sharply, indicating a potential shift in the market.

In addition, wage inflation is also moderating, despite last year’s spikes due to union settlements and minimum wage increases. This moderation, coupled with significant productivity gains that have kept unit labour costs in check, suggests that inflationary pressures from wages are also easing. The price of Chinese imports is also on its way down. I think the Fed are right not to cut rates anytime soon, particularly given the strength of the economy. However, being a glass-half-full person, barring any major shocks, such as a significant rise in oil prices, inflation could continue to move towards the Fed’s target by the end of the year. I believe that rate cuts could still be on the table this year as the economy adjusts, potentially impacting the market significantly.

Next week is huge, and I may be eating my words come Friday when we get the PCE figures on inflation, which might even show that the disinflation process has officially stalled and potentially reversed. We also get first-quarter gross domestic product (GDP) out on Wednesday, indicating that the US economy remains healthy. In addition, earnings season will intensify, with Tesla, Microsoft, and Google parent company Alphabet among the big names due to report their latest quarterly results. However, Meta Platforms’ results may be the most consequential given how much the Facebook owner’s stock has rallied lately – its shares have been up more than 60% over the past six months.

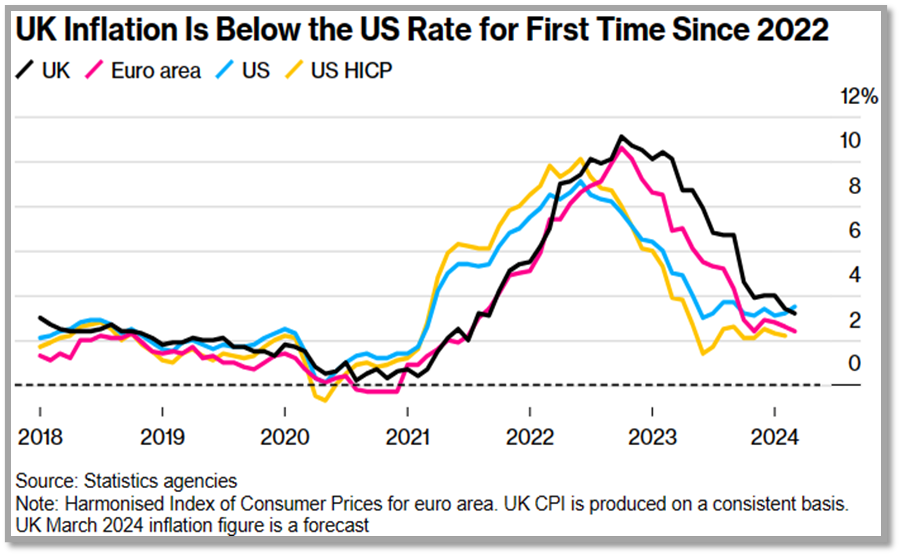

UK

Bank of England Governor Andrew Bailey indicated that the UK might be in a position to lower interest rates ahead of the US, citing diverging inflation trends between the two countries. During an interview with the International Monetary Fund, Bailey noted that the US is experiencing more “demand-led inflation pressure” compared to the UK. Bailey pointed out that there is “strong evidence” that price pressures are subsiding in the UK. The fact that Bailey seems to be paving the way for the UK to cut rates ahead of the US is of enormous significance and, to my mind, creates a much more positive backdrop for Gilts and UK equities as I expect the former to fall and the latter to rise. The BOE has to be careful and stay considered as it doesn’t want Sterling to drop sharply versus the Dollar as that would be inflationary. Still, the scene is set for rate cuts in the first half of the year, especially when we get data that should confirm headline inflation is back to 2%.

Indian Elections Have Started

It takes a long time for almost 1 billion Indians to vote, so the process that began Friday will last more than six weeks, with voters weighing up whether to hand Prime Minister Narendra Modi a third five-year term to continue his mix of economic and Hindu nationalist policies.

Modi’s Bharatiya Janata Party, or BJP, is campaigning on the prime minister’s popularity, the strength of India’s economy and a pro-Hindu agenda that has resonated with the country’s majority. The opposition, a coalition of parties led by the Indian National Congress, is arguing that Modi has eroded India’s democratic institutions and paid insufficient attention to the jobless and the poor.

Expect a BJP victory as Modi enjoys high popularity ratings in India. If anything, his party is aiming for a substantial win that expands its majority in the country’s lower house of parliament, the Lok Sabha.

Important Information

This content is intended for financial professionals only. These are the author’s views at the time of writing and may be subject to change. This content is not intended to provide the basis for any investment advice or recommendation. Any forecasts, figures, opinions, tools, strategies, data, or investment techniques are included for information purposes only.

The information presented is considered to be accurate at the time of production and has been obtained from or based upon sources believed by the author to be reliable and accurate, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Please visit our Regulatory Information and Terms of Use pages for more information.

Production

Production